Updated January 16, 2024

Social Security forms are used to apply for benefits and services administered by the Social Security Administration (SSA). Programs managed by the SSA include Medicare, retirement, disability, and supplemental income. The SSA is also responsible for social security records, numbers, and cards.

Common Services

- Replace your Social Security card

- Locate a Social Security office near you

- Log into your Social Security account

Table of Contents |

Popular Forms

Form SS-5 – application for a social security card

Form SS-5 – application for a social security card

Download: PDF

Form SSA-827 – authorization to release information

Form SSA-827 – authorization to release information

Download: PDF

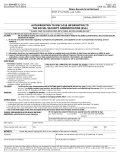

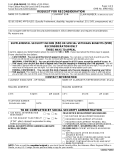

Form SSA-561-U2 – appeal form for requesting reconsideration

Form SSA-561-U2 – appeal form for requesting reconsideration

Download: PDF

Form SSA-44 – application form to lower Medicare premium costs following a reduction in income

Form SSA-44 – application form to lower Medicare premium costs following a reduction in income

Download: PDF

Form SSA-1724 – claim for a payment or refund after the beneficiary’s passing

Form SSA-1724 – claim for a payment or refund after the beneficiary’s passing

Download: PDF

Form Types

From public benefits to personal records, SSA forms cover a range of issues and services.[1] Most cases fall into one of the following categories:

- Records and Information – for updating personal information, applying for new or updated social security cards, and authorizing the transfer of information for services like direct deposit

- Retirement and Disability Benefits – used to apply for various benefits programs related to work, healthcare, and family

- Medicare Enrollment – includes forms for enrolling in health insurance programs and reporting income changes

- Survivor Benefits – for individuals who relied on the earnings of a family member who has passed away

- Supplemental Security Income – financial assistance application forms

Filing Instructions

Submitting SSA forms is a straightforward process. For many documents, filers have the option to submit printed copies or complete the process online.

By Mail

Once completed and signed, SSA forms are accepted by mail or in-person delivery to the applicant’s local office (or the office that requested the document).[2]

Online

Several SSA services are available online, including requesting a Social Security card and filing tax forms. Users can create an account to get started.

FAQs

What is the SSA?

The Social Security Administration is a government agency that provides financial support for Americans navigating life events like marriage and divorce, family loss, retirement, and healthcare enrollment.[3] It collects payroll taxes to fund its programs and distributes benefits to eligible individuals.

What is a Social Security number?

A Social Security number, or SSN, is a unique nine-digit number assigned to individuals by the SSA. SSNs serve as a crucial identifier for employment, tax reporting, financial transactions, credit reporting, and public benefits.

Do I file taxes with the SSA?

Each year, employers fulfill their wage and tax reporting requirements by filing the W-2 Wage and Tax Statement with the SSA. Although W-2s and W-3s are IRS documents, they are submitted to the SSA, which shares information with the IRS.