Updated March 20, 2024

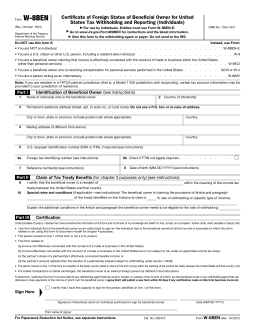

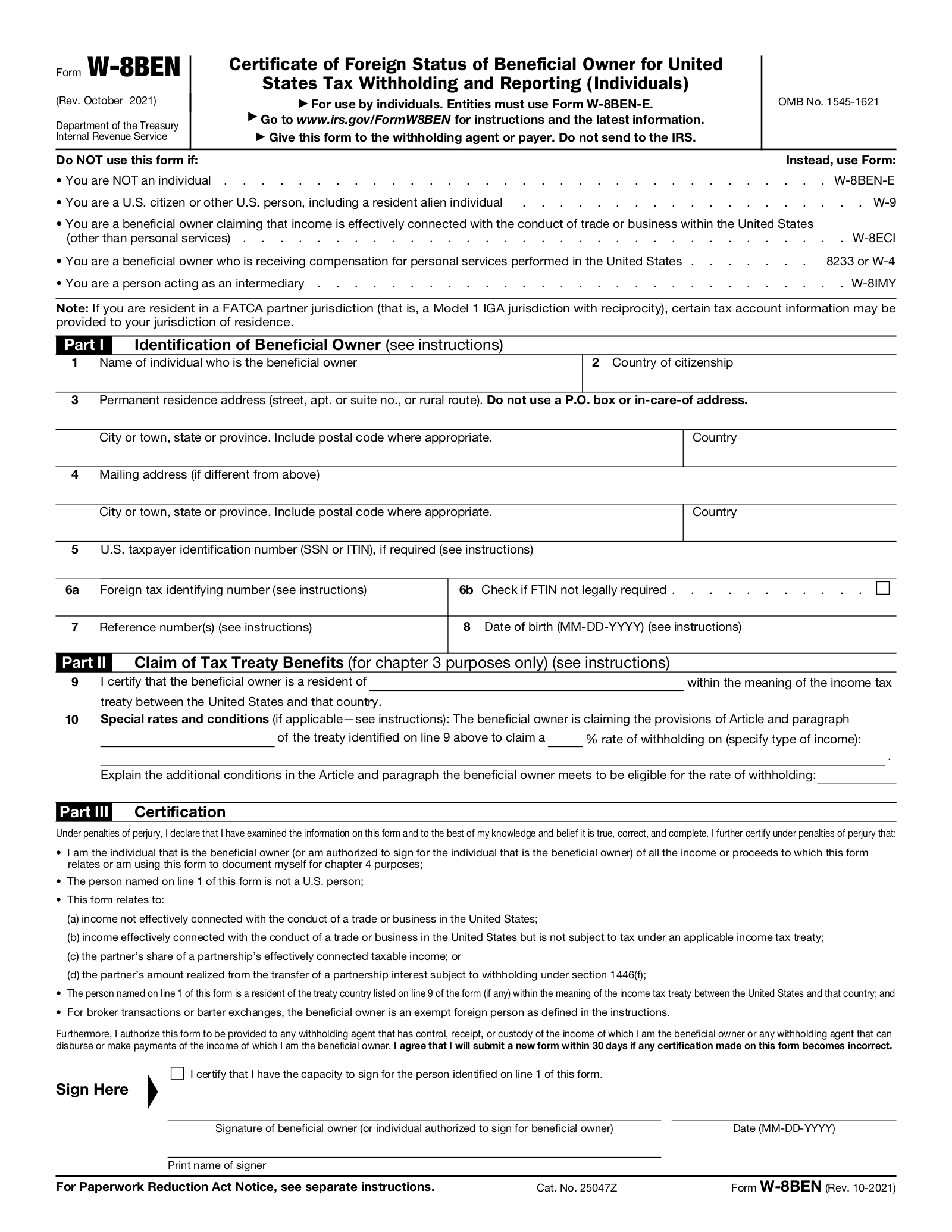

A Form W-8BEN is a required IRS document for foreign individuals living outside the United States who earn income from a U.S. source. The form verifies an individual’s country of residence and can establish a lower tax withholding rate on income for people residing in qualifying countries. Income for a business entity should be handled through Form W-8BEN-E.

How Long is the Form Valid?

Form W-8BEN is effective for the next three years once signed and handed off.

Table of Contents |

What is a W-8BEN Form?

The official title of Form W-8 BEN is “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).” This means that it is used to establish that the person filling out the form is what the IRS refers to as a “non-resident alien,” and therefore not subject to the same taxes as U.S. citizens, permanent residents, and those who spend the majority of the year in the United States.[1]

Without a W8-BEN form, and individual could be assessed a higher tax rate on their U.S.-sourced income.

Tax Treaty

Form W-8BEN is how individuals show that they are from a country whose residents are entitled to lower withholding rates. These rates come from “tax treaties” that the United States has negotiated with other countries. These treaties generally allow residents of other countries to be taxed at a reduced rate on income earned in the United States; in turn, income U.S. residents earn in these countries is also taxed at a lower rate.[3]

The withholding rate varies depending on the terms of the treaty the country has and the situation of the person filing. Those filing should be aware that, under the terms of certain tax agreements, the IRS may share information provided on the W-8BEN with the government of the individual’s country of residence.[4]

Form W-8BEN-E

Form W-8BEN is for individuals who earn income from U.S. sources. But if it is an entity like a corporation, rather than an individual, earning the money, then Form W-8BEN-E should be used instead.

The exception is for “disregarded entities,” a business separate from its owner but which elects to be separate from the business owner for federal tax purposes. The most common example is a single-member LLC.[5] Owners of disregarded entities may provide a W-8BEN, rather than a W-8BEN-E, but must do so if requested whether or not they are seeking a lower withholding rate.

Withholding Agent

A withholding agent is a person with control of funds paid to a foreign person that are subject to withholding under U.S. tax law.[6] Examples of withholding agents include:

- buyers that purchase US real estate owned by foreigners

- companies that hire foreign workers

- universities that give grants to foreign scholars

- banks that pay interest to foreign depositors

Because it is the responsibility of withholding agents to withhold taxes from the individuals they pay and send the tax payment to the IRS, Form W-8BEN is submitted to the withholding agent, rather than to the IRS. Withholding agents will generally provide a W-8BEN to a payee when required, apply the appropriate withholding discount, and then retain the document for their records.

Foreign Financial Institutions

In certain cases, a Foreign Financial Institution (FFI) may request a W-8BEN from a resident of a foreign country in association to document a payee’s status. FFIs, as they are commonly known, have obligations to disclose certain information under the treaties that the countries where they are based have signed.[7]

Who Needs to Fill out Form W-8BEN?

Form W-8BEN should be filled out by nonresident aliens who receive income from U.S. sources.

Non-Resident Alien

For non-citizens, there are two “tests” to determine whether someone is a non-resident alien and thus subject to the requirement to fill out a Form W-8BEN.[8] Both apply only to non-citizens; U.S. citizens should not file the form.

- The Green Card Test: If someone is a lawful permanent resident of the United States at any point during the calendar year in which they received income, they are a resident alien and not subject to the W-8BEN requirement.

- The Substantial Presence Test: If someone has spent a sufficient amount of time in the United States within the previous three years, they are a resident alien and not subject to the W-8BEN requirement. Consult the IRS for the formula to calculate days for the substantial presence test.

Personal Services

Form W-8BEN is for those who receive certain kinds of income, such as wages from employment. Non-resident aliens being paid for personal services performed in the United States should fill out Form 8332 rather than Form W-8BEN.

Examples of “personal services” include those who are self-employed, and those providing professional services, such as lawyers or doctors.[9]

How to Fill Out

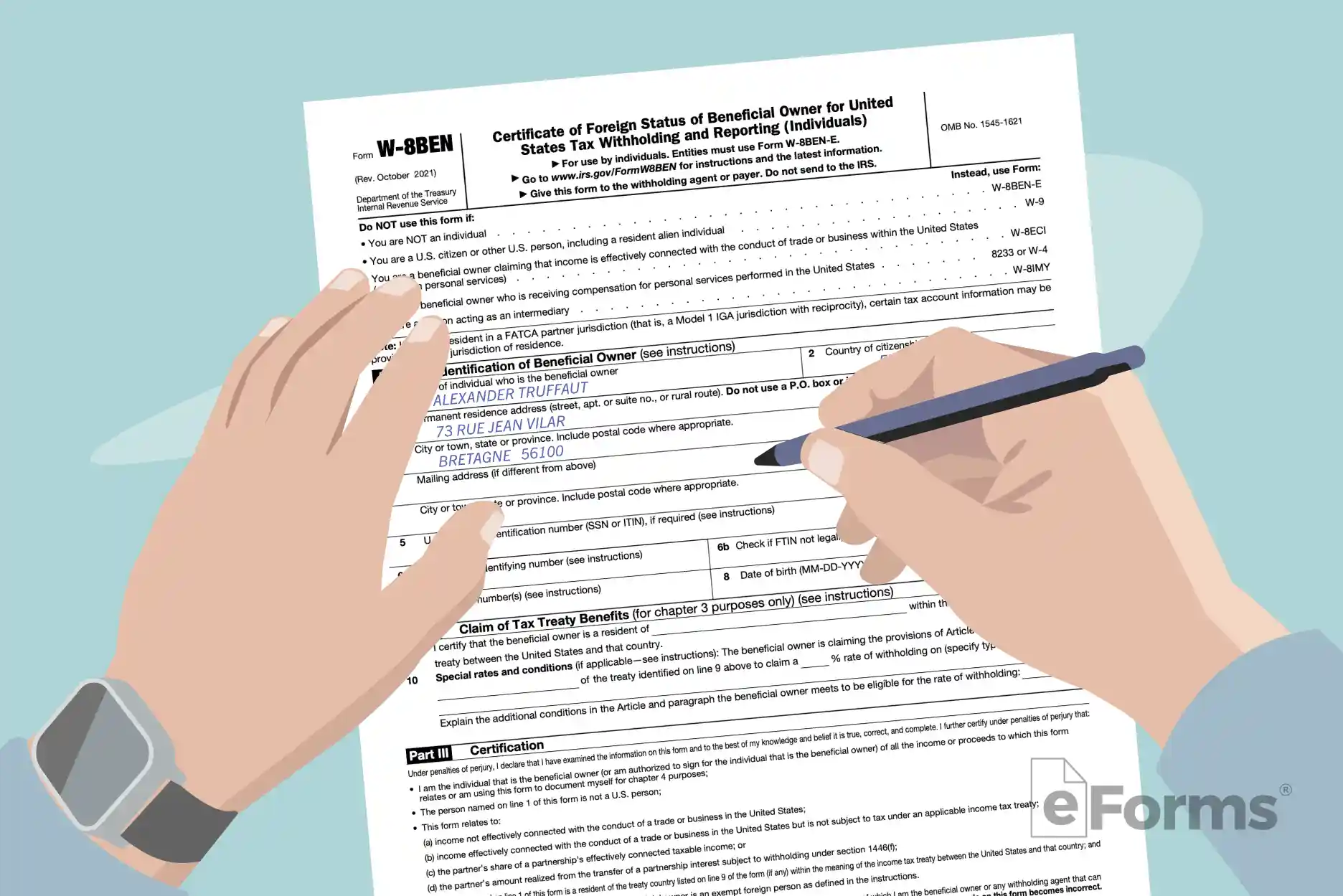

Once someone has determined that they must fill out Form W-8BEN, the form itself consists mostly of biographical information. Filers should have their Foreign Tax Identification Number (FTIN) available, as well as information about the tax treaty between the United States and the country of which they are a resident.

Australia, Bermuda, the British Virgin Islands, the Cayman Islands, and Japan do not issue FTINs.[10] More detailed information about withholding rates by country and situation can be found in this list of U.S. income tax treaties.

Note: If the foreign individual does not have an ITIN required on line 5, they may need to complete Form W-7 along with a US tax return to reclaim tax withholding.

Sources

- Instructions for Form W-8BEN | Internal Revenue Service (IRS)

- 26 CFR 1.1441-1(b)(1)

- United States Income Tax Treaties A – Z | Dept. of Treasury

- Foreign Account Tax Compliance Act (FACTA) | Dept. of Treasury

- Single-Member Limited Liability Companies | IRS

- Withholding Agent | IRS

- 26 CFR 1.1471-5(d)

- Publication 519 | IRS

- Pay for Personal Services Performed | IRS

- List of Jurisdictions that Do not Issue Foreign ITNs | IRS