Updated March 19, 2024

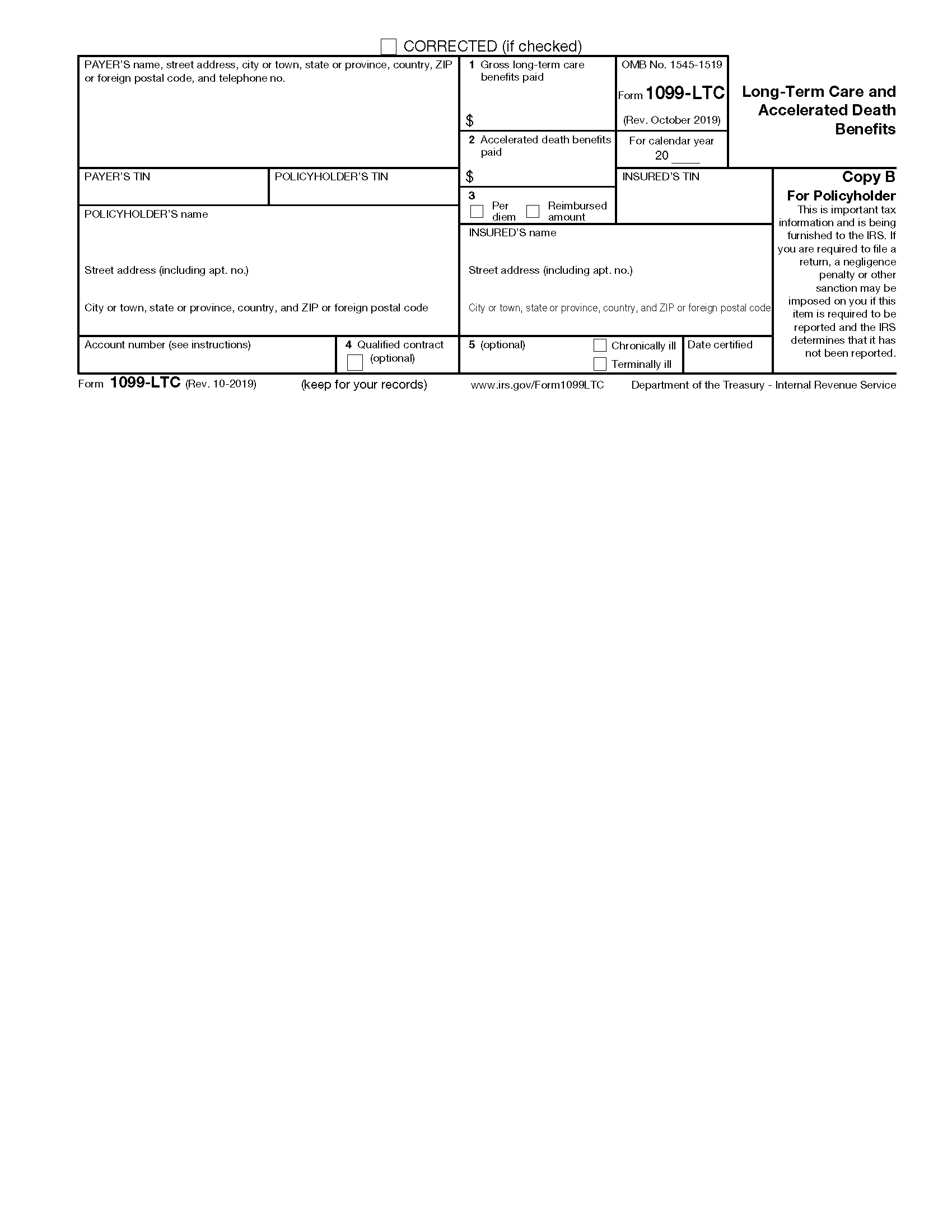

A 1099-LTC form (Long-Term Care and Accelerated Death Benefits) is an IRS document used to report long-term care or accelerated death benefits paid on behalf of a chronically or terminally ill individual. This form is typically filed by insurance companies, who must also send a copy to the policyholder.

What is a Long-Term Care Insurance Contract?

A long-term care (LTC) insurance contract provides coverage of expenses for long-term care services for an individual who has been certified by a licensed healthcare practitioner as chronically ill. Accelerated death benefits are payments from life insurance policies for terminally ill individuals.

Table of Contents |

Who Files a 1099-LTC?

A 1099-LTC must be filed by payers of long-term care and accelerated death benefits. This includes:[1]

- Insurance companies

- Governmental units

- Viatical settlement providers

Reporting payments via a 1099-LTC is only required if the policyholder is an individual.[2]

Who Gets a 1099-LTC?

A 1099-LTC must be sent to the policyholder of the LTC or life insurance contract. The policyholder may or may not be the insured individual receiving the benefits.

If the policyholder and the insured individual are two different parties, a copy of the 1099-LTC must be provided to both.

In the case of a group contract, the certificate holder qualifies as the policyholder.

Chronically Ill vs. Terminally Ill

A chronically ill individual is someone who has been certified (at least annually) by a licensed health care practitioner as:[3]

- Being unable to perform on their own at least two daily living activities (eating, toileting, transferring, bathing, dressing, and continence) for at least 90 days due to a loss of functional capacity; or

- Requiring substantial supervision to protect the individual from threats to health and safety due to severe cognitive impairment.

A terminally ill individual is someone who has been certified by a physician as having an illness or physical condition that can reasonably be expected to result in death in 24 months or less after the date of certification.[4]

Deadlines

A 1099-LTC must be filed with the IRS by February 28 if filing by paper, or by March 31 if filing electronically.

The payer must also send copies of the 1099-LTC to the policyholder and the insured individual by January 31.[5]

2024 Deadlines

- January 31, 2024 (Recipient)

- February 28, 2024 (IRS – Filing by Paper)

- March 31, 2024 (IRS – Filing Electronically)

Form Parts

- Payer’s Information and TIN: Shows the name, address, phone number, and taxpayer identification number of the party filing the 1099-K.

- Policyholder’s Information and TIN: Shows the name, address, and taxpayer identification number of the individual who holds or owns the LTC insurance policy.

- Insured’s Information and TIN: Shows the name, address, and taxpayer identification number of the chronically or terminally ill individual on whose behalf the LTC benefits are paid.

- Account Number: Shows a unique identifying number assigned to the account. An account number is required if the payer has multiple accounts for whom they are filing multiple 1099-LTCs.

- Box 1. Gross Long-Term Care Benefits Paid: Shows the gross long-term care benefits paid this year on a per diem, periodic basis, or reimbursed basis. It includes all amounts paid to the insured, to the policyholder, and to third parties on the insured’s behalf.

- Box 2. Accelerated Death Benefits Paid: Shows the gross accelerated death benefits paid under a life insurance contract this year to or on behalf of an insured who has been certified as terminally or chronically ill. This includes the amount paid by a viatical settlement provider for the sale or assignment of the insured’s death benefit under a life insurance contract.

- Box 3. Per Diem or Reimbursed Amount: Shows whether the payments were made on a per diem (periodic) basis without regard to actual expenses or on a reimbursed basis made for actual expenses incurred.

- Box 4. Qualified Contract (Optional): Shows whether the long-term care insurance benefits are paid from a qualified (non-taxable) LTC insurance contract.

- Box 5. Check if Chronically Ill or Terminally Ill (Optional): Shows whether the insured individual is chronically or terminally ill and the last date it was certified. Leave this box blank if the insured is neither.

Instructions for Filing

Due to the low volume of 1099-LTC forms processed by the IRS every year, the IRS has made this form available in an online fillable format. This means that the filer does not have to order an official copy.

- Collect a W9 from the policyholder and the insured to obtain their TINs.

- Choose a filing method (by mail, online, or with third-party software).

- Copy A must be submitted to the IRS. If filing by mail, send in a black-and-white copy of Copy A with a copy of Form 1096.

- Copy B must be sent to the policyholder.

- Copy C must be sent to the insured individual, if different from the policyholder.

- Copy D can be kept by the payer for their own records.

Frequently Asked Questions (FAQs)

Do I need to report 1099-LTC on my tax return?

If the long-term care insurance contract is a tax-qualified contract, you generally do not need to report the benefits on your tax return. However, if it is not tax-qualified, you must determine the taxable amount and report it on your tax return.

Does the insured individual have to report 1099-LTC?

Only the policyholder is required to report the benefits on their tax return. The insured individual is sent a copy of the 1099-LTC only for informational purposes.

How do I report 1099-LTC on my taxes?

File IRS Form 8853 to report any taxable benefits from an LTC insurance contract or a life insurance policy.

Sources

- IRS – Instructions for Form 1099-LTC: Who Must File

- IRS – Instructions for Form 1099-LTC: Reporting

- IRS – Instructions for Form 1099-LTC: Chronically Ill Individual

- IRS – Instructions for Form 1099-LTC: Terminally Ill Individual

- General Instructions for Certain Information Returns (2023)