Updated April 13, 2023

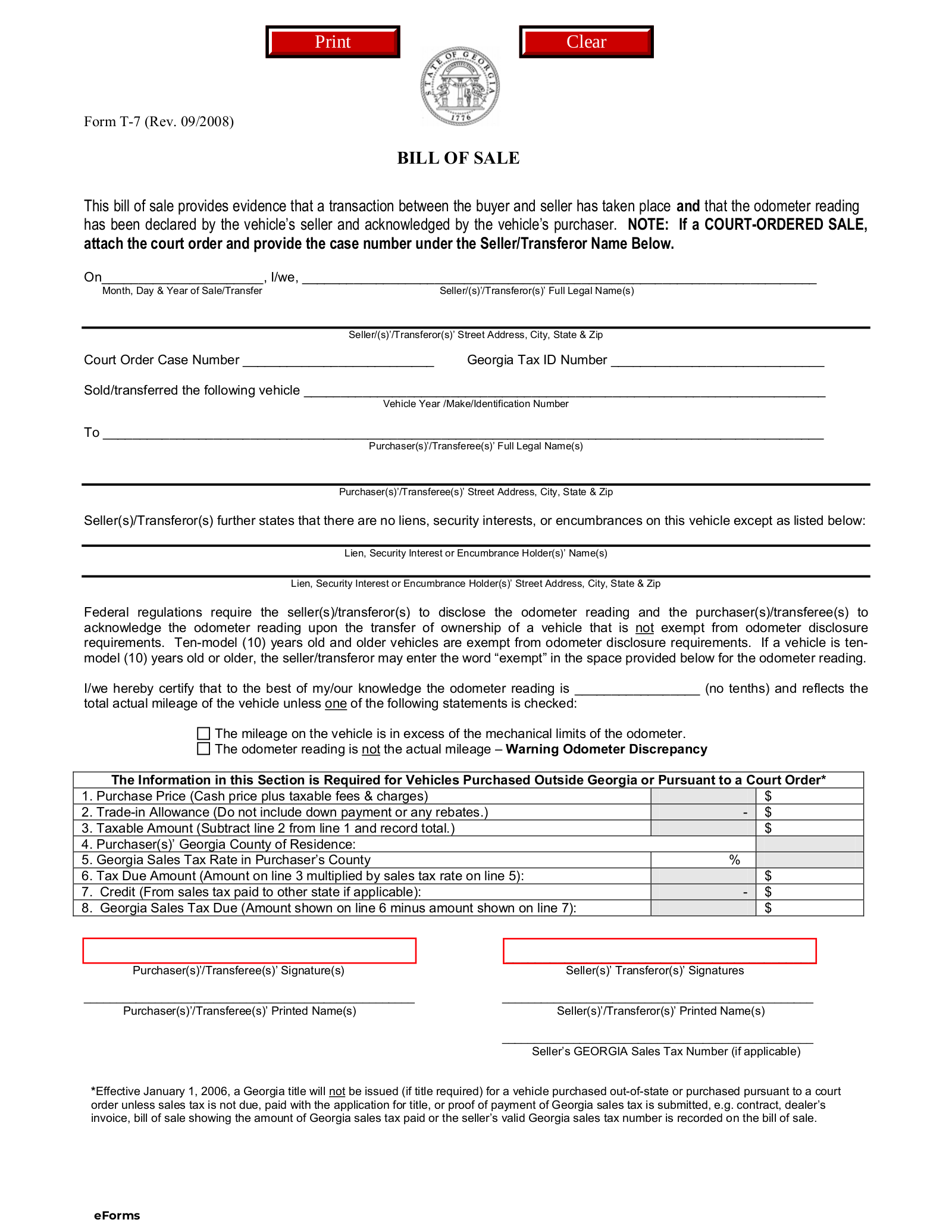

A Georgia motor vehicle bill of sale (Form T-7) is a legal document in which a buyer and seller formally agree to the terms of a vehicle’s transfer of ownership. A bill of sale, as well as an odometer disclosure statement, are required in the State of Georgia when registering a vehicle under new ownership at the Tax Commissioner’s Tag Office. This document shall be legally binding once both parties sign, and it does not require the acknowledgment of a notary public or other witnesses.

Signing Requirements – Both buyer and seller must sign.

Table of Contents |

Registering a Vehicle

According to Georgia law, a motor vehicle must be registered within thirty (30) days of purchase or within 30 days of establishing residency after moving from another state or county. Those who recently moved to the state must acquire a Georgia Driver’s License prior to registering a vehicle.

Where to Register

Refer to the map at the lower section of the Tax Commissioner’s Tag Office Page. Selecting a county on the map or through the drop-down menu will reveal the physical location where one must go to register a vehicle.

Required Documents

- Bill of Sale;

- Odometer Disclosure Statement;

- Form MV-1 Tag/Title Application;

- Vehicle’s Original Valid Title (if the title is not available, a Manufacturer’s Certificate of Origin (MSO) or a registration certification from non-title state/county);

- Valid Georgia Driver’s License or State ID;

- Proof of Insurance, via one of the following:

- Filed by your insurance company directly in the Department’s database; or

- Insurance Binder showing insurance liability coverage;

- Title Registration and Transfer Fees; and

- Motor Vehicle Power of Attorney Form, if an agent shall represent the seller in the transfer of the vehicle.