Updated September 18, 2023

A credit report authorization form is a document used to give permission to an individual or organization to perform a credit report only. This form provides broad language that allows a credit report to be generated for any type of legal reason.[1]

Fair Credit Reporting Act Disclosure – This should be given to all individuals before their credit report is run.

Landlord (Tenant) Background Check – Allows a landlord to run a credit report and a criminal background check on an applying tenant.

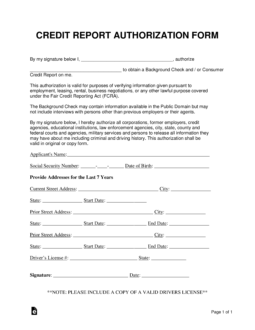

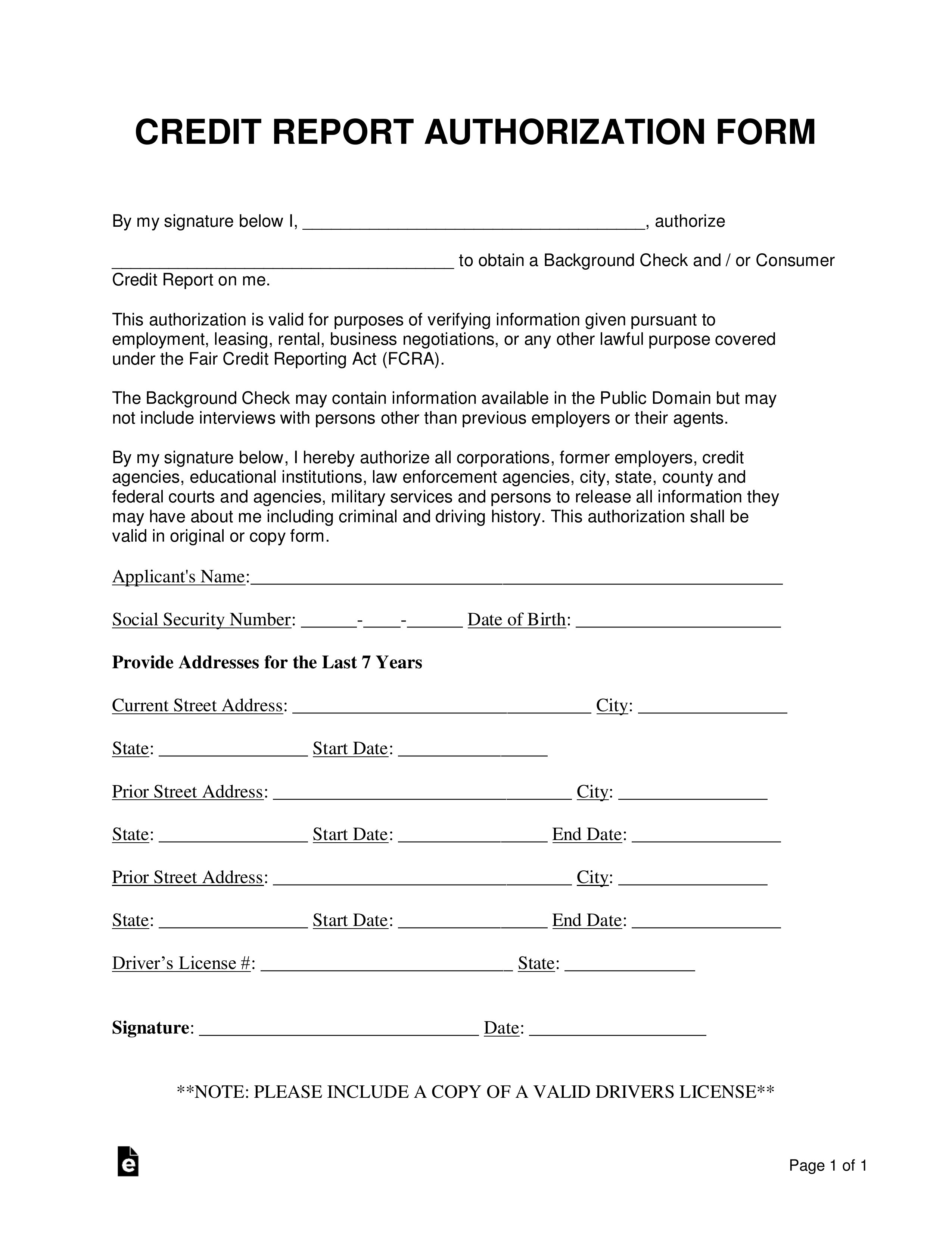

What to Include

This form should provide the full names of the authorized party and the applicant. In addition, it should include the applicant’s:

- Social security number;

- Date of birth;

- Driver’s license number; and

- Residential history for the past seven (7) years.

To complete the form, the applicant should sign and date at the bottom.

Though the list of information requested from the applicant might seem like overkill, it provides alternative ways to search for records. While a social security number and name might be sufficient to run some checks, other information can be helping in turning up financial or criminal history – especially if the applicant has ever used a different name or alias.

Getting Consent to Run a Credit Report

Before a financier, landlord, or any party would like to perform a credit check on an individual, it’s required, under the Fair Credit Reporting Act, that the individual gives consent before their credit is searched.

Step 1 – Explain the Purpose to the Individual

Describe, in full, the purpose of the credit check and ask for all the necessary personal details and information. Emphasize that sensitive information will be safeguarded and provided to them at their request. If this is to be approved for a lease agreement, the individual may be subject to paying a fee to run the credit report (typically between $25 to $75).

Step 2 – Completing the Form

The authorization form should be completed by the consenter and given to the party handling the credit check. In most cases, an answer will be provided within 24-48 hours in order to view the person’s credit score, outstanding debts, and total credit limit. If an individual has multiple credit queries within a short amount of time, credit reporting agencies will treat all the filings as one search, therefore, not affecting their credit score.[2]

Step 3 – Obtaining a Real Signature

Once the form is complete, the consenter must sign the form. Due to the sensitive information that is being looked up, the consenter will have to handwrite their signature or elect to electronically sign through an authorized electronic signature (such as DocuSign, HelloSign, or Adobe Sign).

Step 4 – Run the Credit Report

Depending on the preference of the person running the credit check, the following companies are recommended to run a credit check:

- Experian – Consenter is emailed and will be required to enter their information and pay a $14.95 fee.

- MySmartMove – For landlords, the applying tenant will be required to enter their information and pay a $25 fee.

Step 5 – Review and Give a Copy to the Consenter (if asked)

After reviewing the report it’s now time to contact the individual and inform them of their request.

Financiers – If the applicant is applying for a mortgage or a loan usually the credit report will be provided after completion.

Housing – The landlord or property manager will let them know if they were approved (use the approval letter). If rejected, the landlord is required to send a rejection letter or other form of communication informing the tenant the reasons for their rejection.

Video

Download: Adobe PDF, Microsoft Word (.docx), or Open Document Text (.odt).

1 – Select The Appropriate File Version To Gain Access To The Correct Waiver

The paperwork on this page will enable its user to give explicit permission to an entity requesting to research his or her credit background. You may save this form in any of the formats provided via the buttons under the image on this page or the above links then open it to work on at your leisure.

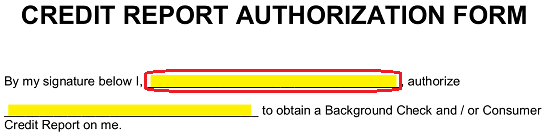

2 – Complete The Authorization Statement

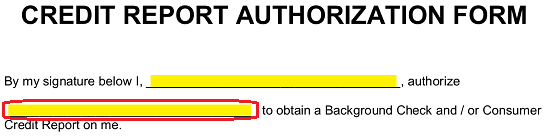

The body of this template will supply some valuable (and required) language when giving someone permission to do a credit background check, however, this language will not be applicable unless each of the parties involved with this waiver is properly identified. This disclosure of identity will take place in the first statement. First, locate the blank space after the words “By My Signature Below I,” then fill in the Name of the individual granting permission and releasing his or her right to privacy according to this paperwork’s language. This party will be referred to as the “Applicant.”

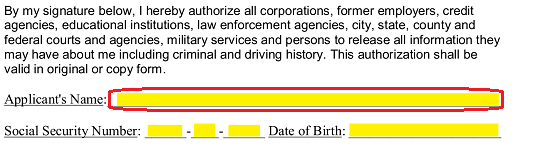

Next, record the official name of the entity receiving permission through this document on the blank line provided between the word “…Authorize” and the phrase “…To Obtain A Background Check And/Or Consumer Credit Report.”  The last paragraph will conclude this waiver’s language. Below this, print the Full Name of the individual approving the credit check on the “Applicant’s Name” line. Note: This must be identical to the name supplied in the first statement.

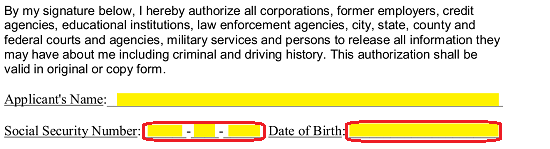

The last paragraph will conclude this waiver’s language. Below this, print the Full Name of the individual approving the credit check on the “Applicant’s Name” line. Note: This must be identical to the name supplied in the first statement.

In addition to the Applicant’s printed names, a record of the Applicant’s “Social Security Number” and “Date Of Birth” must be produced in the area provided.

3 – Some Basic Background On The Applicant Should Be Supplied

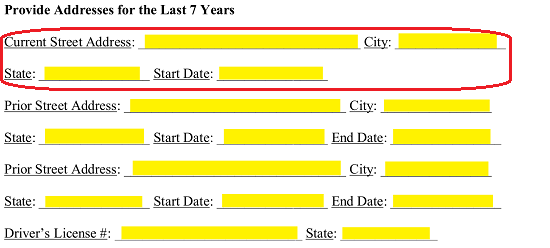

The final area, titled “Provide Addresses For The Last 7 Years,” requests some additional information regarding the Applicant and will serve to solidify his or her identity. This section assumes the Applicant has lived in three places in the previous seven years (including the current year). If there are more, you should continue reporting this information by either copying and pasting one of the blank sections or by supplying an attachment with that information. If the Applicant lived in less than three places, you may leave the unused portion blank or delete it with the appropriate software.

The first blank space, labeled “Current Street Address,” must have the Applicant’s Building Number, Street, and Unit Number where he or she currently lives furnished to it. There will also be a blank space reserved for this Address’ “City,” “State,” and “Start Date” (as recorded on the Master Lease). Make sure all these areas are filled in to fully document where the applicant currently lives.  There will be two more areas, each beginning with the label “Prior Street Address.” Supply the Residential Address of the last place the Applicant lived in the first of these areas and the second to last place where he or she lived in the second area. If there are more Residential Addresses to report for this Applicant, they should continue to be recorded sequentially in descending order either here or on an attachment.

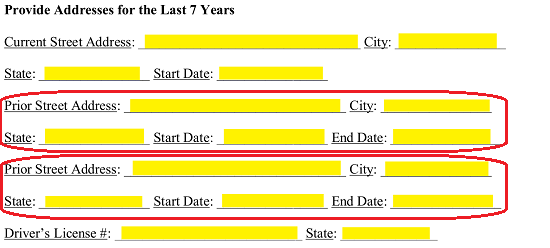

There will be two more areas, each beginning with the label “Prior Street Address.” Supply the Residential Address of the last place the Applicant lived in the first of these areas and the second to last place where he or she lived in the second area. If there are more Residential Addresses to report for this Applicant, they should continue to be recorded sequentially in descending order either here or on an attachment.  Once every Residential Address where the Applicant lived in the past seven years has been presented, record his or her Driver’s License I.D. Number and the State where it was issued using the blank spaces labeled “Driver’s License #” and “State.”

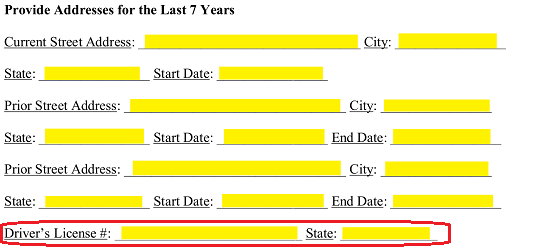

Once every Residential Address where the Applicant lived in the past seven years has been presented, record his or her Driver’s License I.D. Number and the State where it was issued using the blank spaces labeled “Driver’s License #” and “State.”

4- The Applicant’s Signature Must Be Submitted

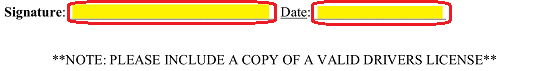

Finally, the Applicant must supply his or her signature to this template as a proof of acknowledgment and intent. He or she should sign the line just after the bold label “Signature” then, report the current date immediately after his or her signing on the “Date” line.  It is important to submit this form with a clear photocopy of the applicant’s current Driver’s License.”

It is important to submit this form with a clear photocopy of the applicant’s current Driver’s License.”