Updated March 21, 2024

An Arkansas beneficiary deed transfers real property to a designated beneficiary upon the current owner’s death. Also known as a transfer on death deed, this document allows the beneficiary to forgo probate proceedings, which can be fairly costly and time-intensive.

Table of Contents |

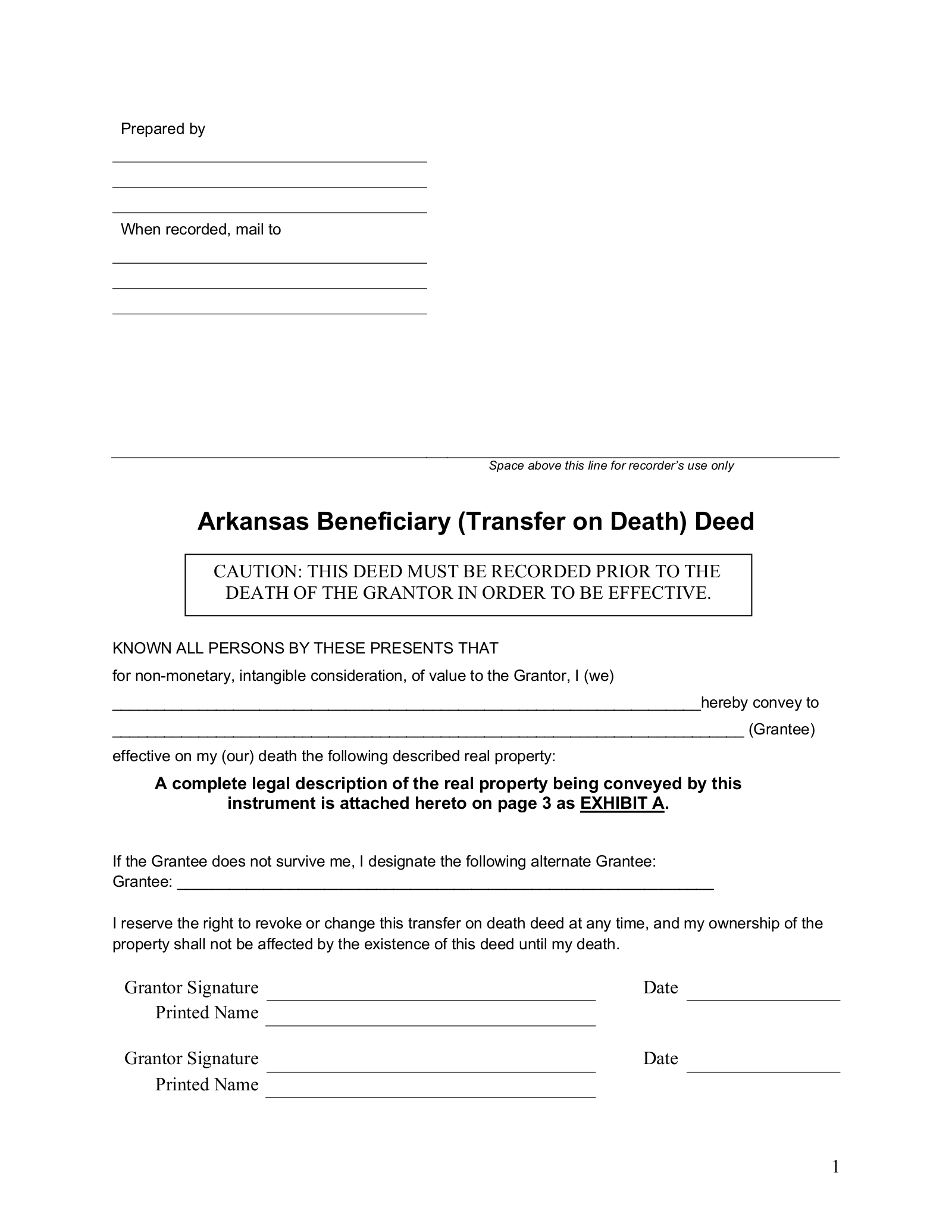

Requirements

- Notary: Required (§ 18-12-201)

- Recording: Must be recorded before the property owner’s death in the respective county recorder’s office (§ 18-12-608)

Legal Description

A beneficiary deed must include a legal description. This is a written statement that specifies the precise location and boundaries of the property. Unlike an address, this information is a very unique identifier.

Legal descriptions can be found on property tax statements or the current deed. The county recorder’s office can also provide this information.

Example

“Lot 10, Block 22, Snook’s Creek Subdivision, according to the official plat thereof, filed in the office of the County Recorder of Clay County, State of Arkansas.”

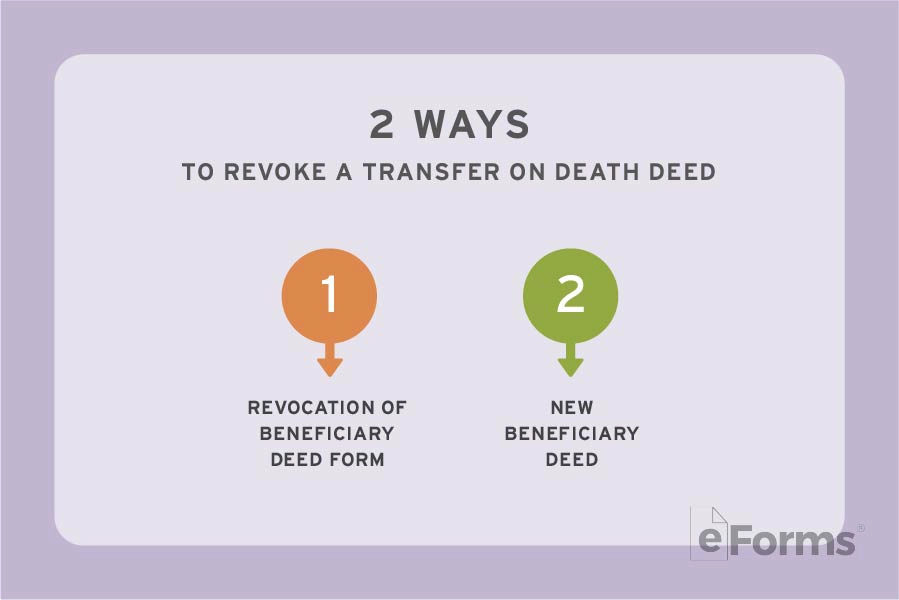

Revocation

A property owner may revoke a beneficiary deed using two methods:

- Complete a revocation of beneficiary deed form (§ 18-12-608(h)). This document must be recorded prior to the grantor’s death to be effective.

- Alternatively, a grantor may choose to complete and record a new beneficiary deed. In Arkansas, the beneficiary deed last signed before the grantor’s death is the effective deed (§ 18-12-608(d)).

Where to Record

In Arkansas, a beneficiary deed is only valid if it is recorded before the grantor’s death in the office of the county recorder where the property is located (§ 14-15-404(a)(1)).

Fee: A recording fee may apply and is dependent upon the county.