Updated April 11, 2024

A Minnesota special warranty deed is similar to a warranty deed because it provides a warranty from a seller to a buyer, but different from a warranty deed in that it only provides a limited warranty of title. The grantor warrants that he or she has not encumbered the title since he or she has owned the property, but does not guarantee anything that may have happened before they acquired the title. It is prudent to have a thorough property search completed to ascertain whether or not there are any issues with the title.

Laws – Chapter 507 – Recording and Filing Conveyances

Signing (M.S.A. § 507.24) – Must be signed before a Notary Public or other Court Officer before it is deemed recordable.

Recording (M.S.A. § 507.0944)- Must be filed with the County Recorder’s Office.

How to Write

Download; PDF, MS Word, OpenDocument

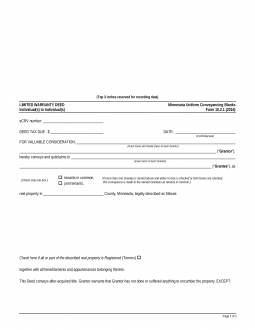

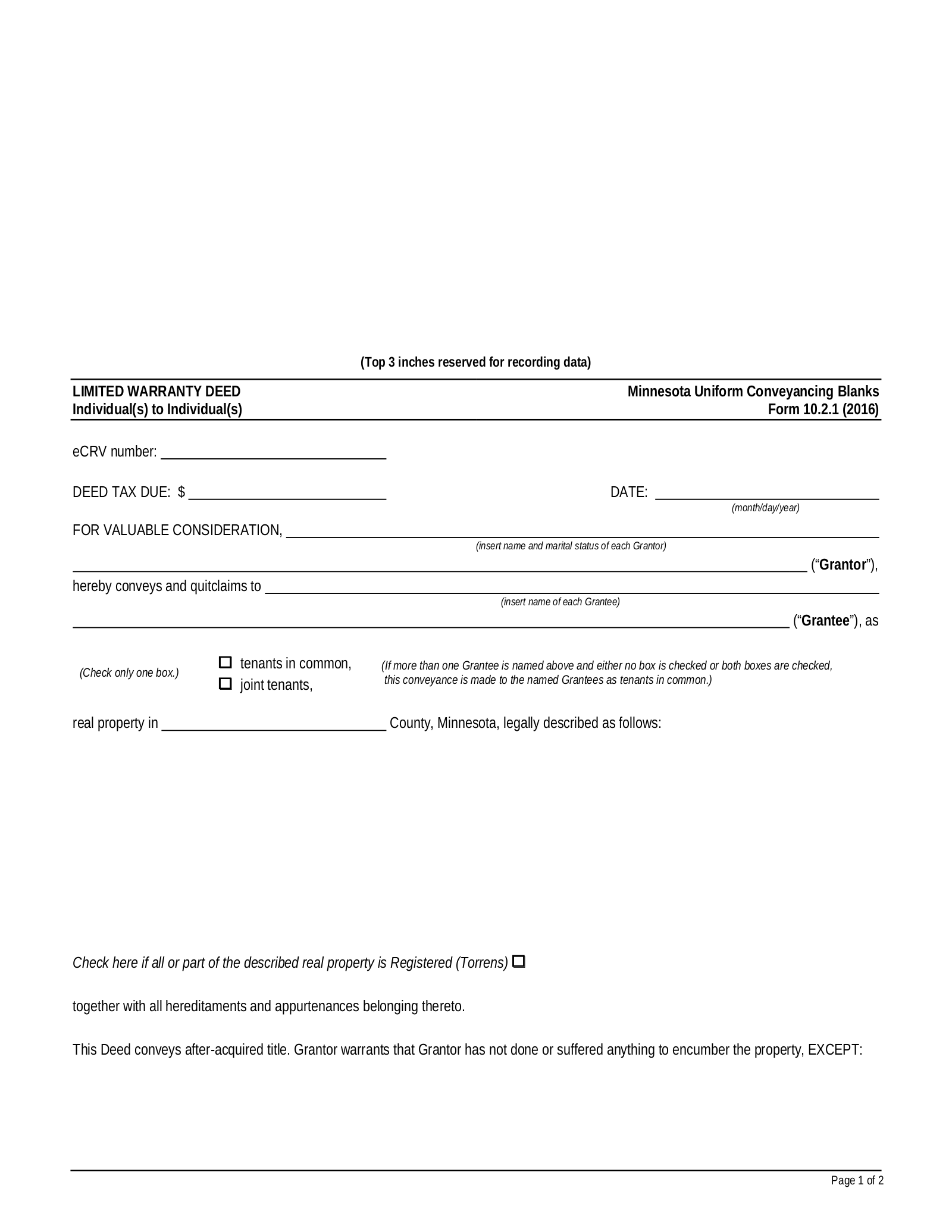

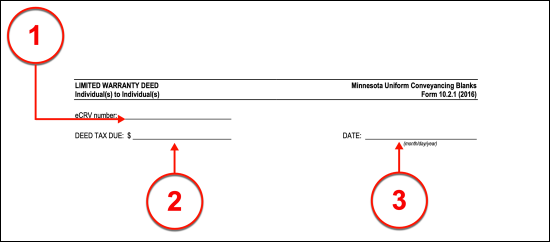

I. Preliminary Information

(1) ECRV Number. This statement must include some background information on the property and its current Owner. Therefore, a record of the Electronic Certificate of Real Estate Value Number assigned to this property during its last sale/transfer must be supplied in the first available line. If this information is not readily available more information may be found with the Minnesota Department of Revenue or with the County Recorder Office where the Minnesota property is located.

(2) Deed Tax Due. The amount of money due in taxes for the Minnesota property (according to its last formal assessment) should also be dispensed to the top of this page.

(3) Date. The formal date for this document should be documented. This will verify that the above information currently applies to this property at the time of this document’s execution.

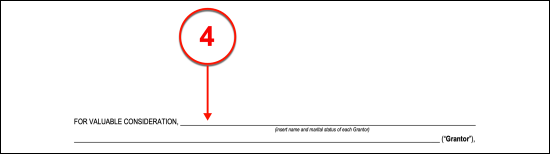

II. Minnesota Statement Of Conveyance

(4) Minnesota Grantor Of Real Estate. The current Minnesota Property Owner who is selling the defined real estate and releasing his or her held interest over it must be fully identified. Formally identify the Minnesota Grantor with his or her complete name and legal address. If more than one Party should be considered the Minnesota Grantor then make sure all their full names are supplied to this statement. Additionally, the residential address where each of the Minnesota Grantors involved with this conveyance should be documented when reporting each one’s identity.

(5) Minnesota Grantee Of Real Estate. In addition to an identification of the Minnesota Grantor(s), every Party allowed to claim ownership through this deed will need to be set as the Minnesota Grantee in it. To this end supply the Minnesota Grantee’s full name. If there will be more than one Minnesota Grantee, make sure the legal name of each one of these Parties is attached to the Minnesota Grantee role by supplying all their names.

(6) Minnesota Grantee Status. If more than one Party will be granted ownership of the Minnesota property as its Grantee, the relationship between these Grantees will need to be established within this document. Two check boxes will allow a quick report to satisfy this requirement. If there will be multiple Minnesota Grantees who the State should consider Tenants in Common then select the first checkbox status. If not, then select the second checkbox to indicate that the Minnesota Grantees should be held as “Joint Tenants.” Be advised that if neither box is selected and there is more than one Grantee, then the State of Minnesota will consider these Parties “Tenants In Common.”

III. Minnesota Property

(7) Minnesota County Of Effect. In order for the Parties involved to be considered the Minnesota Grantor and Grantee, the property must be located in a Minnesota County. Name this County where requested.

(8) Minnesota Real Property. The Minnesota property at the center of this discussion should be defined with two reports. The first will be its physical address while the second must be its official legal description (as recorded by the County where the most recent deed was registered or filed).

(9) Minnesota Property Recording. If the Minnesota Property has a formal title that is registered then select the checkbox on display.

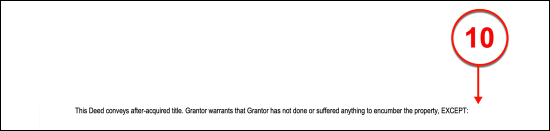

(10) Current Owner Description. If the Minnesota Grantor has any encumbrances on the property that he or she is responsible for, then each such debt, repair, or alteration should be documented. This report should only consist of items that occurred under the Minnesota Grantor’s ownership. If no details are recorded, the State of Minnesota shall hold that the Minnesota Grantor has incurred absolutely no encumbrances on the property during the time he or she acquired and owned it until the execution of this deed.

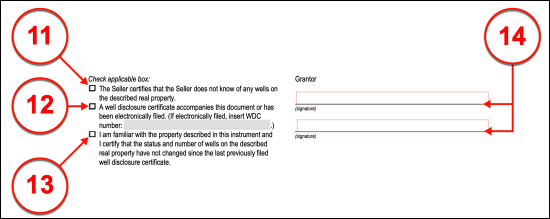

IV. Wells On Property Statement

(11) No Wells Known. If the Minnesota Grantor can state that he or she has no knowledge of any wells on the property, then the first checkbox statement of the final section discussing the property should be selected.

(12) Well Disclosure. If the property will be released to the Grantee with a Well Disclosure Certificate, select the second statement and document the Well Disclosure Certificate Number. Make sure that if such a certificate has been issued, it is attached to this document.

(13) Statement On Known Wells. If no new Well Disclosure Certificate has been issued but the Minnesota Grantor can guarantee that he or she has reliable knowledge of the property since the last Well Disclosure Certificate and that no wells have been removed or added during his or her time as the Property Owner then select the third statement.

V. Minnesota Grantor Signature

(14) Minnesota Grantor Signing. This document will not be considered effective unless every Minnesota Grantor above signs his or her name upon its completion. It is mandatory that the Minnesota Grantor produce a notarized signature.

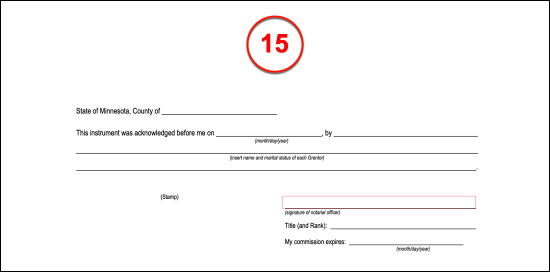

VI. Minnesota Grantor Notarization

(15) Notary Public Effect. The Notary Public will be able to authenticate the signature process of the Minnesota Grantor by personally witnessing it after verifying the Minnesota Grantor’s ID. The area displayed beneath the Minnesota Grantor’s signature is reserved for the Notary’s report and credentials.

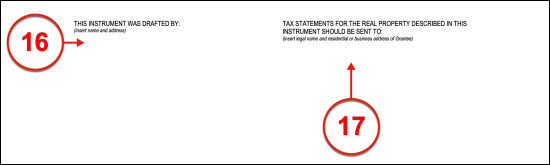

VII. Minnesota Statement Reporter

(16) Preparer Of Minnesota Document. The Party that was responsible for preparing this document for signing by dispensing the information it requests. As the Preparer of this Minnesota conveyance statement, dispense your legal name and business address where requested.

VIII. Formal Contact Information

(17) Minnesota Grantee Contact. All tax correspondence, notices, and issues regarding this property will be sent to the Grantee after this conveyance is filed. Therefore, furnish the name and address of the Minnesota Grantee(s) that should receive such material in the future.