Updated April 12, 2024

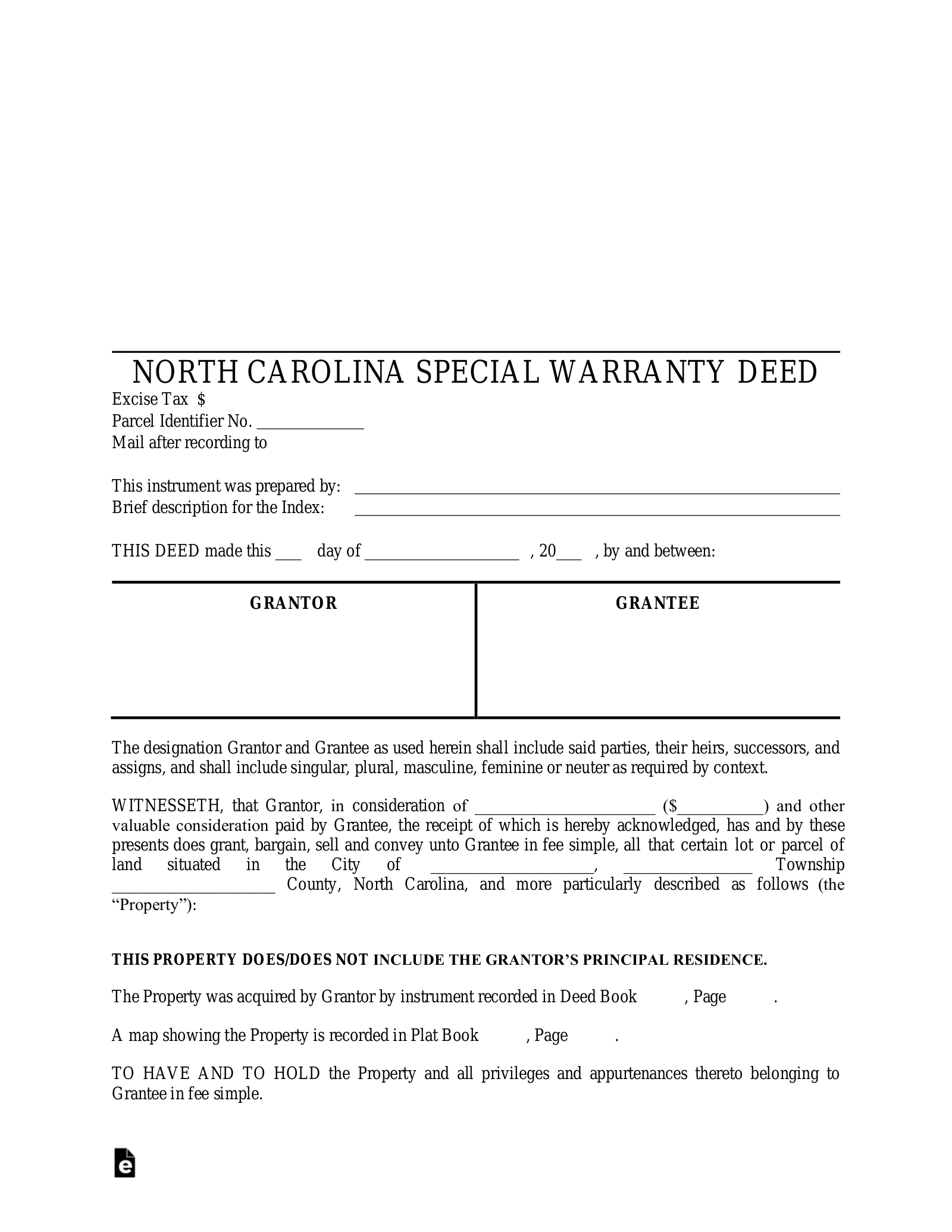

A North Carolina special warranty deed is used to convey property from a grantor (seller) to a grantee (buyer) with a limited guarantee that there are no liens or encumbrances on the title during the grantor’s ownership. Although, the deed does not guarantee clean title from past owners.

Once this deed is properly completed, the grantee should file it with the Registry of Deeds in the county where the property is located.

Laws – Chapter 47 through Chapter 47H

Recording – Must be filed and recorded in the Registry of Deeds in the county in which the real estate is situated.[1]

Signing – Must be acknowledged before a Notary Public.[2]

How to Write

Download: PDF

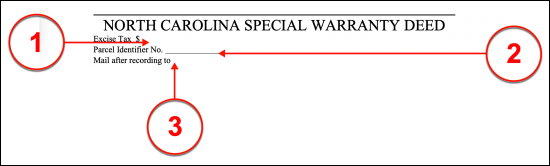

I. Preliminary Information

(1) Excise Tax. Furnish the dollar amount of the excise tax required for this property as of the last assessment.

(2) Parcel Identifier No. Dispense the parcel number or parcel identifier number assigned to the real property.

(3) Predetermined Recipient Of Statement. The Party elected to receive this paperwork once the North Carolina Registry of Deeds files it should be documented with his or her permanent mailing address.

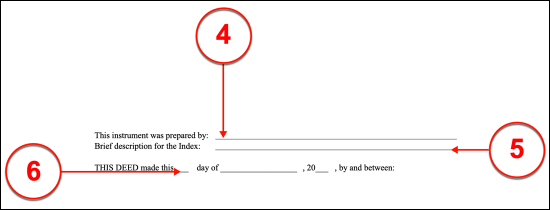

(4) Preparer Of North Carolina Instrument. The Instrument Preparer who is responsible for dispensing the information behind the property transfer to this form must be named. In addition to this or her identity, make sure the mailing address of the Instrument preparer is displayed.

(5) Index Information. Define the purpose of this paperwork as a special warranty deed for a specific property. This will require a record of the physical address of the property.

(6) Date Of North Carolina Instrument. Document the calendar date when the North Carolina instrument being completed becomes active.

II. North Carolina Grantor

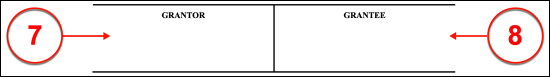

(7) North Carolina Property Owner. The Grantor of the North Carolina instrument to convey a current Property Owner’s interest (or a claim of ownership) on North Carolina real estate is the North Carolina Property Owner who currently possesses the real property. Oftentimes, this Party will receive payment for the real estate but property can also be released as a result of a court order or even as a gift. Regardless of the reason, dispense the full name of the North Carolina Property Owner to the “Grantor” column along with his or her address. If this is a Company or Business Entity, make sure its entire legal name is on display.

III. North Carolina Grantee

(8) North Carolina Property Recipient. The Party who shall receive the Grantor’s ownership over the North Carolina real property through this written instrument must be identified as the North Carolina Grantee. His or her full name and address will be required in the “Grantee” column for this task.

IV. North Carolina Real Property

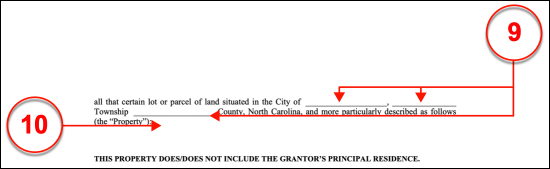

(9) General Location. The North Carolina property will have to be located within the State of North Carolina. To this end, deliver the name of the City, Township, and County of its location to the spaces provided in the second paragraph.

(10) Legal Description Of North Carolina Property. The exact wording making up the legal description used on record to define the North Carolina real property is required by the conveyance statement being issued. The North Carolina Registry of Deeds or the last deed issued for this property will contain this required report. If there is not enough space, more may be inserted or the balance of this description can be presented on an attachment.

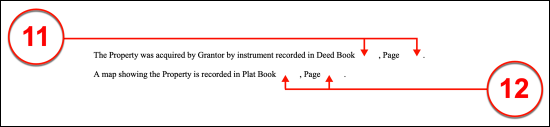

(11) Deed Book Information. The property discussed must be fully defined so that ownership over it may be conveyed accurately and without delay. Therefore, identify the North Carolina Registry Deed Book holding the legal description of the property along with the page number where this information will be found.

(12) Formal Map Reference. Identify the Deed Registry’s Plat Book and Page Number where the map of the property, its place in the Township and County, and its boundaries are defined as a matter of record.

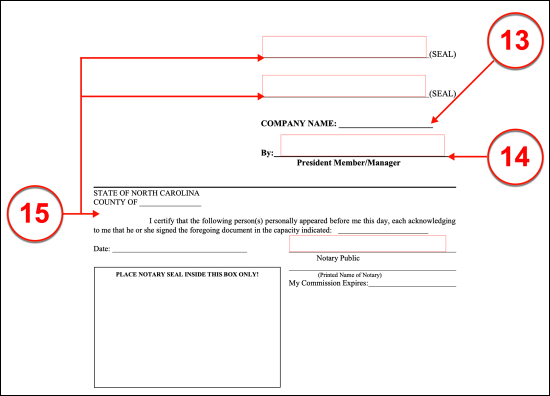

V. Execution

(13) Grantor Company Name. The North Carolina Grantor must sign this document and have his or her signature notarized at the time of signing. Two Seals are provided for the Notary Public to display this process (in case there are two North Carolina Grantors). Every North Carolina Property Owner or Grantor acting to release this real estate will need to satisfy this requirement even if the North Carolina Grantor is not a Private Party. If the North Carolina Grantor is a Business Entity, it must be identified as well. Therefore, a space for the “Company Name” has been provided. If this is the case, the name of the Company acting as the North Carolina Grantor must have its name presented in print to the space provided.

(14) Signature. The North Carolina Grantor must sign this document before a Notary Public. If the Grantor is a Company, then a Representative who is authorized by that Company or has the power within that Company to grant ownership over the real estate must sign this document.

(15) Notary Action For North Carolina Instrument. The final area is reserved for the use of the certified Notary Public working to notarize the execution of this document.