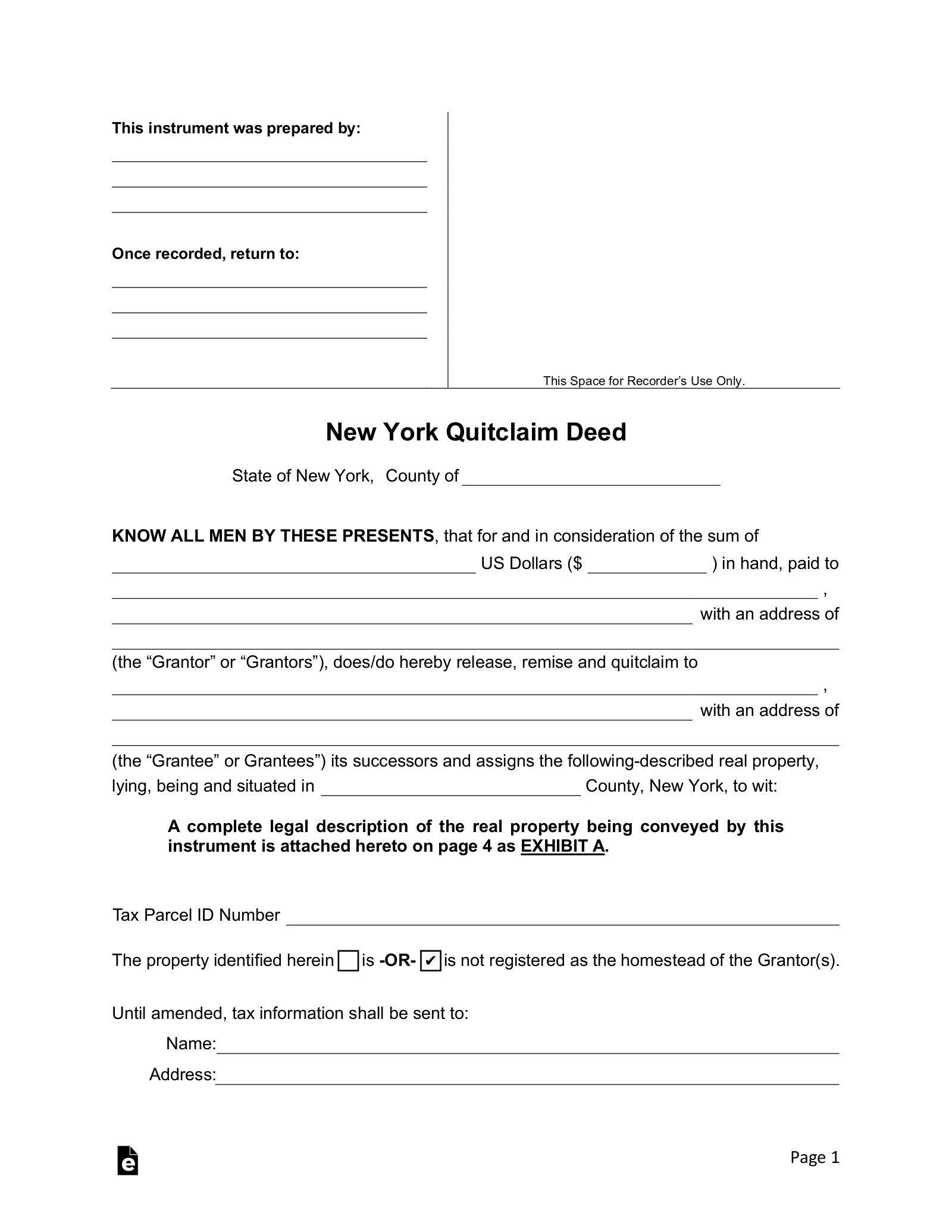

Updated April 12, 2024

A New York quit claim deed may be used as a legal tool to convey a property from one individual to another. This form will also require additional filings, some of them dependent on the location of the property itself. This form does not provide actual proof of the Grantor’s relationship with the Property only that whatever that relationship is, it will be transferred to another party as a result of this conveyance. This form must be filed with the New York County recorder where the property is located.

Laws

- Form TP-584 (All Counties outside NYC) OR Form TP-584-NYC (NYC Use Only) – This form is a tax return directly regarding real estate property.

- RP-5217-PDF (All Counties except NYC) OR RP-5217-NYC (NYC Use Only) This form is a real property transfer report and a version may also be completed and filed online.

- Recording – All quit claim deeds are filed with the County Clerk’s Office in the jurisdiction of where the property is located (See Court Locator).[1]

- Signing – A quit claim deed is required to be signed with a Notary Public present (only the Grantor(s) must sign).[2]

- Statute – N.Y. Real Prop. Law § 258