Updated April 12, 2024

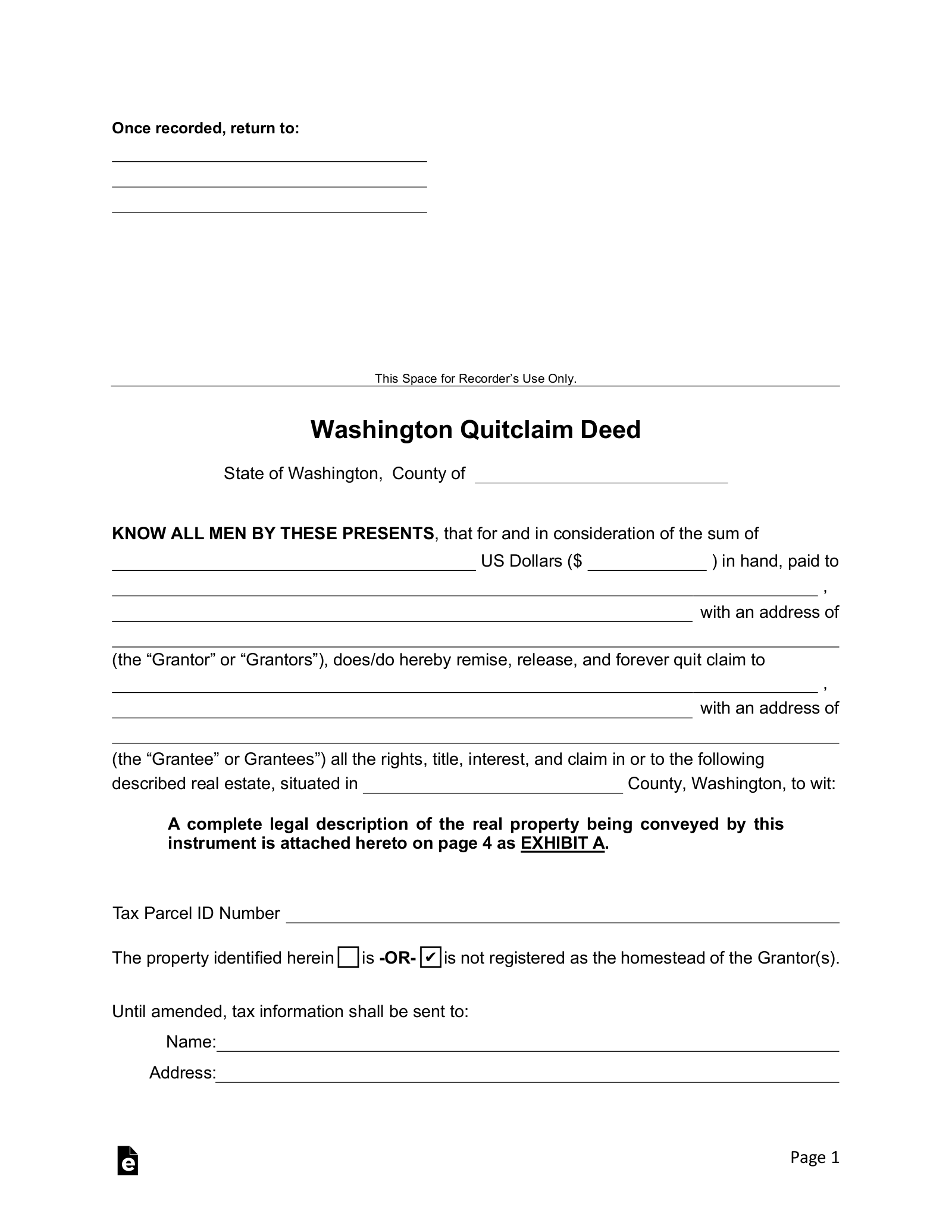

A Washington quit claim deed is a form that documents the conveyance of property. As it is an informal method of achieving this goal, there is no specific guarantee as to the grantor’s Claim or Rights to the property. Such a guarantee is implied by the nature of this paperwork but not necessarily validated. It is worth mentioning that if the land is connected or related to a separate property or a community then an additional cover sheet must be included. This must include the Description of such real estate by lot, block, or plat. If such real estate is not on record with the Washington County Auditor, the quit claim deed referring to this real estate will not be accepted. It is important to verify that if any such condition exists, the additional or connecting real estate is well documented beforehand.

Laws

- Cover Sheet – Must be placed on top of the quit claim deed in order to be processed.

- Formatting – There must be a margin of at least three (3) inches on the top and one (1) inch on the bottom.[1]

- Guide – Use to help with obtaining the recording.[1][2]

- Recording – To be filed, along with the fee, to the County Recorder’s Office in the jurisdiction of the property (See List of Counties).[3]

- Signing – Must be acknowledged by a notary public.[4]

- Statute – RCW 64.04.050