Updated September 27, 2023

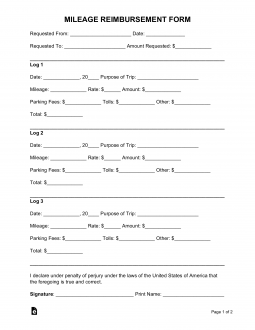

A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Seeing as there is no way to properly calculate the true cost of performing the trip by the employee, the IRS announces these rates on an annual basis for employers and businesses.

Current (2023) IRS Mileage Rate

- Business: $0.655 (65.5 cents)

- Medical or Moving: $0.22

- Charitable Organization: $0.14

What is the IRS Mileage Rate?

The IRS mileage rate is an amount per mile ($/mile) that the IRS allows businesses to reimburse their employees for trips made using a personal vehicle.

This is a flat rate that is the same for all vehicles. No matter if it’s an electric vehicle or pickup truck.

Mileage Rates By Year

| YEAR | BUSINESS | CHARITABLE SERVICE | MEDICAL & MOVING |

| 2023 | $0.655 (65.5 cents) | $0.14 | $0.22 |

| 2022 | $0.585 (58.5 cents) | $0.14 | $0.17 |

| 2021 | $0.56 (56 cents) | $0.14 | $0.16 |

| 2020 | $0.575 (57.5 cents) | $0.14 | $0.17 |

| 2019 | $0.58 (58 cents) | $0.14 | $0.20 |

| 2018 | $0.545 (54.5 cents) | $0.14 | $0.18 |

| 2017 | $0.535 (53.5 cents) | $0.14 | $0.17 |

| 2016 | $0.54 (54 cents) | $0.14 | $0.19 |

| 2015 | $0.575 (57.5 cents) | $0.14 | $0.23 |

| 2014 | $0.56 (56 cents) | $0.14 | $0.235 |

| 2013 | $0.565 (56.5 cents) | $0.14 | $0.24 |

Source: IRS Standard Mileage Rates

What Does It Cover?

The IRS mileage rate covers:

- Depreciation;

- Fuel (gas, electricity, etc.);

- Oil changes;

- Vehicle expenses (insurance, registration, etc.); and

- Common maintenance due to wear and tear.

It Does NOT Cover:

- Food;

- Lodging;

- Parking Fees;

- Tolls; and

- Minor accidents or repairs.

For the above-listed items, it is not an obligation but recommended for the employer to reimburse the employee.

How It’s Calculated

Number (#) of Miles multiplied by the Current Rate ($0.655) = Amount ($)

Example

Dan is an employee of a company and needs to meet with a client that is located in the next town. Dan drives and meets with the client and returns directly back to his business address.

In total, Dan drove 42 miles and ate lunch, which cost him $15.

- Driving: 42 miles multiplied by $0.655 = $27.51

- Lunch: The lunch reimbursement of $15 would only be reimbursed at the employer’s option. It is not a legal requirement.