Updated February 16, 2024

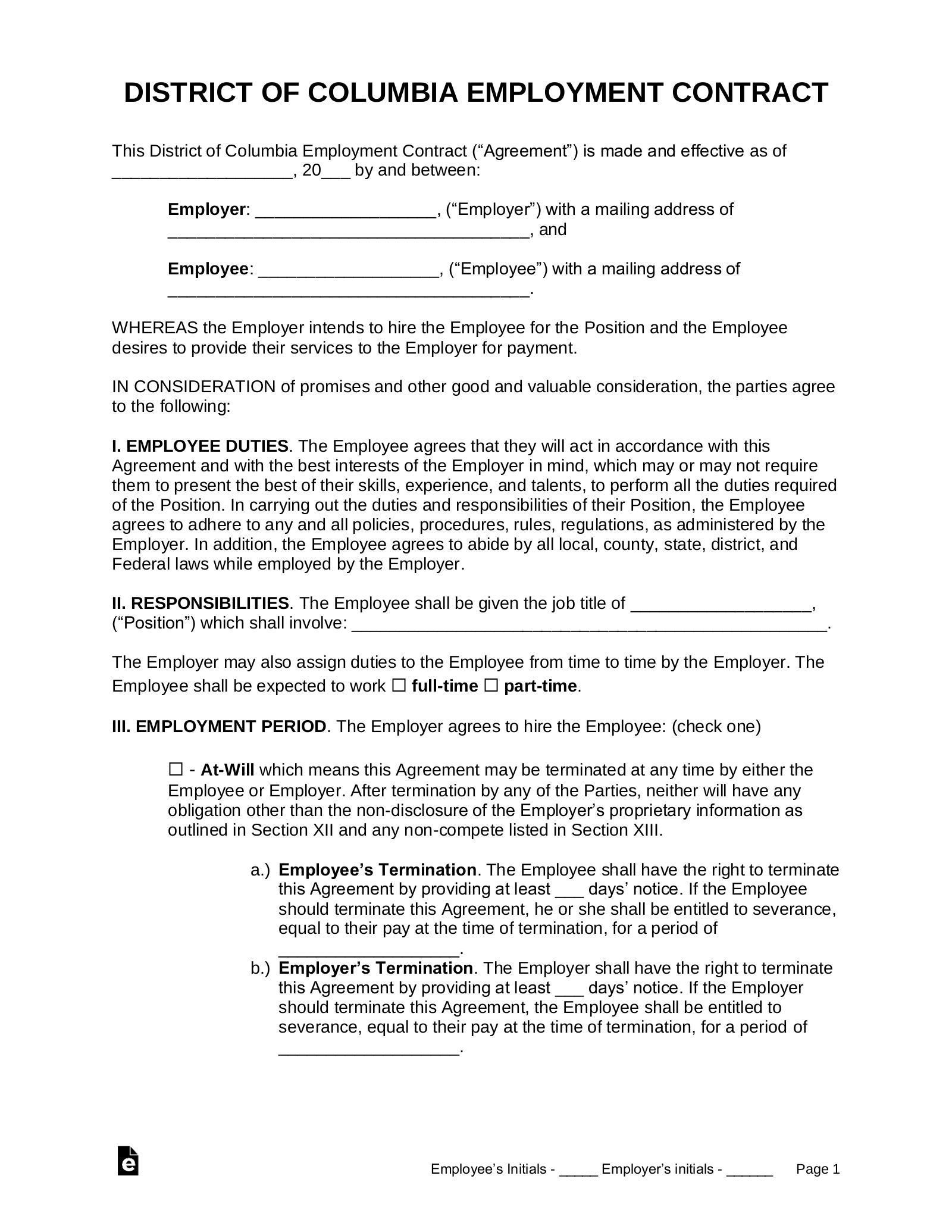

A Washington D.C. employment contract agreement is a legal document that creates an employer-employee relationship. The agreement will contain binding terms that set out the employee’s job description and duties and the pay and benefits that the employee will receive in return for working a certain amount of time. Depending on the nature of the employment, the agreement may also include other terms, including how long the relationship will endure, whether the employee’s wages benefits will increase over time, and additional obligations, such as non-disclosure requirements. Employment contracts create a legal basis for an employer’s expectations for an employee, while also requiring the employer to comply with certain federal and district-specific labor laws.

By Type (3)

Employee Non-Disclosure Agreement (NDA) – Prevents employees from disclosing trade secrets to other parties after the end of their period of employment.

Employee Non-Disclosure Agreement (NDA) – Prevents employees from disclosing trade secrets to other parties after the end of their period of employment.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Contains the duties and payment terms for workers who will perform discrete tasks without becoming employees.

Independent Contractor Agreement – Contains the duties and payment terms for workers who will perform discrete tasks without becoming employees.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – Allows general contractors to select people or entities to perform a part of a broader task; often used in the construction industry.

Subcontractor Agreement – Allows general contractors to select people or entities to perform a part of a broader task; often used in the construction industry.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“Employee” means any individual employed by an employer, but shall not include:

(A) Any individual who, without payment and without expectation of any gain, directly or indirectly, volunteers to engage in the activities of an educational, charitable, religious, or nonprofit organization;

(B) Any lay member elected or appointed to office within the discipline of any religious organization and engaged in religious functions;

(C) Any individual employed as a casual babysitter, in or about the residence of the employer.

(D) An independent contractor;

(E) A student;

(F) Health care workers who choose to participate in a premium pay program; or

(G) A substitute teacher or a substitute aide who is employed by District of Columbia Public Schools for a period of 30 or fewer consecutive work days.

At-Will Employment

According to the district’s Department of Employment Services, Washington D.C. is an at-will jurisdiction, meaning that unless otherwise specified, employers may terminate employment at any time, without reason or cause.

Income Tax Rate (Individual)

Individual Income Tax – For taxes payable starting Jan. 1, 2022, individual income tax rates will be:

| Not over $10,000 | 4% of the taxable income |

| Over $10,000 but not over $40,000 | $400, plus 6% of the excess over $10,000 |

| Over $40,000 but not over $60,000 | $2,200, plus 6.5% of the excess over $40,000 |

| Over $60,000 but not over $250,000 | $3,500, plus 8.5% of the excess over $60,000 |

| Over $250,000 but not over $500,000 | $19,650, plus 9.25% of the excess over $250,000 |

| Over $500,000 but not over $1,000,000 | $42,775, plus 9.75% of the excess over $500,000 |

| Over $1,000,000 | $91,525, plus 10.75% of the excess over $1,000,000 |

Minimum Wage ($/hr)

Minimum Wage – As of July 1, 2021, the minimum wage is $15.20. The wage was set at $15/hr on July 2020, and will increase each year by an amount linked to the Department of Labor’s Consumer Price Index for the region.[2]