Updated September 25, 2023

A Hawaii employment contract agreement is a legal document binding an employer and employee to predetermined terms and conditions. This type of agreement is most often used when an employer is hiring a high-level or highly-valued employee, an individual who will only agree to the job/position if certain guarantees are provided in writing. An employment contract can include terms outlining the length of employment, amount of pay, duties/responsibilities, how employee/employer can/cannot terminate employment, non-disclosure of confidential information, and non-compete clauses. Provisions may be negotiated by both parties depending on specific interests and the type of employment in question.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Designed to maintain the confidentiality of employer’s information and trade secrets.

Employee Non-Disclosure Agreement (NDA) – Designed to maintain the confidentiality of employer’s information and trade secrets.

Download: PDF, MS Word (.docx), OpenDocument

Employee Non-Compete Agreement – Prohibits employees from engaging in competition against the employer in the same field of business.

Employee Non-Compete Agreement – Prohibits employees from engaging in competition against the employer in the same field of business.

Download: PDF, MS Word (.docx), OpenDocument

Independent Contractor Agreement – Signed agreement between client and contractor outlining terms of employment.

Independent Contractor Agreement – Signed agreement between client and contractor outlining terms of employment.

Download: PDF, MS Word (.docx), OpenDocument

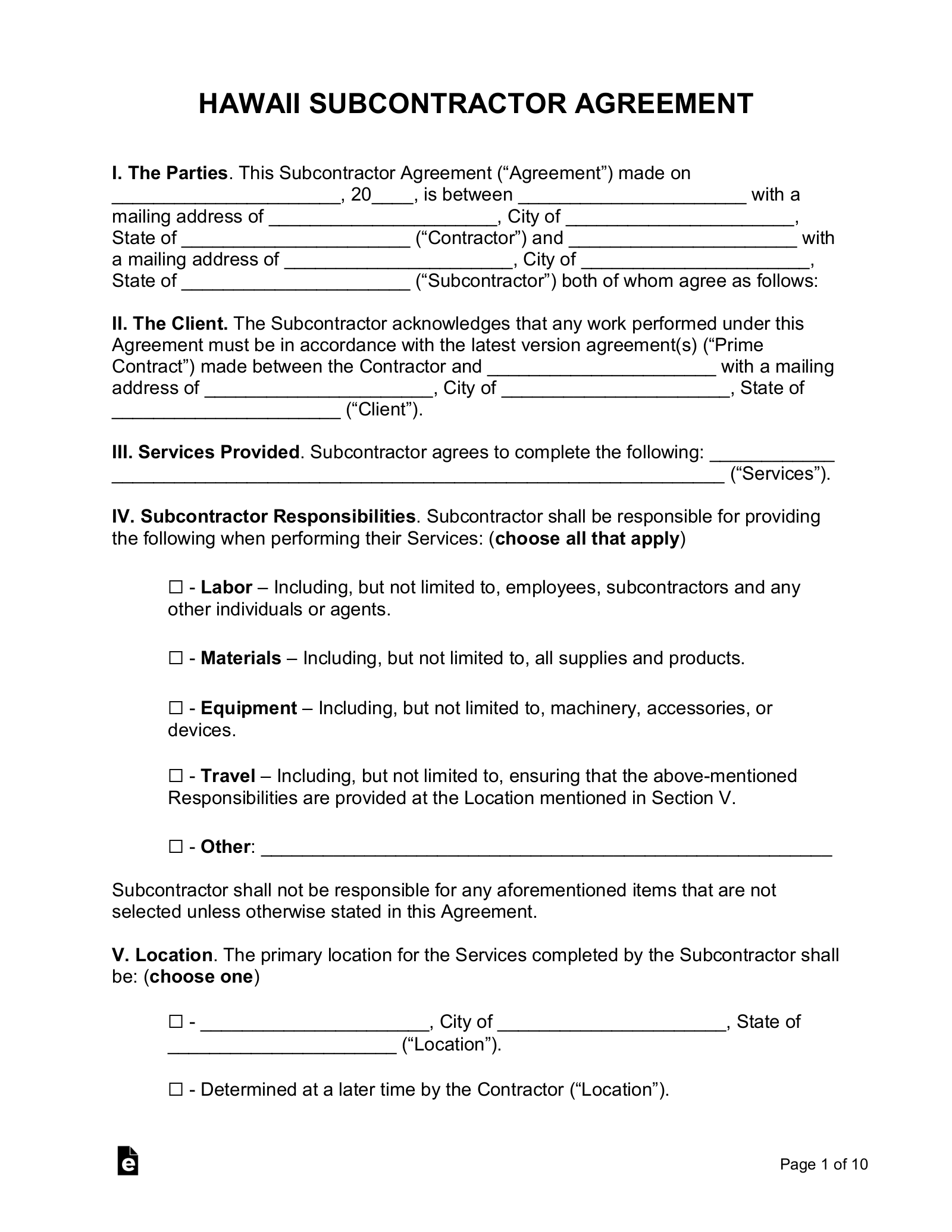

Subcontractor Agreement – Signed agreement between contractor and subcontractor outlining terms of employment.

Subcontractor Agreement – Signed agreement between contractor and subcontractor outlining terms of employment.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – Any person “suffered or permitted to work.”[1]

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” and “Implied Contracts” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 1.4% – 11%[2]

Minimum Wage ($/hr)

Minimum Wage – $10.10[3]