Updated August 04, 2023

A remodeling contract supplies the terms of an agreement under which a contractor performs substantial work on a client’s property. Remodeling contracts are essential for formalizing the manner of payment, project due dates, parties’ termination rights, and other common issues.

Table of Contents |

Do I Need a Permit to Remodel?

A remodel is a construction project that substantially modifies one or more rooms of an existing structure. A remodel is also sometimes referred to as a “renovation,” and while the terms are sometimes used interchangeably, a remodel is usually more extensive.

Although there is no universal legal definition of a remodel, some jurisdictions require that those wishing to carry out a remodel must obtain a building permit. Whether a project requires a building permit is a decision for the county or city’s building department.

Permit Required

Examples of projects that typically do require a permit include:

- Modifying load-bearing walls

- Building additions

- Changing floorplan

- Fireplace or chimney work

- Sewer line modifications

- Fencing over a certain height

Permit NOT Required

Examples of projects that typically do not require a permit include:

- Painting, whether exterior or interior

- Removing or modifying flooring

- Light electrical work (though projects that require new circuits or temporary power shutdowns likely will)

- Landscaping

- Installing new appliances or fixtures

- Roofing work that does not change a structure’s height or impact sightlines of surrounding property

It’s essential to check with the local building department before proceeding with a remodel. For projects with a remodeling contract, in which a client hires a remodeling contractor, the contractor will likely have some insight into whether a permit is required.

Remodel vs. New Construction

Remodels are also treated differently than new construction, a term whose definition can also shift from jurisdiction to jurisdiction. Regardless of how a client thinks of a project, being considered “new construction” can expose a project to more extensive requirements.

In many states, the state government will publish a lengthy building code, which cities and counties will adopt with modifications to reflect local conditions like topography or fire danger. These local building codes will determine whether a project qualifies as new construction. For example, in some cases, a modification of a majority of a structure’s exterior walls is considered new construction.

Types of Remodel

There are many different types of remodeling projects. Any type of structure can be remodeled, but some of the most common remodel projects include:

- Bathroom remodel

- Kitchen remodel

- Garage conversion

- Window replacements

Remodeling Under a Lease

Those occupying a property under a lease are generally allowed to remodel their property. However, tenants must consult the terms of their lease before doing so, and are generally required to obtain the approval of the landlord or property owner before proceeding. Additionally, tenants should think carefully about the cost of remodeling, particularly those on short-term leases, because any increase in the value would remain with the property after they have left.

From a property owner’s perspective, it is possible to pursue a remodel of a structure while it is being leased. However, some states require landlords to provide tenants with significant notice if they are to be evicted because of a pending remodel. And some cities or counties may require landlords wishing to remodel a property to provide existing tenants with relocation assistance.

How to Find a Remodeling Contractor

The first question to consider is how the property to be remodeled is zoned: residential, commercial, or industrial. Contractors will usually have specialization or experience in one of these categories. From there, it is generally best to select a group of potential candidates based of reputation, either through word-of-mouth or online review aggregators.

The final step is generally interviewing potential contractors. Before the interview takes place, it’s a good idea to prepare a basic scope of work: an expectation of what the work will consist of. During the interview, some questions to ask the contractor include:

- How long they estimate the project will take

- What are examples of similar projects they’ve done before?

- Would any subcontractors be required for the project, and if so, who might they be?

Licensing

States require contractors to be licensed. The National Association of State Contractors Licensing Agencies maintains a list of each state’s licensing body, where potential clients can verify that a contractor has the appropriate license, and in some cases gather other information, such as whether there have been previous complaints or problems with the contractor’s work.

What to Include

The content of a remodeling contract will vary from project to project, but there are some sections that are important to include:

- Terms of Payment: How will the contractor be paid — in a lump sum, a series of payments or some other way? And when will payments begin — once work is completed, or once it gets underway? Payment issues are the most common dispute in remodeling contracts, so getting these sorted out is essential.

- Due Date: Some remodel projects will impose a firm due date, and may even include a provision for a penalty if the contractor fails to meet it. However, because projects can be delayed for many reasons, contractors are likely to require much higher payments in order to submit to a fixed due date.

- Reimbursements: The contract should clarify which costs are incorporated in the price being paid by the client, and which must later be reimbursed. Reimbursement provisions are more common in projects with components whose price is highly variable, such as rare types of wood.

Sample

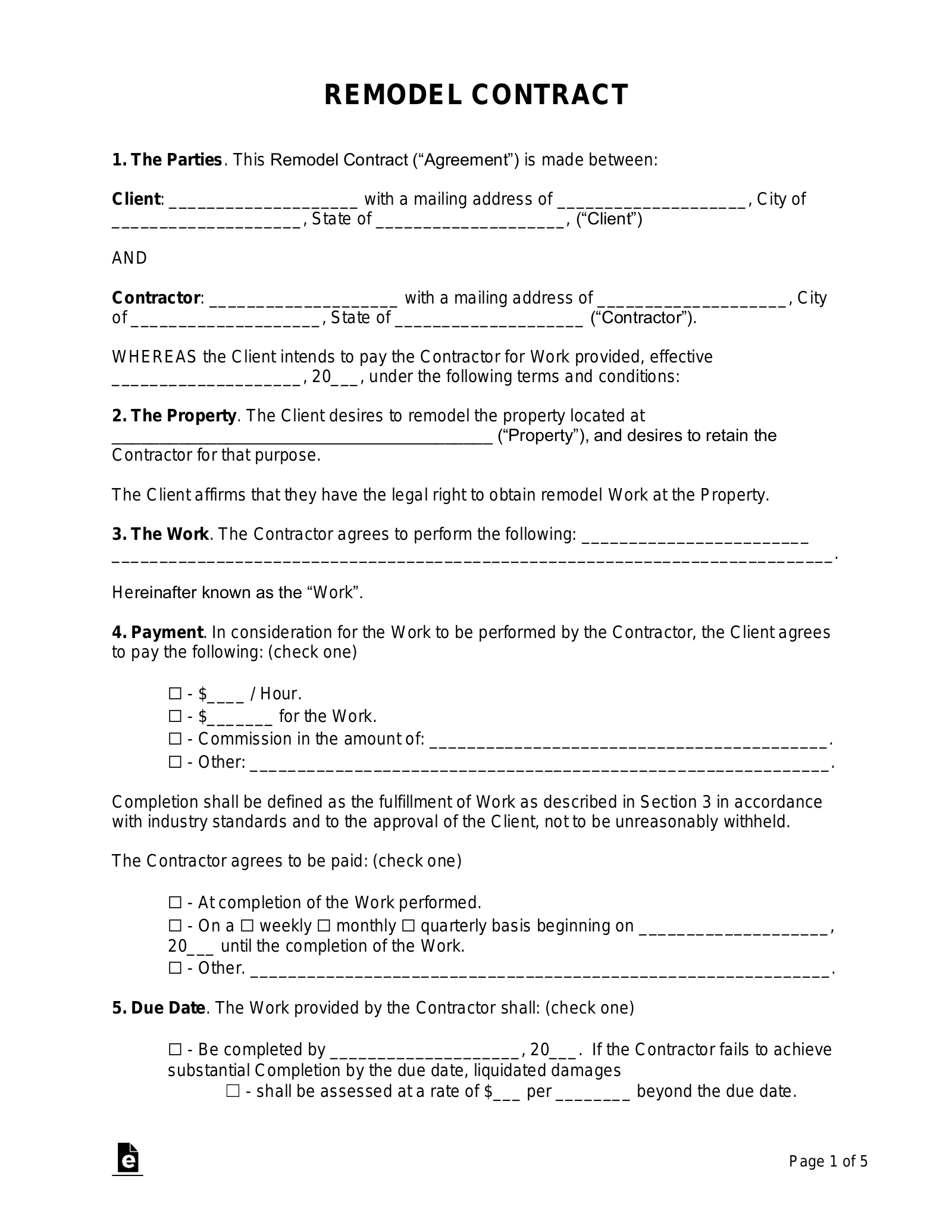

REMODELING CONTRACT

1. The Parties. This Remodel Contract (“Agreement”) dated [DATE] (“Effective Date”), is between the following:

Client: [CLIENT’S NAME] with a mailing address of [ADDRESS] (“Client”) and

Contractor: [CONTRACTORS’S NAME] with a mailing address of [ADDRESS] (“CONTRACTOR”)

WHEREAS the Client intends to pay the Contractor for Work provided, under the following terms and conditions:

2. The Property. The Client desires to remodel the property located at [PROPERTY ADDRESS] (“Property”), and desires to retain the Contractor for that purpose.

The Client affirms that they have the legal right to obtain remodel work at the Property.

3. The Work. In remodeling the Property, the Contractor agrees to perform the following work: [DESCRIBE REMODEL PLANS].

Hereinafter known as the “Work”.

4. Payment.

In consideration for the Work to be performed by the Contractor, the Client agrees to pay the following: (check one)

☐ – $[HOURLY RATE]/ Hour.

☐ – $[TOTAL PAYMENT] for the Work.

☐ – Commission in the amount of: [COMMISSION AMOUNT].

☐ – Other: [DESCRIBE].

Completion shall be defined as the fulfillment of Work as described in Section 3 in accordance with industry standards and to the approval of the Client, not to be unreasonably withheld.

The Contractor agrees to be paid: (check one)

☐ – At completion of the Work performed.

☐ – On a ☐ weekly ☐ monthly ☐ quarterly basis beginning on [DATE] until the completion of the Work.

☐ – Other. [DESCRIBE].

5. Due Date. The Work provided by the Contractor shall: (check one)

☐– Be completed by [DATE].

☐ – Not have a due date.

☐ – Other. [DESCRIBE]

6. Expenses. The Contractor shall be: (check one)

☐ – Responsible for all expenses related to providing the Work under this Agreement. This includes, but is not limited to, supplies, equipment, operating costs, business costs, employment costs, taxes, Social Security contributions/payments, disability insurance, unemployment taxes, and any other cost that may or may not be in connection with the Work provided Contractor.

☐ – *Reimbursed for the following expenses that are attributable directly to the Work performed under this Agreement: [DESCRIBE].

*The Client will be required to pay the Contractor within thirty (30) days of any Expense after receiving an itemized expense statement from the Contractor. Upon request by the Client, the Contractor may have to show any receipt(s) or proof of purchase for said Expense(s).

7. Liability Insurance (Minimum ($) Amount). The Contractor agrees to bear all responsibility for the actions related to themselves and their employees or personnel under this Agreement. In addition, the Contractor agrees to obtain comprehensive liability insurance coverage in case of bodily or personal injury, property damage, contractual liability, and cross-liability (“Liability Insurance”).

The minimum amount ($) for the Liability Insurance shall: (check one)

☐ – Be a minimum amount of combined single limit of $[AMOUNT].

☐ – Not have a minimum amount required.

8. Termination. This Agreement shall terminate upon the: (check one)

☐ – Completion of the Work provided.

☐ – Date of [DATE].

☐ – Other. [DESCRIBE].

In addition, the Client or Contractor may terminate this Agreement, and any obligations stated hereunder, with reasonable cause by providing written notice of a material breach of the other party; or any act exposing the other party to liability to others for personal injury or property damage.

9. Option to Terminate. The Client and Contractor shall: (check one)

☐ – Have the option to terminate this Agreement at any time by providing [NUMBER] days’ written notice.

☐ – Not have the option to terminate this Agreement unless there is reasonable cause, as defined in Section 8.

10. Business Licenses, Permits, and Certificates. The Contractor represents and warrants that all they are licensed to perform remodeling work in the state of [STATE] and that to that end they have a license number of [LICENSE NUMBER]; and further, that all employees and personnel associated shall comply with federal, state, and local laws requiring any required licenses, permits, and certificates necessary to perform the Work under this Agreement.

11. Independent Contractor Status. The Contractor, under the code of the Internal Revenue Service (IRS), is an independent contractor, and neither the Contractor’s employees or contract personnel are, or shall be deemed, the Client’s employees.

12. Governing Law. This Agreement shall be governed under the laws in the State of [STATE].

13. Additional Terms and Conditions. [ADDITIONAL TERMS AND CONDITIONS]

Client’s Signature ______________________ Date: _______________

Print Name ______________________

Contractor’s Signature ______________________ Date: _______________

Company: ______________________

Print Name: ______________________