Updated August 16, 2023

A cost accountant is someone who focuses on internal accounting in order to help company management make decisions. This can include planning budgets, preparing financial analyses, and measuring performance. Whereas some types of accountants prepare financial statements for the benefit of outside investors, the work a cost accountant does informs a company’s decisions about reducing expenses and increasing profit.

Salary (Median Pay)

For accountants and auditors.

- Salary: $73,560/yr

- Hourly Rate: $35.37/hr

Source: Bureau of Labor Statistics (BLS)

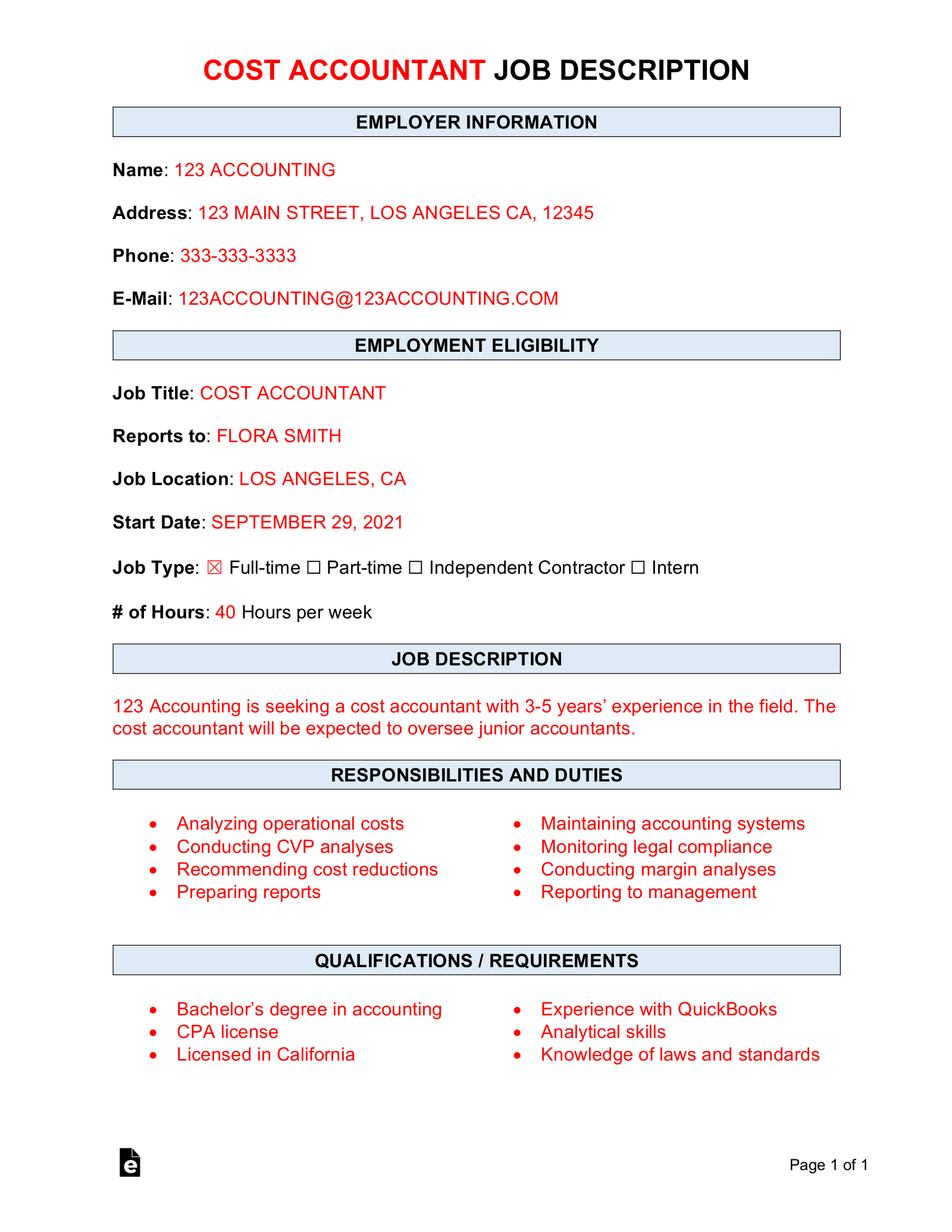

Duties and Responsibilities

- Analyzing operational costs and cost standards;

- Conducting cost-volume-profit (CVP) analyses;

- Preparing reports comparing standard costs to actual costs;

- Recommending opportunities for cost reduction and profit maximization;

- Maintaining cost accounting systems;

- Monitoring compliance with all laws and standards;

- Preparing financial statements; and

- Conducting margin analysis.

Qualifications

- Bachelor’s degree in accounting or related field;

- Licensed in the state;

- Experience working with QuickBooks or MAPICS;

- Computer skills;

- Excellent analytical skills; and

- Knowledge of accounting best practices, laws, standards, and Generally Accepted Accounting Principles (GAAP).