Updated August 23, 2023

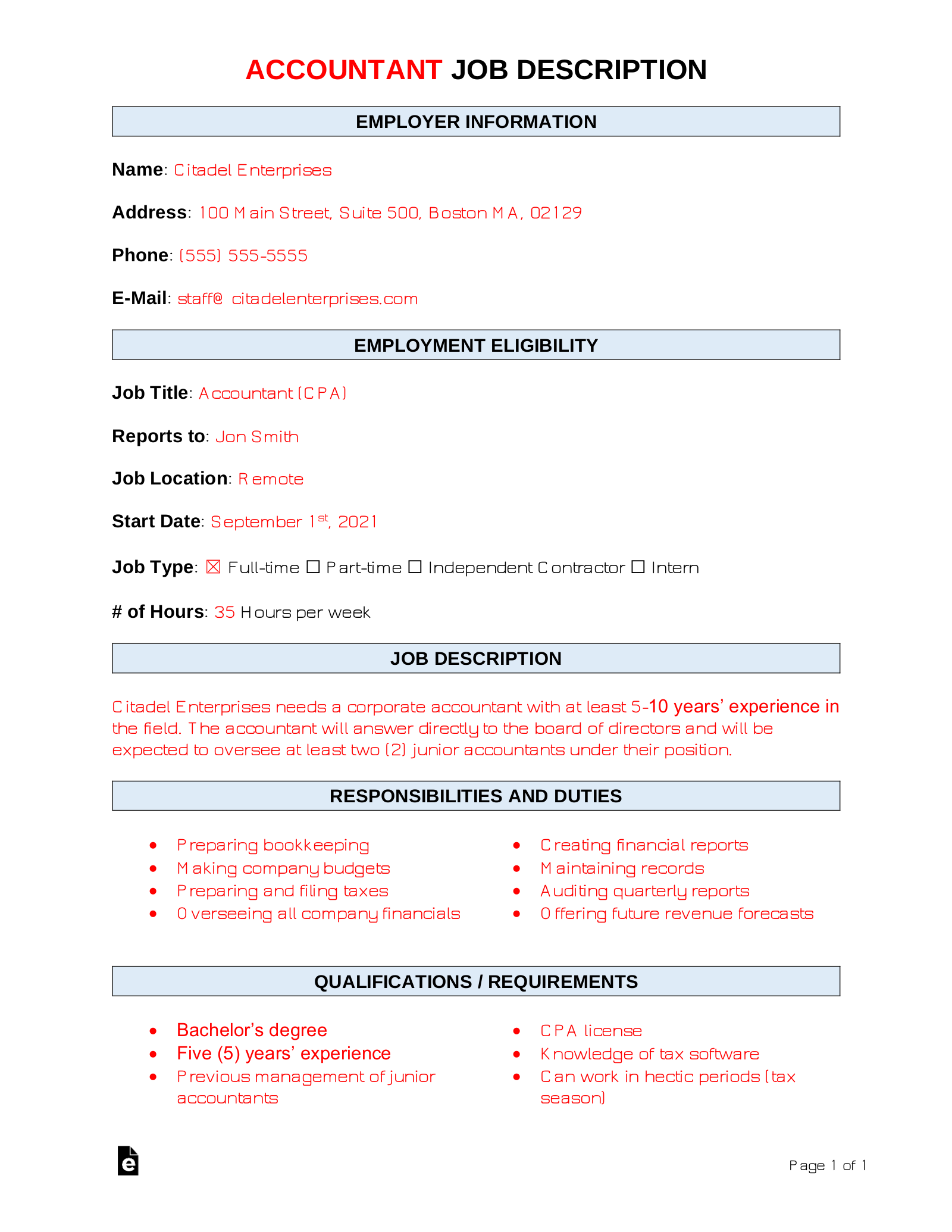

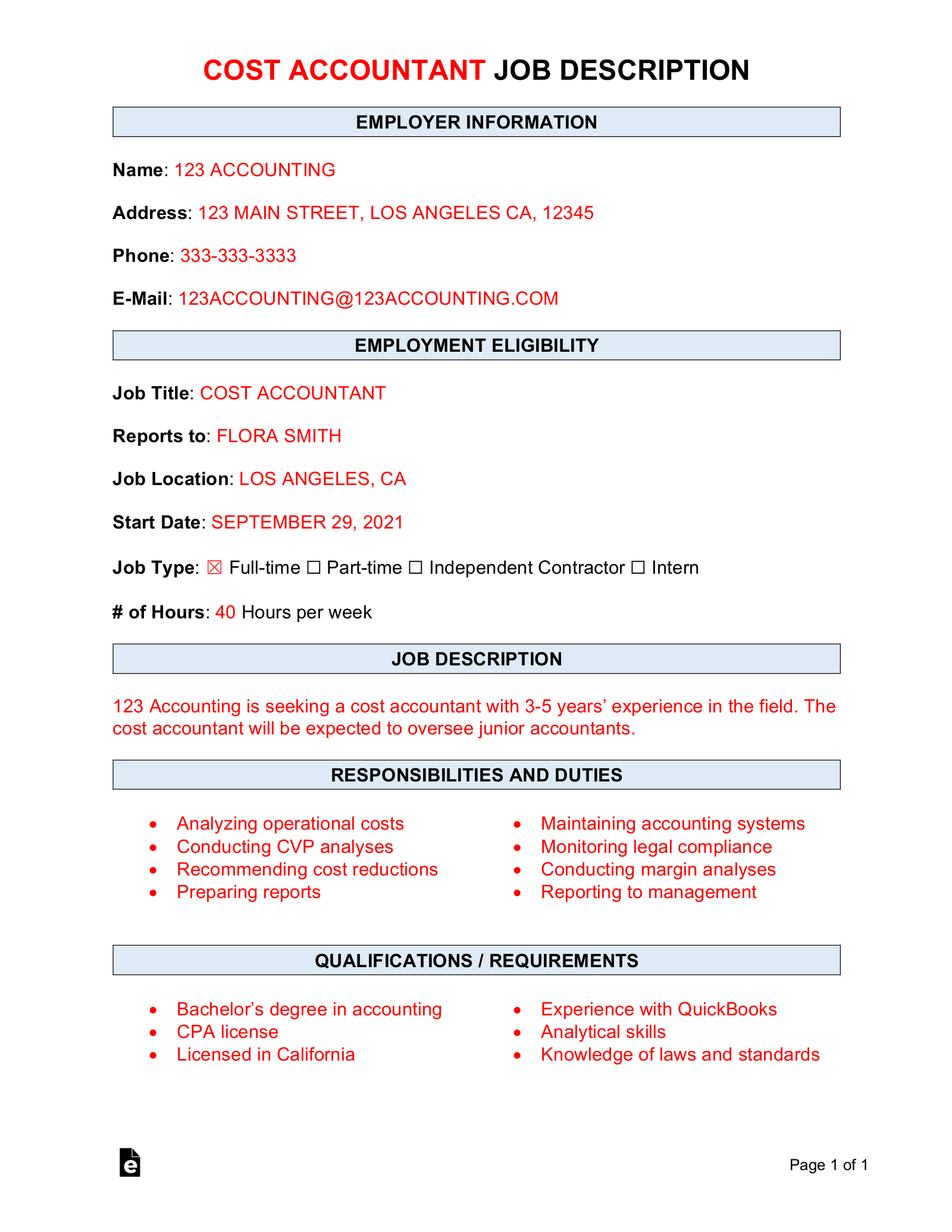

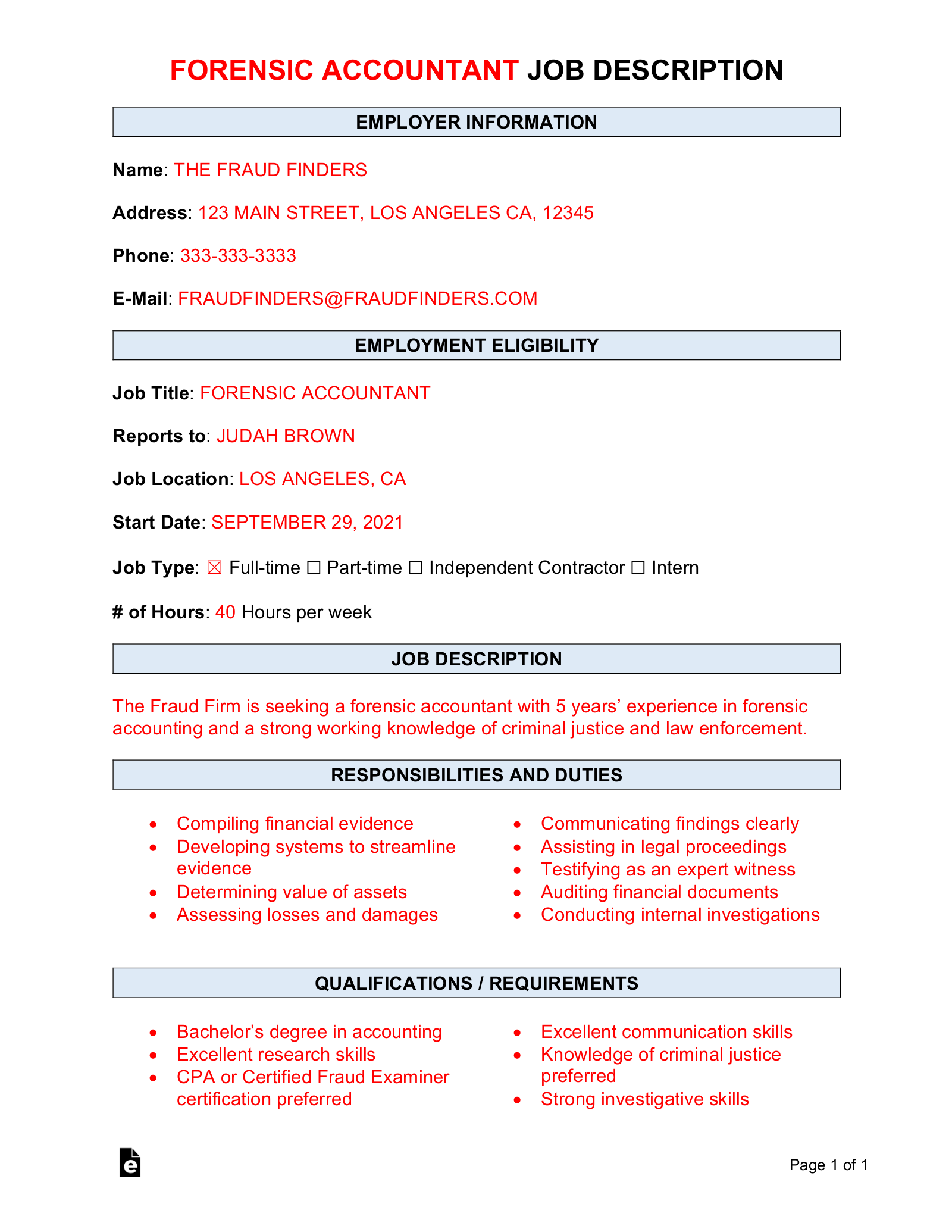

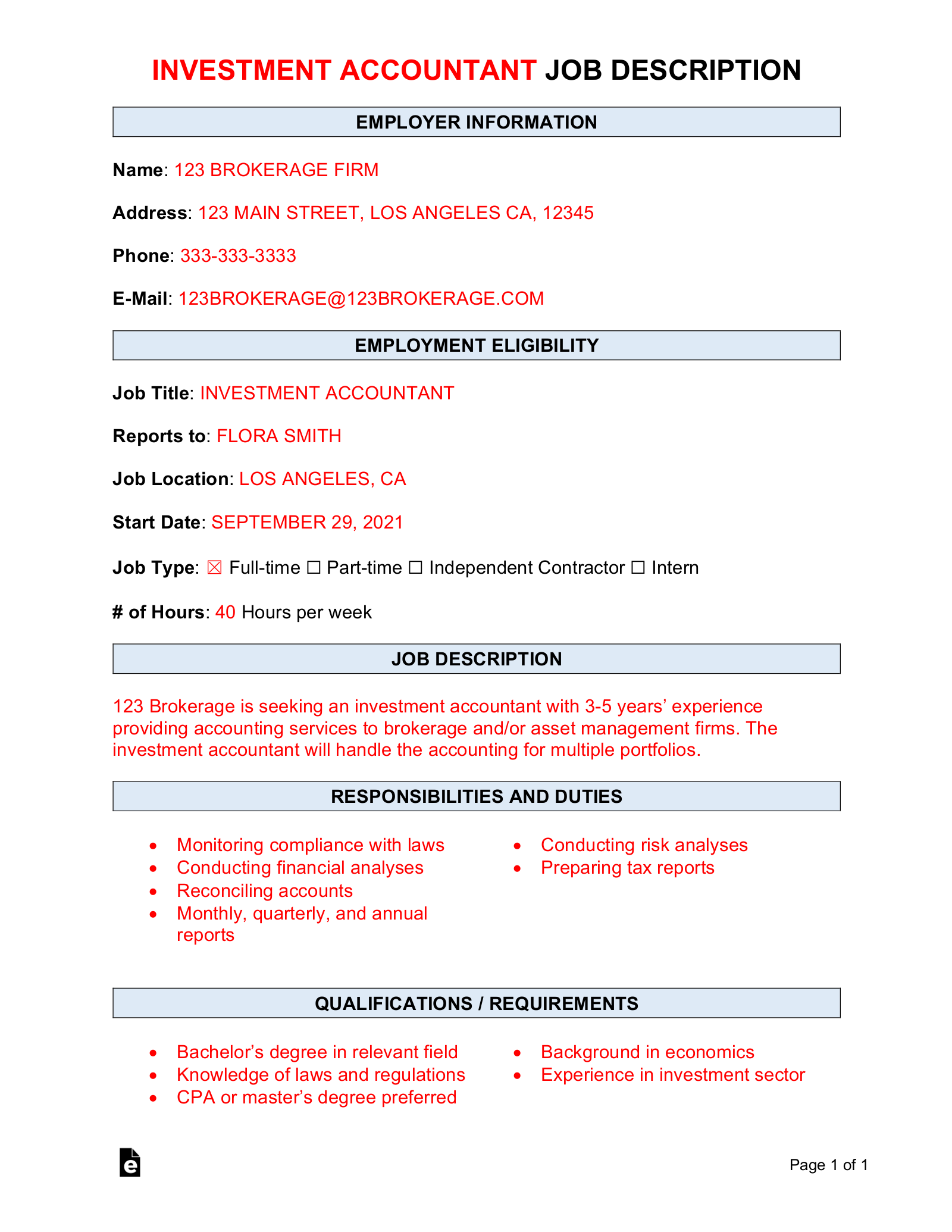

An accountant, also known as a “CPA” (certified public account), is a professionally licensed individual to practice proper accounting methods. The job description is to advertise an open position for an account by including the type of accounting involved and any position requirements.

Salary (Median Pay)

For accountants and auditors.

- Salary: $73,560/yr

- Hourly Rate: $35.37/hr

Source: Bureau of Labor Statistics (BLS)

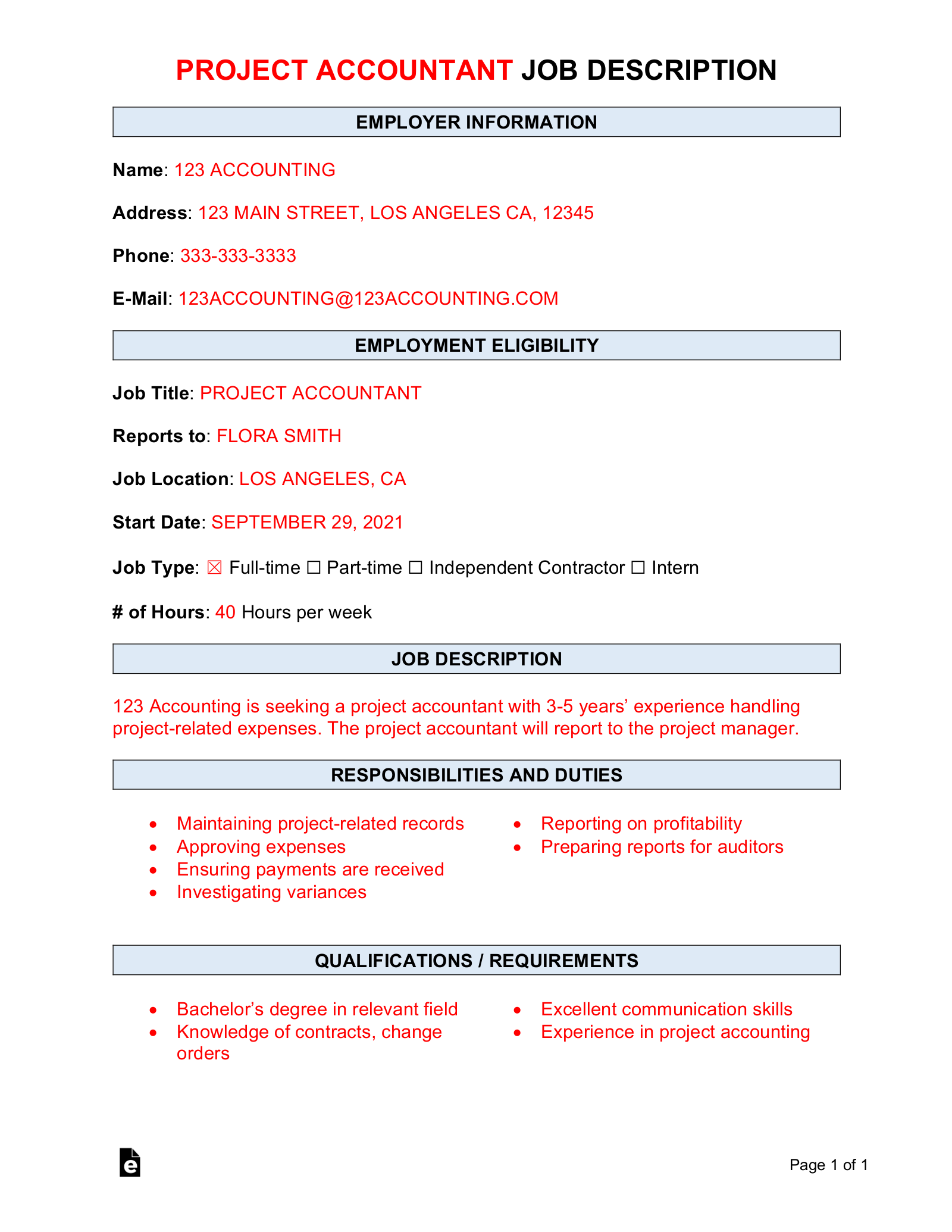

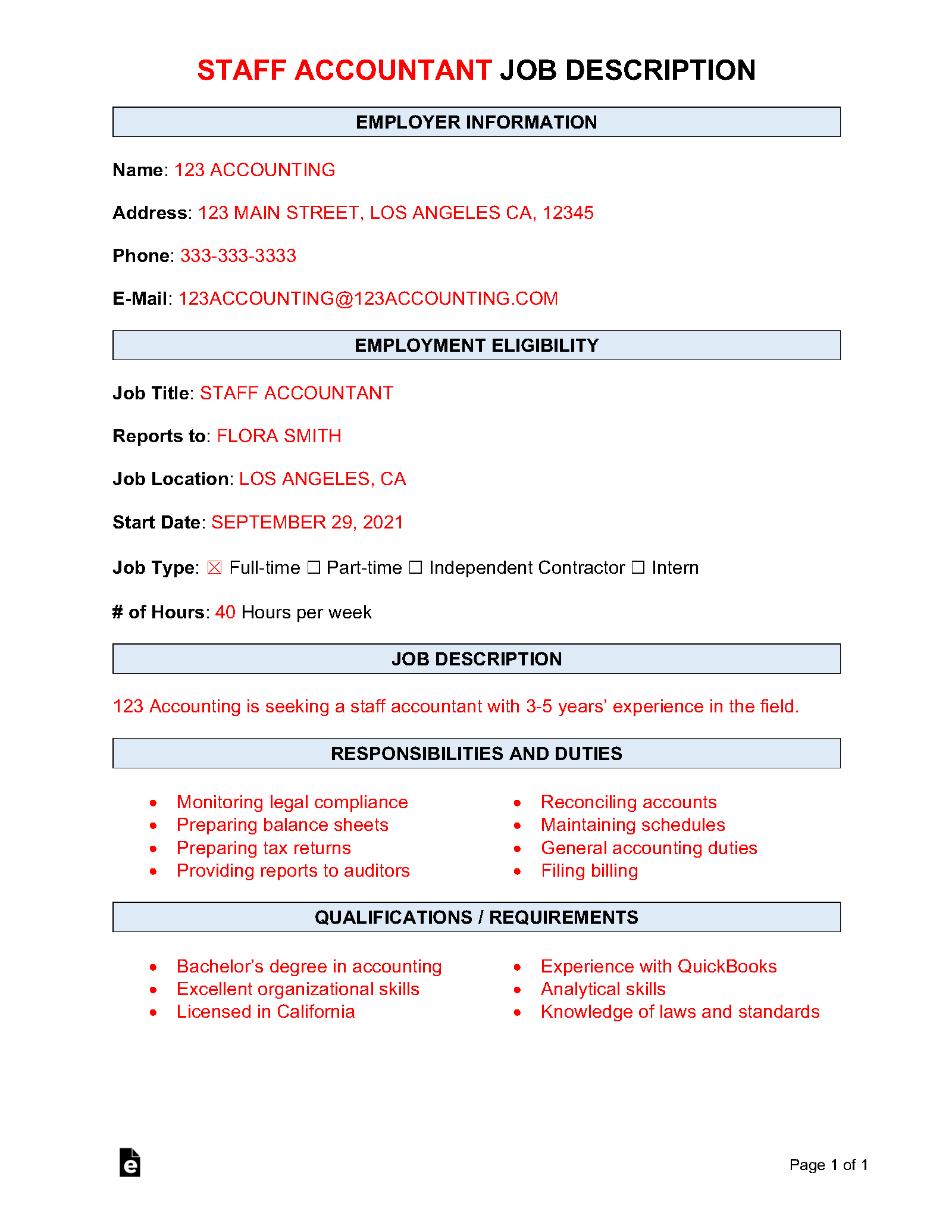

By Type (5)

Duties and Responsibilities

- Reviewing financial information;

- Preparing and filing taxes;

- Profit and loss statements;

- Expense tracking;

- Quarterly and annual reports;

- Handling or delegating bookkeeping items;

- Publishing reports; and

- Audit-related tasks.

Qualifications

- Registered CPA (or has passed the national test and seeking experience);

- Bachelor’s degree;

- Experience with tax software (such as QuickBooks, MS Office, etc.);

- Ability to create spreadsheets and publish reports;

- Can work during hectic periods (tax season); and

- Auditing experience.

How to Become a CPA (4 steps)

2. Pass the National Test

Apply for the State Boards.

4. Pass the Professional Ethics Exam

This is either provided by the State Board or the AICPA.