Updated August 16, 2023

A forensic accountant uses accounting, auditing, and investigative skills to analyze the financial trail of a person or business. Forensic accounting seeks to interpret complex financial matters and communicate them clearly. This type of accountant often prepares evidence used in a court of law — for example, in fraud and embezzlement cases — and are typically engaged by insurance companies, banks, police forces, government agencies, and public accounting firms.

Salary (Median Pay)

For accountants and auditors.

- Salary: $73,560/yr

- Hourly Rate: $35.37/hr

Source: Bureau of Labor Statistics (BLS)

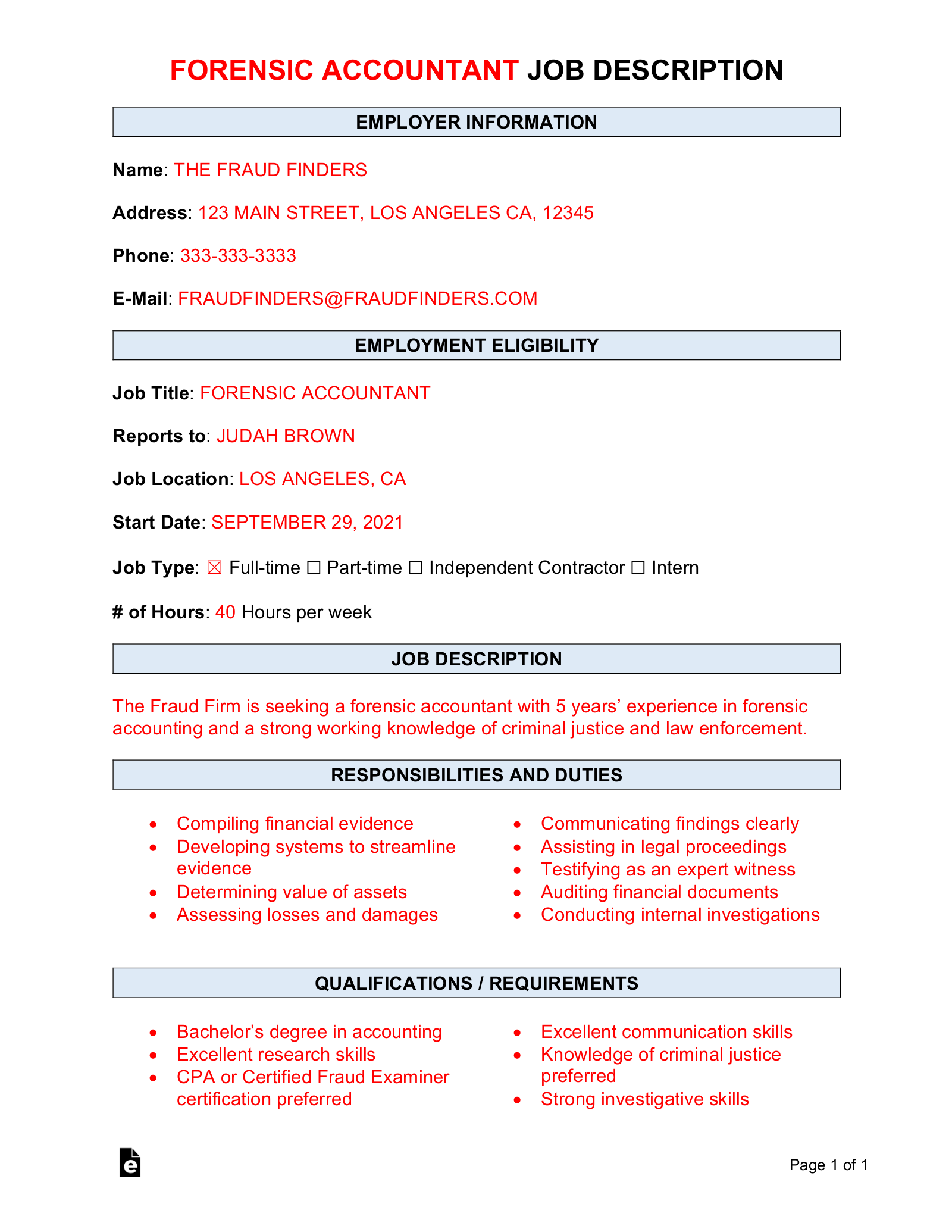

Duties and Responsibilities

- Compiling and investigating financial evidence;

- Developing systems to manage the information compiled;

- Determining the value of assets;

- Assessing losses and damage;

- Applying tax law knowledge;

- Communicating findings through reports and visual data;

- Assisting in legal proceedings, including testifying in court as an expert witness;

- Working closely with law enforcement officers and agencies;

- Auditing financial documents; and

- Conducting internal investigations.

Qualifications

- Bachelor’s degree in accounting or related field;

- Excellent research skills;

- Excellent communication skills;

- Certification as a CPA or Certified Fraud Examiner preferred; and

- Knowledge in criminal justice or law enforcement also preferred.