Updated November 14, 2023

A bookkeeper is an administrative professional who manages the daily financial records and transactions of a business or organization. They generate and manage data collected from payments, purchases, receipts, and sales. The job description advertises an opening for a bookkeeper with a specific business or organization. It will include the daily responsibilities for the position as well as any experience and educational requirements.

Salary (Median Pay)

For bookkeeping, accounting, and auditing clerks.

- Salary: $42,410/yr

- Hourly Rate: $20.39/hr

Source: Bureau of Labor Statistics (BLS)

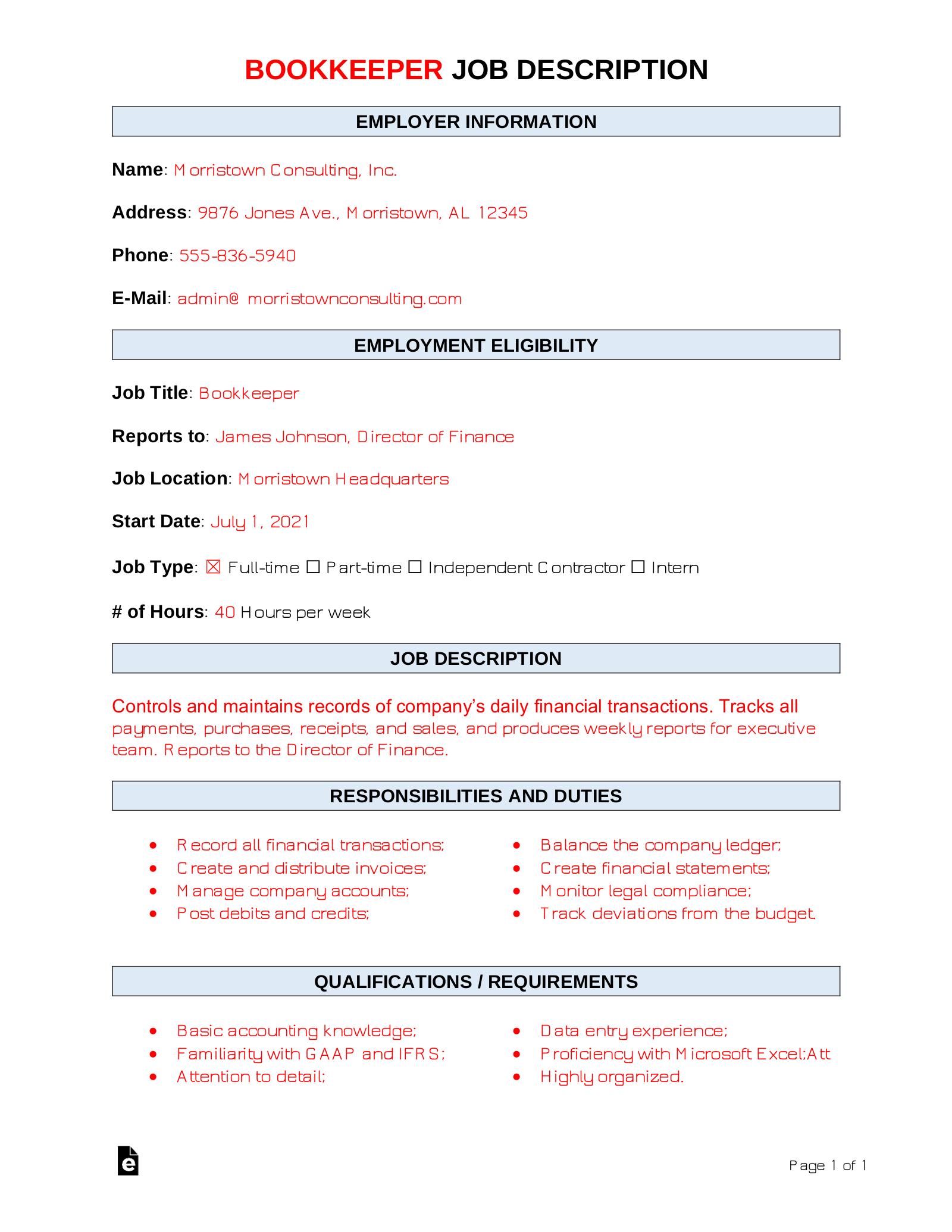

Duties and Responsibilities

- Accurately record all financial transactions;

- Balance the general ledger;

- Create and distribute invoices;

- Create financial statements;

- File tax returns;

- Manage company accounts;

- Manage staff payroll;

- Monitor compliance with local accounting laws and regulations;

- Post debits and credits; and

- Track deviations from the budget.

Qualifications

- Basic knowledge of accounting and best practices;

- Data entry experience;

- Familiarity with the Generally Accepted Accounting Principles (GAAP);

- Familiarity with the International Financial Reporting Standards (IFRS);

- Knowledge of Microsoft Excel;

- Knowledge of bookkeeping software is a plus (FreshBooks, Quickbooks, XERO, Wave, Zoho, etc.)

- Precision, accuracy, efficiency, and attention to detail; and

- Well-practiced organizational skills.

How to Become a Bookkeeper: Two (2) Options

While there is no degree or certification required to become a bookkeeper, there are formal certifications available that can be helpful both in finding full-time work and securing higher pay.

- American Institute of Professional Bookkeepers (AIPB)

- Participate in sixty (60) hours of continuing education every three (3) years;

- Pass the national exam; and

- Two years of full-time work experience.

- National Association of Certified Public Bookkeepers (NACPB)

- Participate in twenty-four (24) hours of continuing education every year;

- Pass tests for bookkeeping, payroll, small business accounting, and small business financial management;

- Pass the national exam;

- Sign a code of conduct; and

- Two-thousand (2,000) hours of related work experience.