Updated November 21, 2023

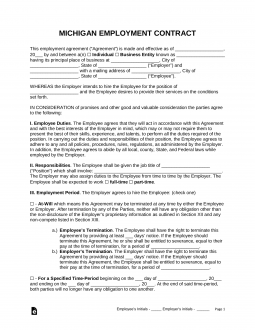

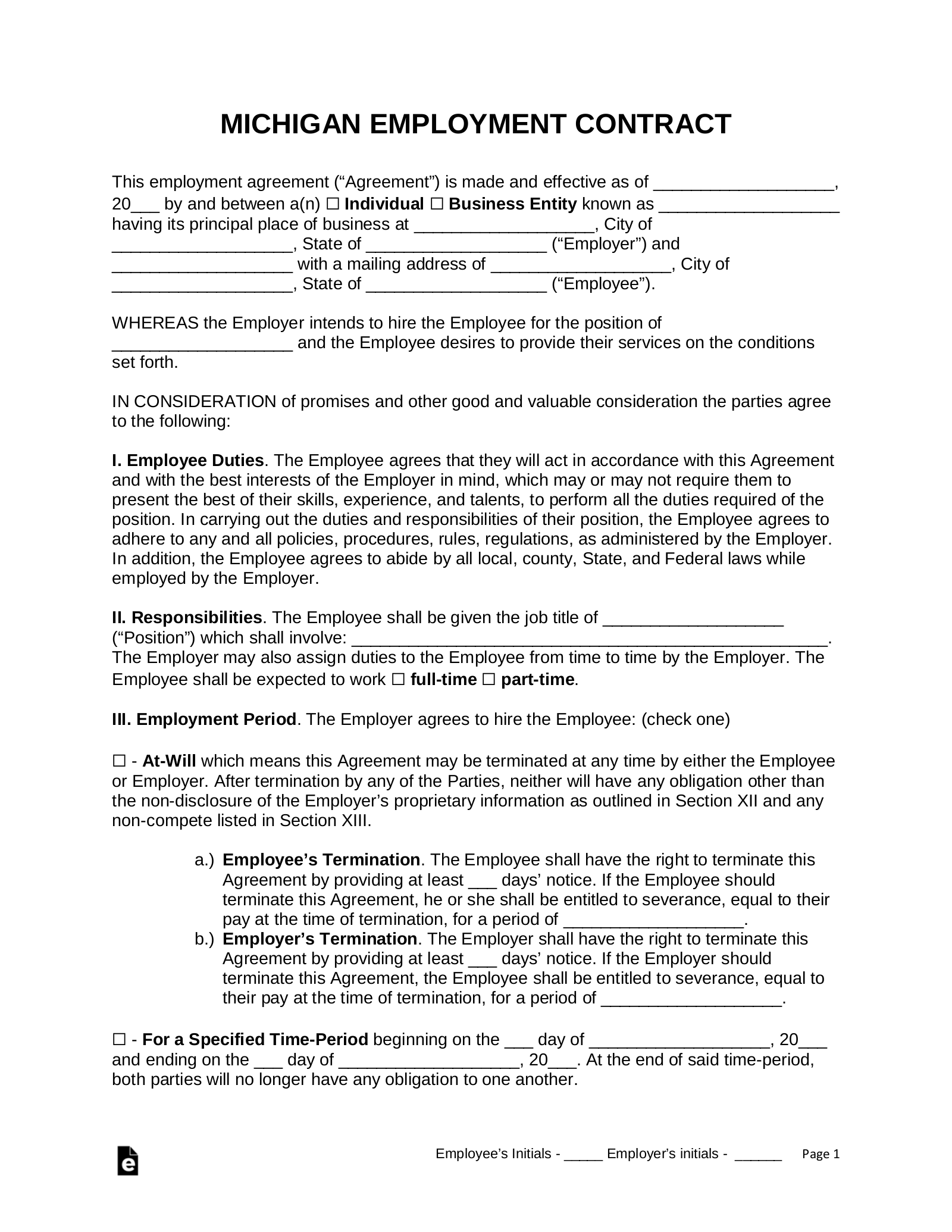

The Michigan employment contract agreement is a document that an employer will use to define the terms of the position for which an employee is hired. In addition to the job title, responsibilities, and financial compensation, the contract should specify the period of employment covered by the contract. If the employee is being given any benefits, such as health benefits, paid leave, paid expenses, bonuses, and days off, they must be written into the agreement. The employer can also include non-disclosure and non-compete agreements to prevent the employee from sharing company information and working with competing businesses.

By Type (4)

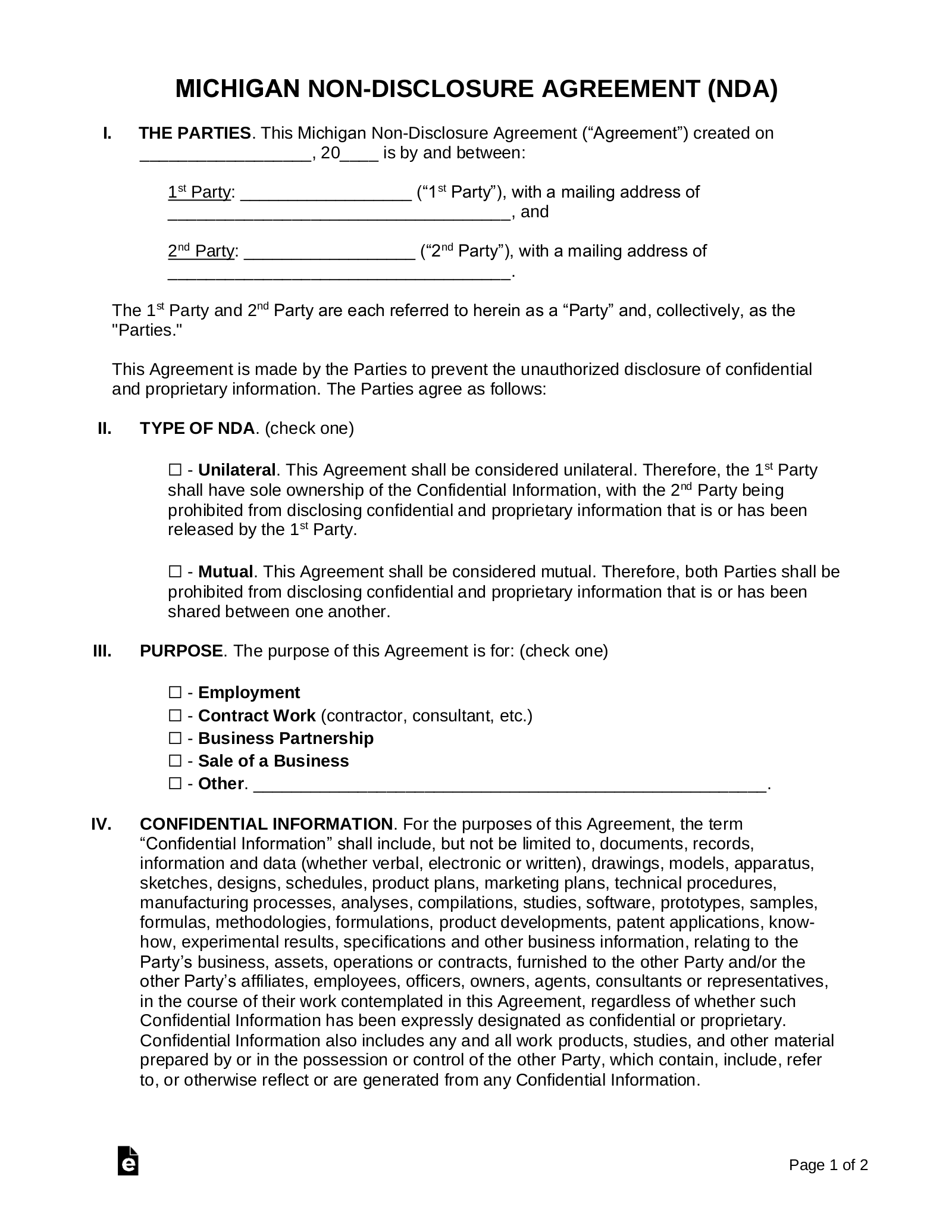

Employee Non-Disclosure Agreement – If an employee signs this document, they are agreeing not to share any confidential information regarding their employer’s business with competitors in the same industry.

Download: PDF, MS Word, OpenDocument

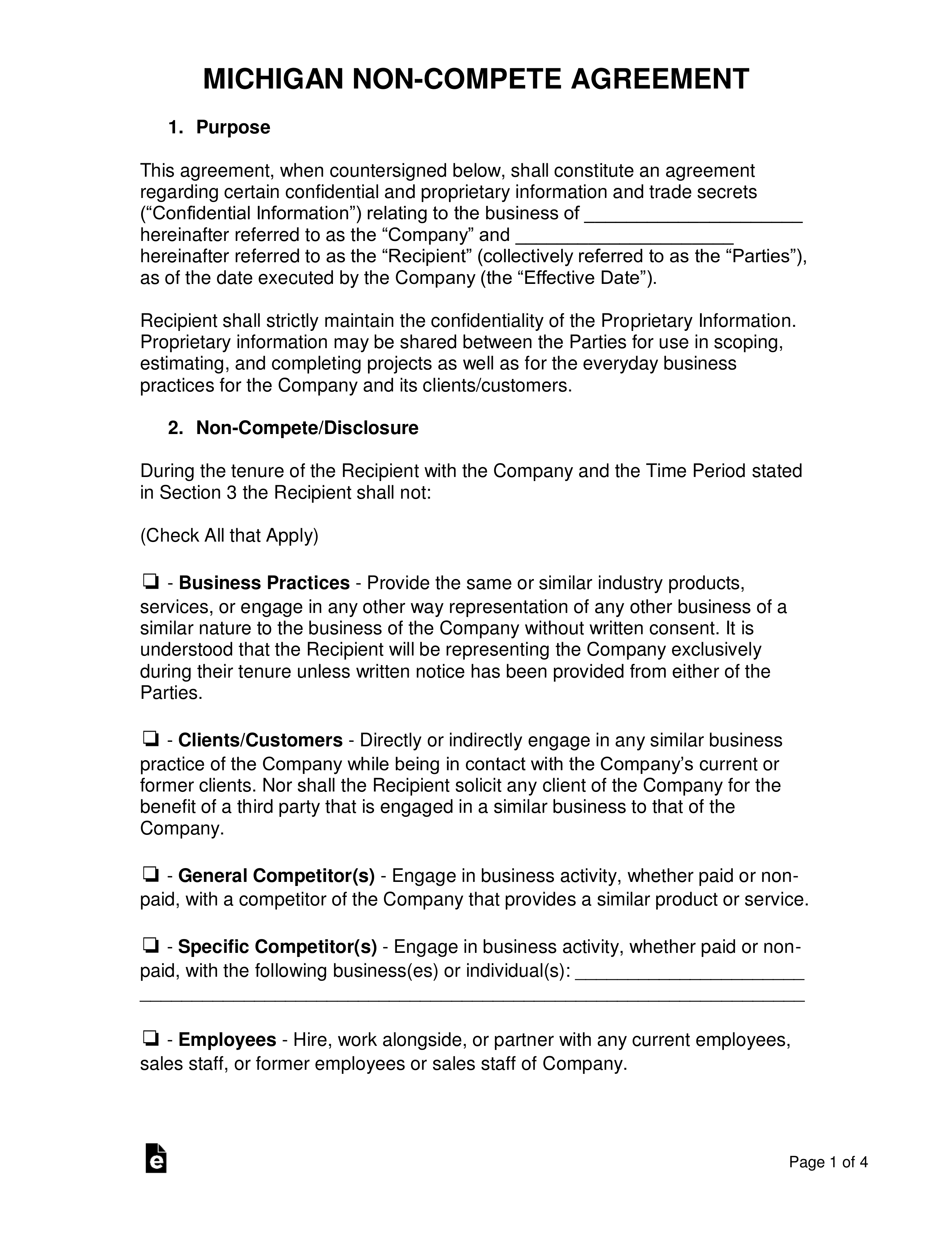

Employee Non-Compete Agreement – This contract forbids the employee from working in direct competition with the employer for a reasonable amount of time following either the date that the document was signed or the individual’s termination date.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Used by an individual or business when hiring a contractor to undertake a project. On the form, the employer must specify the type of compensation that the contractor will receive for completion of the work.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – For prime contractors to use when engaging subcontractors to work on a project they have been hired to complete.

Subcontractor Agreement – For prime contractors to use when engaging subcontractors to work on a project they have been hired to complete.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . A person in the service of the state, a county, city, township, village, or school district, under any appointment, or contract of hire, express or implied, oral or written. A person employed by a contractor who has contracted with a county, city, township, village, school district, or the state, through its representatives, shall not be considered an employee of the state, county, city, township, village, or school district that made the contract, if the contractor is subject to this act . . .”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 4.25%[2]

Minimum Wage ($/hr)

Minimum Wage – $9.45[3]