Updated March 27, 2023

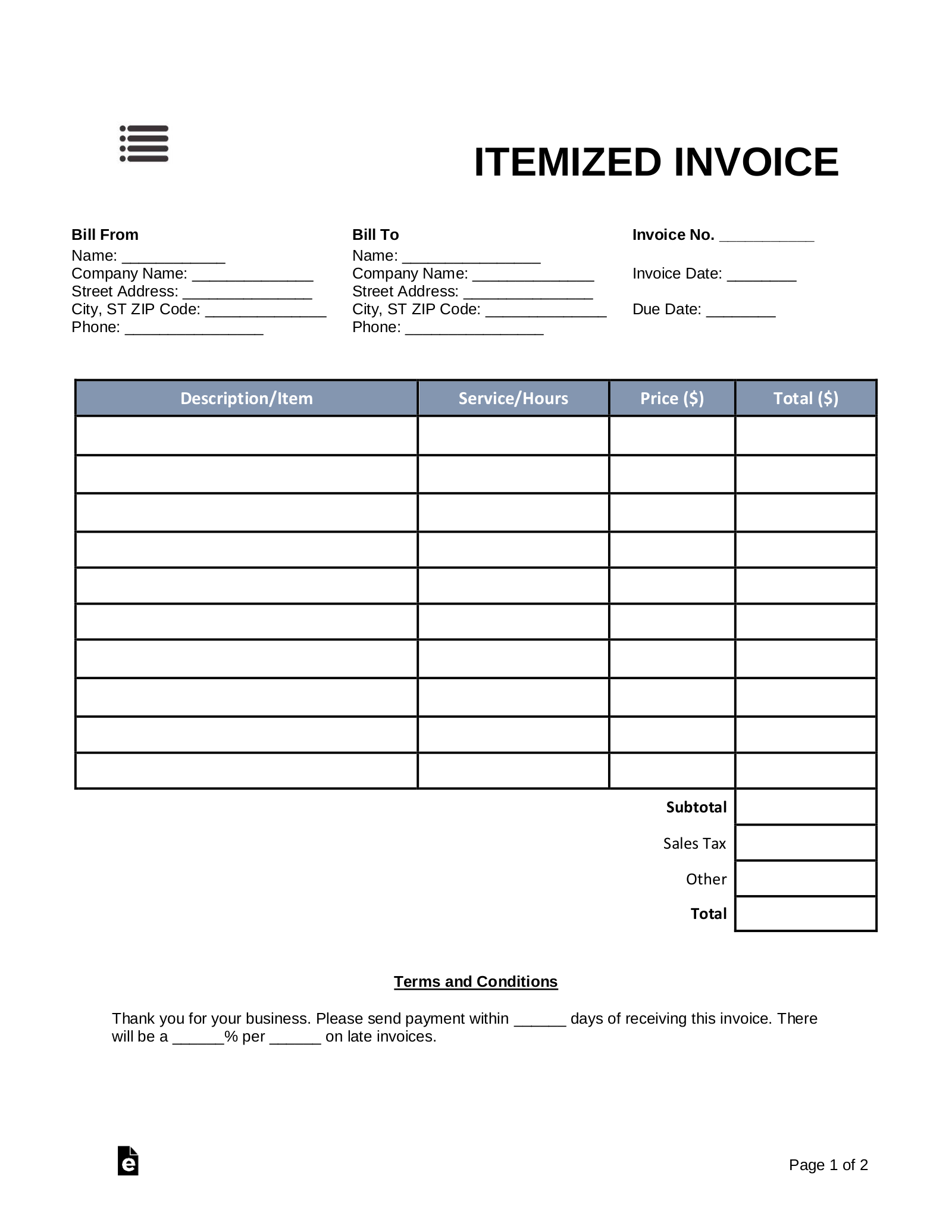

An itemized invoice is a document that is used to provide an itemized statement for a client when goods and/or services are purchased. Each item or service would be listed per line. All items would be calculated and the final amount with tax and any additional charges would be accurately displayed at the bottom of the form.

What to Include in an Itemized Invoice

An effective itemized invoice will have the following information:

- Name of the Merchant

- Merchant contact information (street address, phone number, email, etc.)

- Description of item or service being invoiced

- Date of service or purchase

- Cost – each item and service should be listed separately

- Total cost – ensure taxes and any applicable fees are included.

- Shipping Charges

- Statement advising acceptable payment types should be included

When to Use an Itemized Invoice

An itemized invoice template should be utilized when a business needs to receive payment for multiple items. These “items” can stem from a service provided continually to products being purchased. Providing a line of sight to each item being purchased or each service ensures that customers or clients understand their final total amount and how it relates to the itemized information. Businesses that utilize Itemized Invoice Templates are:

- Hotels

- Housekeeping Service

- Construction Companies

- Auto Repair Shops

- Consultants

- Artists

- Healthcare

- Rental Agencies

- Photography

How to Bill a Customer with an Itemized Invoice

1. List all products and/or services individually

Each service or item sold should be listed separately. For items sold, they should have a detailed description and total cost for each item. Any services provided should be broken down into labor, materials, add-ons, etc.

2. Sales tax

The sales tax should be included and should be based off the total amount of all items added together. Sales taxes may vary by state and even city depending on location.

3. Payment type

Acceptable payment types should be included on the Itemized Invoice. This may be cash, check, money order, credit card, pay pal, electronic funds transfer, etc.

4. Make Copies

Once a successful payment has been processed, multiple copies should be made. The business or service provider should retain a copy for their records, and provide a copy to the client(s).

5. Finalize and bill customer

The final invoice should be provided to the customer along with the appropriate receipt of payment. Documents should be consolidated and provided to the client all together.