Updated August 03, 2023

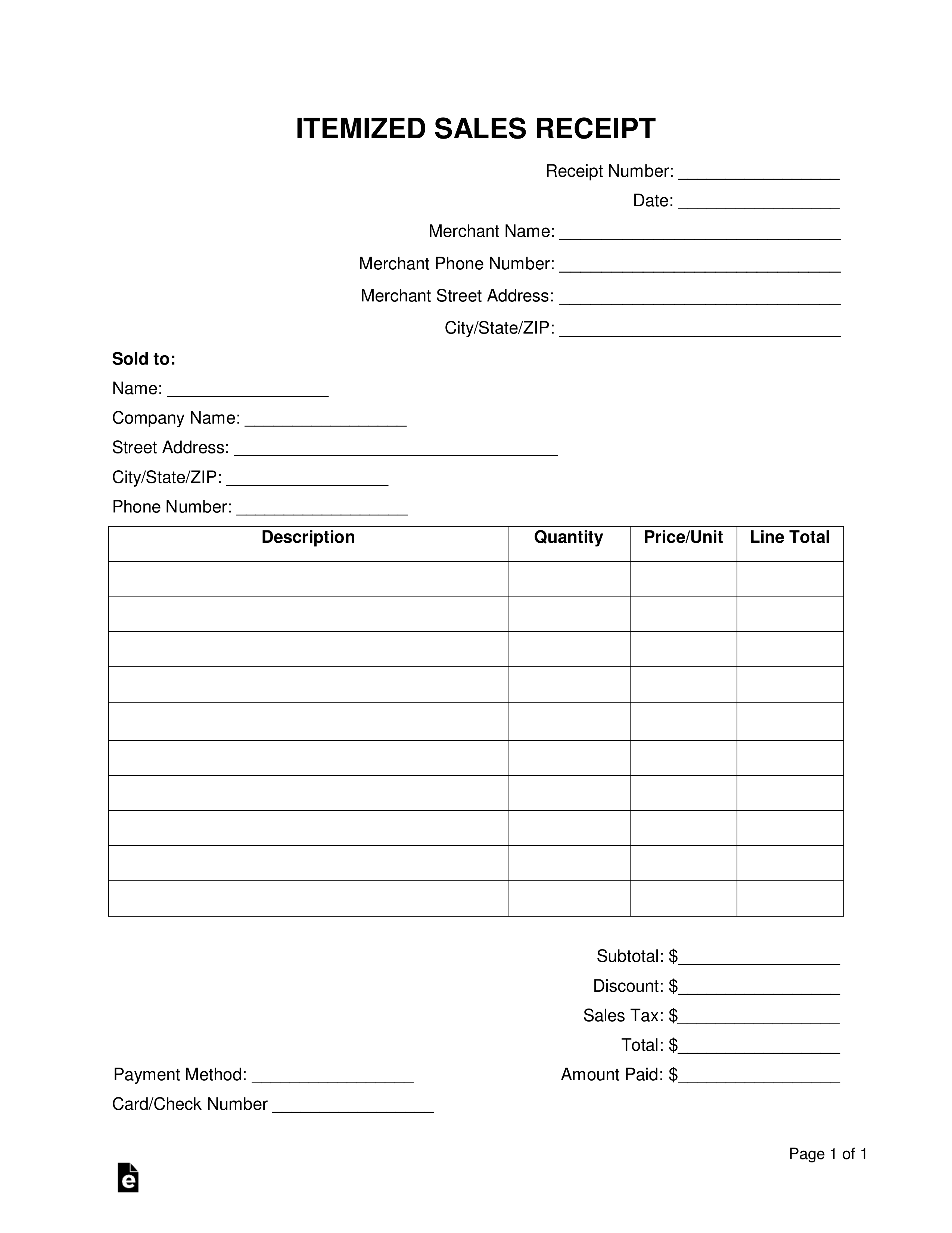

An itemized receipt acts as a proof of purchase that is transferred from a merchant to a consumer following successful payment. It must clearly indicate each party involved in the sale, and it should provide an itemized list of each unit sold (hence the name). The list should be complete with price/unit, the description and quantity sold of each item, as well as a full tax/discount breakdown.

Itemized Invoice – To be used prior to payment of a bill.