Updated December 19, 2023

Form 5498 is an IRS tax document used to report contributions to an individual retirement arrangement (IRA). It is only necessary to file Form 5498 for each individual IRA plan, not for each investment under that plan.

Important to Note

Form 5498 is used to report contributions to both traditional and Roth IRAs. Contributions are reported in different areas of the form depending on the IRA type.

Table of Contents |

Who Must File 5498?

The trustee or issuer of an IRA must file 5498 with the IRS on behalf of each person for whom they maintained an IRA plan during the tax year. If a participant has multiple IRA plans with the same trustee, the trustee must file a separate 5498 for each plan.[1]

Required to Report

The following must be reported on Form 5498:

- Contributions to any IRA[2]

- Certain trustee-to-trustee transfers[3]

- A rollover from a qualified plan, section 403(b) plan, or section 457(b) plan[4]

- Each recharacterization of an IRA contribution[5]

- The conversion of a traditional IRA to a Roth IRA[6]

- Whether the participant must begin taking required minimum distributions (RMDs)[7]

If an IRA participant dies, the trustee or issuer must also file Form 5498 for that year and furnish an annual statement for the decedent and for each non-spouse beneficiary.[8]

Deadlines

The deadline to file Form 5498 is May 31 of the following year. If you are filing 5498 to report the fair market value (FMV) of certain specified assets, RMDs, or SIMPLE IRA contributions, you must furnish Copy B to the participant by January 31. For all other contributions, the deadline for furnishing Copy B is May 31.[9]

2024 Deadlines

- January 31, 2024 (FMV/RMD/SIMPLE IRA contributions)

- May 31, 2024 (all other contributions)

- May 31, 2024 (IRS)

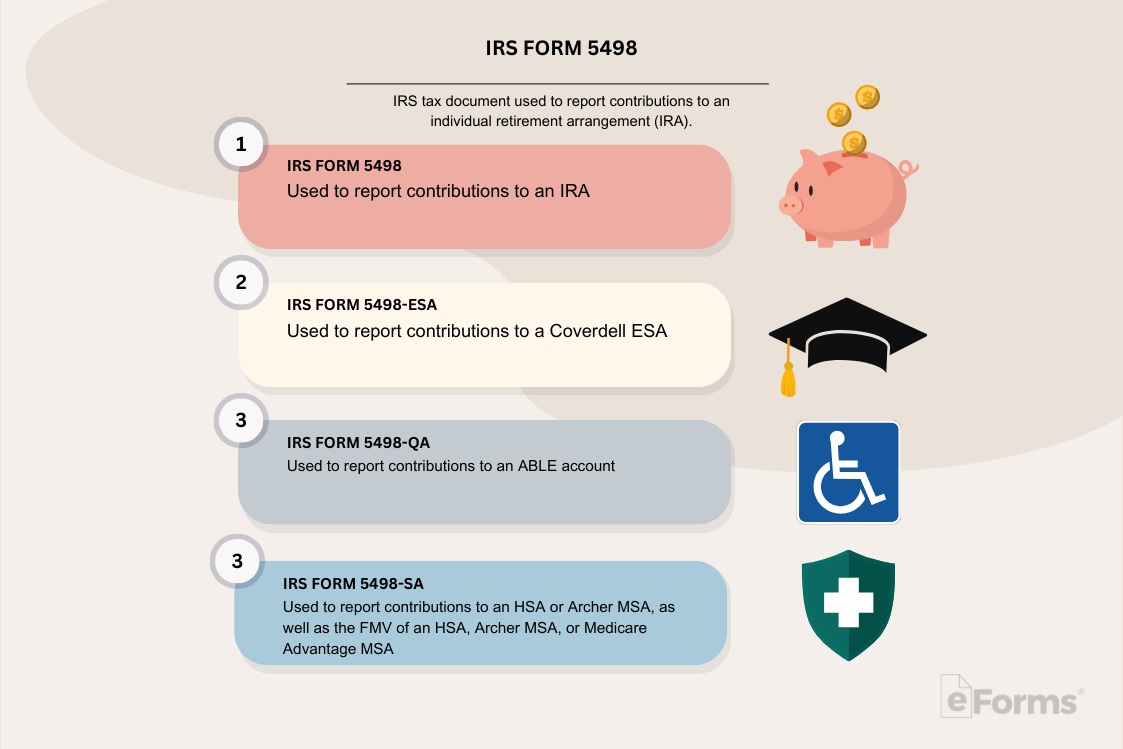

5498 Series

The 5498 series are IRS tax documents used to report contributions made to different tax-advantaged savings accounts. These forms are only used to report contributions to these accounts; distributions from a savings account must be reported on a separate form.

5498: Used to report contributions to an IRA

5498-ESA: Used to report contributions to a Coverdell ESA

5498-QA: Used to report contributions to an ABLE account

5498-SA: Used to report contributions to an HSA or Archer MSA, as well as the FMV of an HSA, Archer MSA, or Medicare Advantage MSA

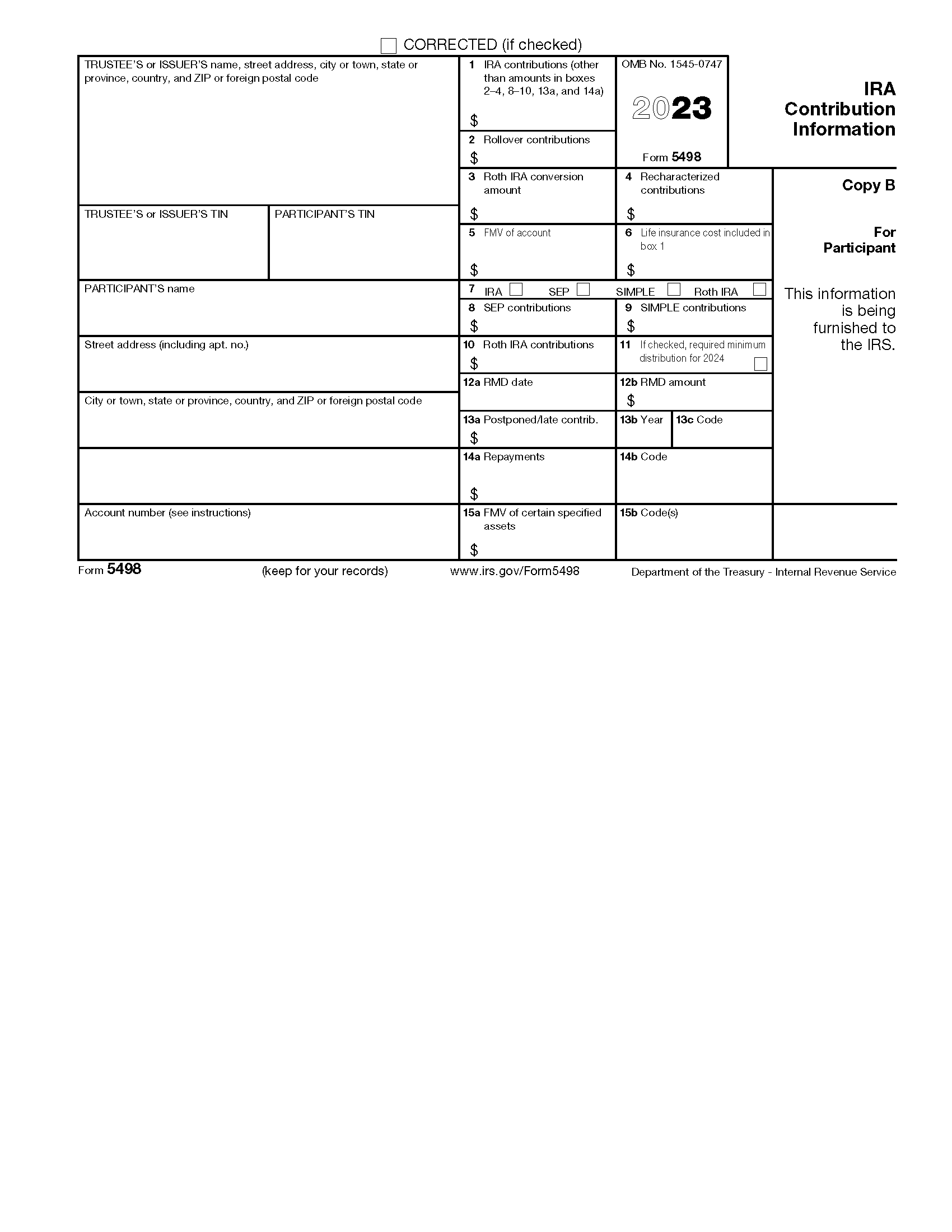

Form Parts (27)

Box 1: IRA Contributions

In this box, enter the amount of gross contributions, including excess contributions, made to a traditional IRA during the calendar year. Include any contributions made through April 15 of the following year that were designated for the tax year.

Do not include the amounts reported in boxes 2-4, 8-10, 13a, and 14a.[10] If an employee made any contributions to a SEP IRA, report those contributions in box 1 instead of box 8.

Box 2: Rollover Contributions

Enter the amount of any rollover contributions, or contributions treated as rollovers, made to the IRA. For the rollover of property, enter the FMV of the property as of the date it was received.[11]

Do not include late rollover contributions in this amount.

Box 3: Roth IRA Conversion Amount

Enter the amount converted from a traditional IRA, SEP IRA, or SIMPLE IRA to a Roth IRA. Do not include any rollover contributions to a Roth IRA reported in box 2.[12]

Box 4: Recharacterized Contributions

Enter the amount of any contributions that were recharacterized from one type of IRA to another. Include any earnings that were accumulated on these contributions as well.[13]

Box 6: Life Insurance Cost Included in Box 1

Enter the amount included in box 1 that is allocable to the cost of life insurance. This only applies to endowment contracts.[16]

Box 7: Checkboxes

Check the appropriate box to identify the type of IRA for which Form 5498 is being filed.[17]

Box 8: SEP Contributions

If applicable, enter the amount of any employer contributions made to a SEP IRA during the calendar year, including contributions made during the calendar year that were designated for the previous year.

Include any contributions made by a self-employed person to their own account.[18]

Box 9: SIMPLE Contributions

If applicable, enter the amount of any employer contributions made to a SIMPLE IRA during the calendar year, including contributions made during the calendar year that were designated for the previous year.[19]

Box 10: Roth IRA Contributions

Enter any contributions made to a Roth IRA during the calendar year, as well as those made through April 15 of the following year that were designated for the calendar year. Do not include the Roth IRA conversion amounts reported in box 3.[20]

Box 11: RMD Checkbox

If the IRA participant turned 72 during the calendar year, check this box to indicate that they must begin taking RMDs from their IRA.

This box must be checked for the year in which the IRA participant reaches the age of 72, even if the RMD date falls in the following year.[21]

Box 12a: RMD Date

If applicable, enter the date by which the RMD must be made. For the year that the IRA participant turned 72, this date is April 1 of the following year.[22]

Box 12b: RMD Amount

If applicable, enter the amount of the RMD with respect to the IRA for the calendar year.[23] Use the IRS website to calculate the RMD amount for each participant.

The trustee is not required to complete box 12b if they choose instead to furnish a separate statement to the participant informing them that they must take an RMD and offering to calculate the amount of the RMD upon request.[24]

Box 13a: Postponed/Late Contributions

Enter the amount of any postponed or late contributions made during the calendar year that were designated for a prior year. Only the postponed contributions for one prior year may be reported on a single Form 5498.[25] Postponed contributions designated for a different prior year must be reported on a separate 5498.

Box 13b: Year for Postponed Contributions

Enter the year for which the postponed contributions in box 13a were made. If the contributions reported in box 13a were late rollover contributions or rollovers of qualified plan loan offset amounts, leave box 13b blank.[26]

If no postponed or late contributions were reported in box 13a, leave this box blank.

Box 13c: Code for Postponed Contributions

Input the code that corresponds to the reason for the participant’s postponed contributions. See the IRS instructions for the specific codes corresponding to different situations.

If the participant did not make any postponed contributions, leave this box blank.

Box 14a: Repayments

If applicable, enter the amount of any repayment of a qualified reservist distribution, a qualified disaster distribution, or a qualified birth or adoption distribution. If these circumstances do not apply to the participant, leave this box blank.[27]

Box 14b: Repayments Code

Input the code corresponding to the type of repayment made by the participant. Use “QR” for a qualified reservist distribution, “DD” for a qualified disaster distribution, or “BA” for a qualified birth or adoption distribution. If no repayment was reported in box 14a, leave this box blank.[28]

Box 15a: FMV of Certain Specified Assets

Enter the FMV of any assets held in the IRA that are not readily tradable on an established securities market or option exchange, or that do not have a readily available FMV. For these assets, use the FMV determined as of December 31 of the calendar year.[29]

Refer to the box below for a list of investment types for which the FMV is reported in box 15a.

Box 15b: Assets Category Codes

If applicable, input the code for the type or types of assets held in the IRA for which the FMV was reported in box 15a. You may input up to two codes in this box.[30]

Applicable codes include:

- A – Stock or other ownership interest in a corporation that is not readily tradable on an established securities market

- B – Short- or long-term debt obligation that is not traded on an established securities market

- C – Ownership interest in a limited liability company or similar entity

- D – Real estate

- E – Ownership interest in a partnership, trust, or similar entity

- F – Option contract or similar product that is not offered for trade on an established option exchange

- G – Other asset that does not have a readily available FMV

- H – More than two of the above types of assets

Identifying Information (6 Entries)

Six boxes on the left side of Form 5498 require information that identifies the trustee or issuer and the participant, including:

- Trustee/Issuer information – name, full address, and phone number

- Trustee/Issuer TIN – taxpayer identification number

- Participant’s TIN – normally an SSN/ITIN or EIN

- Participant’s name – full name

- Participant’s street address – number and street only

- Participant’s remaining address – city/town, state/province, country, Zip/postal code

The participant’s TIN must be entered in XXX-XX-XXXX (SSN or ITIN) or XX-XXXXXXX (EIN) format on Copy A of this form.[31]

Account Number

The account number field is generally provided for the trustee’s reference and for internal recordkeeping. It is required if you have multiple accounts for a recipient for whom you are filing more than one Form 5498.

The IRS encourages you to designate an account number for all 5498 forms you file. Note that the account number must be unique and cannot appear anywhere else on Form 5498.[32]

How to File

Form 5498 can be filed online or on official IRS paper forms.

- Collect W-9s from each participant

- Choose a filing method (by mail with paper forms, online with FIRE, or with third-party software. Skip to step 6 if you are filing electronically)

- Obtain an official copy of Form 5498 from the IRS by ordering online if filing by mail

- Complete Form 1096 along with Copy A

- Mail Form 1096 and Copy A to the appropriate IRS address

- Send Copy B to the participants

- Retain Copy C for your records

Frequently Asked Questions

Does a spouse beneficiary receive a 5498 when an IRA participant dies?

Unless the decedent’s spouse makes the inherited IRA their own, treat the spouse as a non-spouse beneficiary for reporting purposes and furnish them with a 5498.[8]

Do I need to report contributions to a Spousal IRA?

Report contributions to a Spousal IRA on a separate Form 5498 using the name and TIN of the spouse.[2]

Do I have to report IRA contributions from my employer as income?

If your employer pays into a nonqualified retirement plan for you, you likely have to include those contributions in your income as wages. Refer to the IRS guidelines on retirement plan contributions for more information.

Sources

- IRS – Specific Instructions for Form 5498

- IRS – Contributions

- IRS – Transfers

- IRS – Direct Rollovers, Transfers, and Recharacterizations

- IRS – Recharacterizations

- IRS – Roth IRA Conversions

- IRS – RMDs

- IRS – Inherited IRAs

- IRS – Guide to Information Returns

- IRS – IRA Contributions Box Instructions

- IRS – Rollover Contributions Box Instructions

- IRS – Conversion Amount Box Instructions

- IRS – Recharacterized Contributions Box Instructions

- IRS – FMV of Account Box Instructions

- IRS – FMV of Inherited IRAs

- IRS – Life Insurance Cost Box Instructions

- IRS – Checkboxes Box Instructions

- IRS – SEP Contributions Box Instructions

- IRS – SIMPLE Contributions Box Instructions

- IRS – Roth IRA Contributions Box Instructions

- IRS – RMD Checkbox Box Instructions

- IRS – RMD Date Box Instructions

- IRS – RMD Amount Box Instructions

- IRS – RMD Reporting Alternative Two

- IRS – Postponed Contributions Box Instructions

- IRS – Year Box Instructions

- IRS – Repayments Box Instructions

- IRS – Repayments Code Box Instructions

- IRS – FMV of Certain Assets Box Instructions

- IRS – Assets Category Codes Box Instructions

- IRS – Participant TIN Format

- IRS – Account Number Box on Forms