Updated March 06, 2024

Form 940 is an IRS document filed by employers once a year to report their Federal Unemployment Tax Act (FUTA) tax liability. Unlike other federal payroll taxes — such as Medicare and Social Security — FUTA taxes are only paid by the employer and not deducted from employees’ wages.

What is FUTA Tax?

FUTA provides unemployment compensation to workers who have lost their jobs. Most employers are required to pay both federal and state unemployment taxes.[1]

Table of Contents |

Previous Versions

Download: PDF

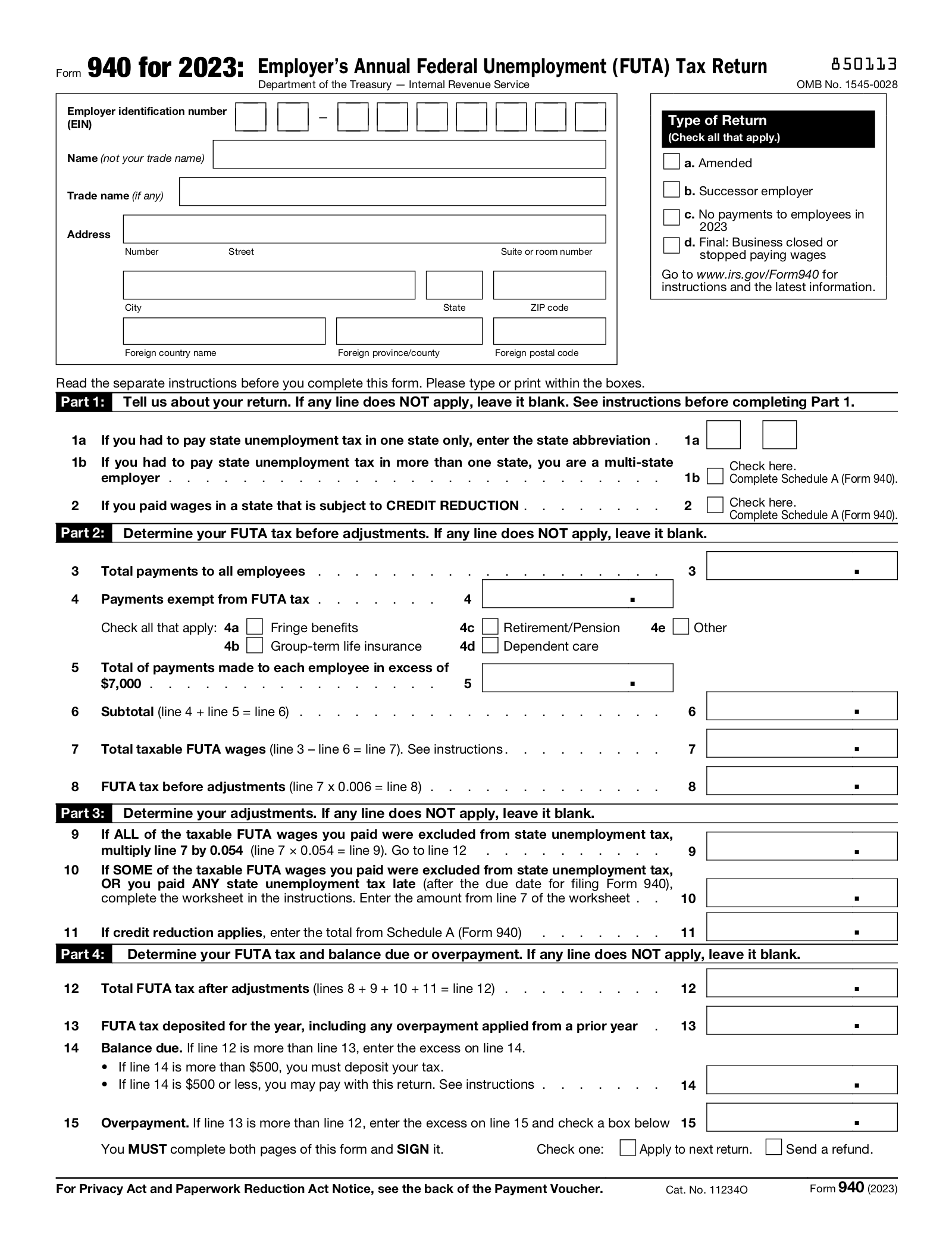

What is Form 940?

Form 940 is a federal tax return required for most employers to calculate and report their federal unemployment tax liability for the calendar year.

To complete the form, the following information is required:

- Total payments made to employees during the year

- Payments exempt from FUTA tax (i.e., fringe benefits, retirement/pension, etc.)

- Total payments exceeding $7,000 for each employee

- Employer Identification Number (EIN)

- Which state unemployment taxes were paid

Who Files Form 940?

Form 940 must be filed by any employer who:[2]

- Paid wages of $1,500 or more to employees in any quarter during the tax year

- Had one or more part-time, full-time, or temporary employees for 20 weeks or more during the tax year

Exceptions

- Household employers, unless they paid cash wages of $1,000 or more in any calendar quarter

- Agricultural employers, unless they paid cash wages of $20,000 or more during any calendar quarter or employed 10 or more farmworkers during any calendar quarter

- Indian tribal governments

- Tax-exempt nonprofit organizations

- State or local government employers

2024 FUTA Tax Rate

The FUTA tax rate is 6%. It applies to the first $7,000 paid in wages to each employee during the tax year.[3]

FUTA Tax Credit

If the employer paid wages that are also subject to state unemployment tax, they may be able to claim a FUTA tax credit of up to 5.4%. Generally, employers who have paid their state unemployment taxes in full before Form 940 is due are eligible to receive the full credit.

When is Form 940 Due?

The deadline to file is January 31 of the following tax year. If the employer’s FUTA taxes have already been paid for the year, they can file by February 10.[4]

2024 Deadlines

January 31, 2024; or February 10, 2024 for employers who have completed their FUTA payments.

Where to File

Electronically

To e-file Form 940, employers may purchase and use IRS-approved software to complete and submit the document. To use a tax professional to e-file Form 940, find an authorized e-file provider. A fee may be charged to file electronically.

Where to Mail

The mailing address for sending a completed Form 940 depends on the employer’s location and whether a payment for the owed FUTA tax will be included.[5]

| States | Without a Payment | With a Payment |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury

Internal Revenue Service Kansas City, MO 64999-0005 |

Internal Revenue Service

P.O. Box 806532 Cincinnati, OH 45280-6532 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury

Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service

P.O. Box 932100 Louisville, KY 40293-2100 |

| Puerto Rico, U.S. Virgin Islands, or if the location of your legal residence, principal place of business, office, or agency is not listed | Internal Revenue Service

P.O. Box 409101 Ogden, UT 84409 |

Internal Revenue Service

P.O. Box 932100 Louisville, KY 40293-2100 |

| Special filing for exceptions: Tax-exempt organizations; federal, state, and local governments; and Indian tribal governments, regardless of your location | Department of the Treasury

Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service

P.O. Box 932100 Louisville, KY 40293-2100 |

Instructions for Form 940 (8 Parts)

- State Unemployment Tax

- FUTA Tax Before Adjustments

- Adjustments and Credits

- Balance Due or Overpayment

- FUTA Liability by Quarter

- Third-Party Designee

- Signature

- Payment Voucher (940-V)

Part 1: State Unemployment Tax

If you paid a state unemployment tax, indicate for which state.

Complete and attach Schedule A (Form 940) if you are either a multi-state employer who paid unemployment taxes in more than one state or if you paid taxes in a state subject to a credit reduction.

The credit reduction states for 2023 are California, New York, and the Virgin Islands.[6]

Part 2: FUTA Tax Before Adjustments

This section calculates your FUTA tax liability before any adjustments or credits are applied.

Enter the total payments made to employees during the tax year, how much of those payments are exempt from FUTA tax, and the total payments made to each employee in excess of $7,000.

Part 4: Balance Due or Overpayment

This section shows your total balance due for the tax year after considering adjustments, credits, any tax payments that have already been made, and any overpayments from a previous year.

If the balance due is lower than what’s already been paid for the tax year, indicate whether you would like a refund or apply the overpayment to the following year.

Part 5: FUTA Liability by Quarter

This section is only required if your total FUTA tax liability calculated in the previous section (line 12) is more than $500. Skip if this doesn’t apply.

Fill out your FUTA tax liability for each quarter. This can be calculated by taking the total FUTA taxable wages paid in each quarter and multiplying it by the FUTA tax rate of 6% (0.06) and adding adjustments.

Part 6: Third-Party Designee

Choose whether you want to designate a third party, such as an employee or a tax preparer, to discuss the return with the IRS. If yes, provide the designee’s name, phone number, and PIN.

By consenting, you are authorizing the third-party designee to:[7]

- Provide the IRS with any information that is missing from the return

- Contact the IRS for information about processing the return

- Respond to certain IRS notices about errors

Part 7: Signature

An authorized signee must provide a signature, along with their official title and a daytime contact phone number.

The person authorized to sign Form 940 varies depending on the type of business:[8]

- Sole proprietorship — The owner of the business.

- Corporation (including an LLC treated as a corporation) —The president, vice president, or other principal officer duly authorized to sign.

- Partnership (including an LLC treated as a partnership) or unincorporated organization — A responsible and duly authorized partner, member, or officer having knowledge of its affairs.

- Single-member LLC treated as a disregarded entity for federal income tax purposes — The owner of the LLC or a principal officer duly authorized to sign.

- Trust or estate —The fiduciary.

An agent authorized by a valid power of attorney may also sign the form on the taxpayer’s behalf.

Payment Voucher (940-V)

You may only make a payment using the attached 940-V if your FUTA tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. If your total FUTA tax liability is more than $500, skip this section and make your deposits via the Electronic Federal Tax Payment System (EFTPS).

Frequently Asked Questions (FAQs)

What is credit reduction on Form 940?

Credit reduction applies to employers of a state that hasn’t repaid money it borrowed from the federal government to pay unemployment benefits. This means that you may have to pay more FUTA tax when filing Form 940.[9]

Can you make a correction on Form 940 after filing?

Yes. Download a paper copy of Form 940 (even if you e-filed the original) and check the “Amended” box on the top right corner of the first page. Fill out the form with the correct information, and attach an explanation of why you are amending the return.

Once completed, send the amended form to the “without a payment” IRS address.[10]

What’s the difference between Form 940 and Form 941?

Form 940 is filed once a year to report an employer’s federal unemployment tax liability, while Form 941 is filed once every three months to report an employer’s Social Security and Medicare taxes as well as its employees’ shares.

Sources

- IRS – Federal Unemployment Tax

- IRS – Instructions for Form 940 (2023): Who Must File Form 940?

- IRS – Topic No. 759, Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return: Filing and Deposit Requirements

- IRS – Instructions for Form 940 (2023): When Must You File Form 940?

- IRS – Instructions for Form 940 (2023): Where Do You File?

- Final 2023 Federal Unemployment Tax Act (FUTA) Credit Reductions

- IRS – Instructions for Form 940 (2023): Part 6

- IRS – Instructions for Form 940 (2023): Part 7

- IRS – Instructions for Form 940 (2023): Credit Reduction State

- IRS – Instructions for Form 940 (2023): Can You Amend a Return?