Updated January 08, 2024

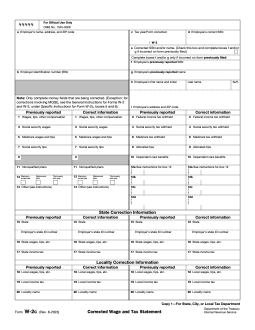

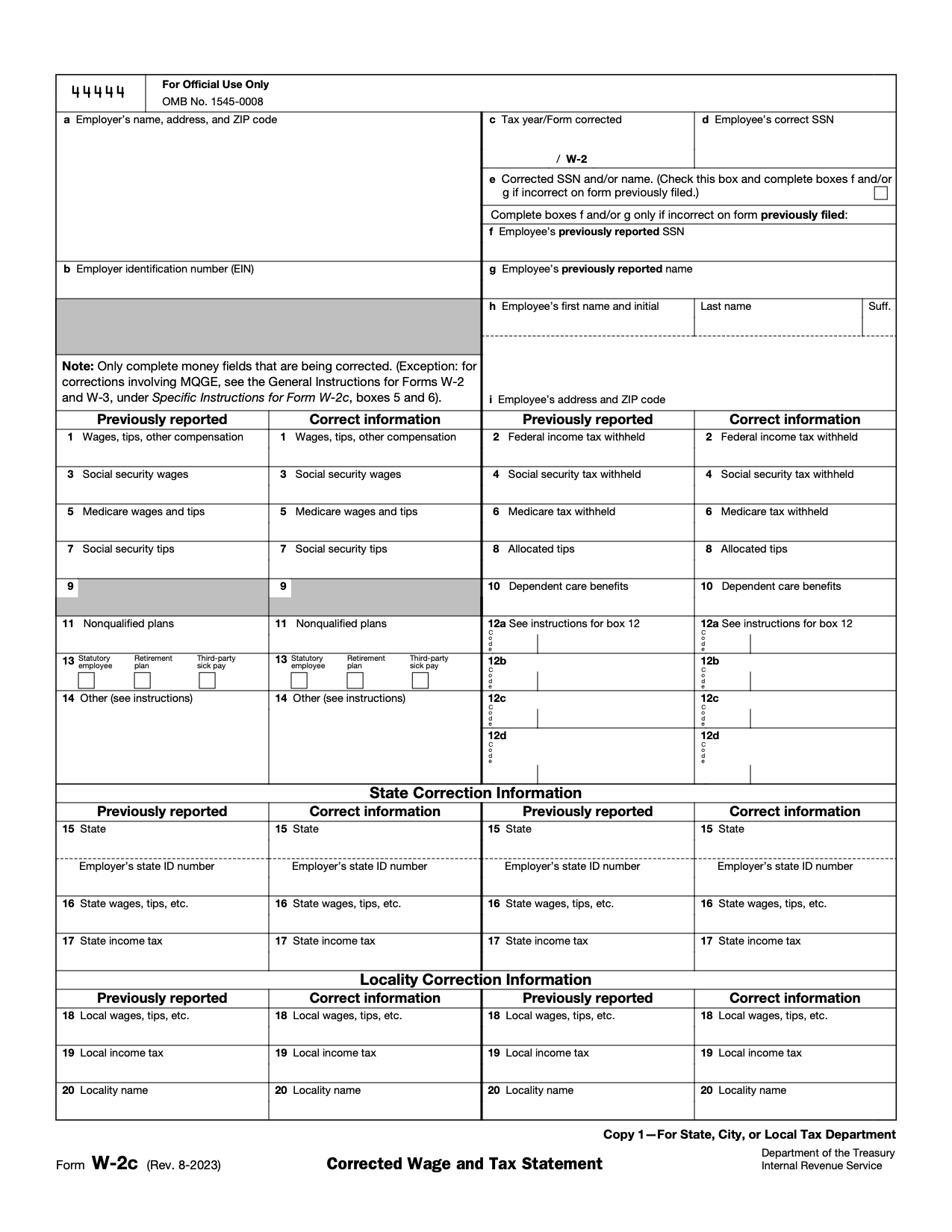

A W-2c, or Corrected Wage and Tax Statement, is an IRS tax document used to amend an error reported on a W-2. The form is submitted to the Social Security Administration (SSA) and provided to the employee.

Companion Form

Form W-3c (Transmittal of Corrected Wage and Tax Statements) must be filed along with any W-2 correction.

Table of Contents |

When Is It Required?

W-2c is generally used to correct a name, Social Security number (SSN), Employer Identification Number (EIN), or dollar amount on a previously filed Form W-2. Depending on the kind of information being corrected, special instructions apply.[1]

- If the employee’s address was incorrect: Issue a new W-2 marked “REISSUED STATEMENT” or a W-2c to the employee. It is not necessary to file with the SSA in this case.

- If the employee’s name and/or SSN were previously left blank: Contact the SSA at 800-772-6270 to update this information.

- If the tax year and/or EIN were reported incorrectly: Prepare two sets of W-2c and W-3c forms. On the first set, enter the original, incorrect information with zeros in the “Correct information” boxes. On the second, enter the updated information with zeros in the “Previously reported” boxes.

Do not use W-2c to report corrections to back pay or to correct Form W-2G.[2]

How to Complete

Employer Information

Tax Year and Form Corrected

Employee SSN

Corrected SSN and/or Name

Employee Information

Wages, Tips, and Taxes

State and Locality Correction Information

How to Submit

Employers should file W-2c as soon as the error is discovered.[3] It can be filed online or on paper (mail to: Social Security Administration Direct Operations Center, P.O. Box 3333, Wilkes-Barre, PA 18767-3333).

If filing on paper, use dark or black ink in 12-point Courier font.[4] Only submit official IRS copies to the SSA. Self-printed copies are sufficient for sending to employees.

- Send Copy A to the SSA

- Send Copy 1 to state or local tax departments

- Provide Copies 2, B, and C to the employee

- Retain Copy D for a minimum of four years[5]

Frequently Asked Questions

Are there penalties for filing an incorrect W-2?

Penalties may apply for filing incorrect information returns.[6] If a correction is filed before the January 31 W-2 filing deadline, the filer may avoid penalties.

How do I order Form W-2c from the IRS?

Paper filings must be completed on official copies ordered from the IRS. To order official copies of employer information returns, visit the IRS Online Ordering portal.

What do I do if I get a W-2c?

If you receive a W-2c from your employer, it means they discovered an error on your W-2 and filed a correction. You may need to file an amended return if you have filed an income tax return for the year shown. Consult a tax professional to determine next steps.