Updated March 17, 2024

Forming an LLC in Alaska is a process that can be completed online or in paper format with the Dept. of Commerce, Community, and Economic Development. If filed online, the formation is immediate, and if filed via the paper application, it will take 10 to 15 business days.[1]

How to FORM (7 steps) |

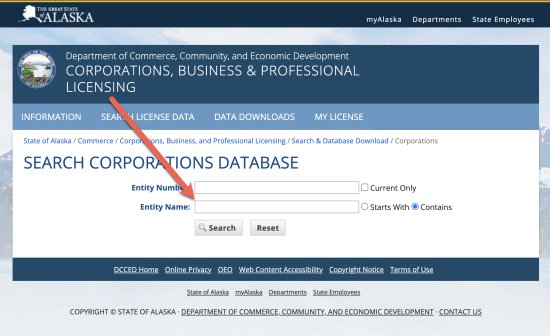

1. Search for a Business Name

- Business Search: www.commerce.alaska.gov

To perform a lookup for an available name, search the Corporations Database by entering your preferred name on the 2nd line titled “Entity Name.”

After entering the desired name and there are matches, the text should read “No Results.” which means the name is available for use.

When ultimately selecting your name, it must contain the words “limited liability company” or the abbreviation “L.L.C.,” or “LLC”. The word “limited” may be abbreviated as “Ltd.,” and the word “company” may be abbreviated as “Co.”[2]

If confirmation is needed to know if a name is available, contact the Dept. of Commerce at corporations@alaska.gov.

2. Choose a Registered Agent

A registered agent is an official representative of the entity that accepts notices of the entity. It is required to have an office location (not a PO Box) located in Alaska.[3]

It is recommended to be someone who is not directly associated with the entity, such as an attorney or business licensed to transact in Alaska.

3. Registering an LLC

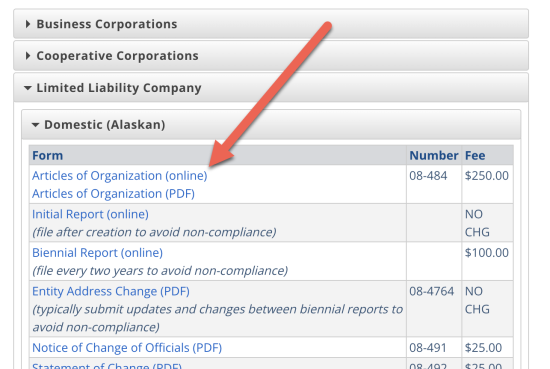

1. Use the Alaska Dept. of Commerce, Community, and Economic Developtment.

- Go to www.commerce.alaska.gov.

In the table area, click the dropdown titled “Limited Liability Company” and select the type of LLC being created (“Domestic” or “Foreign”).

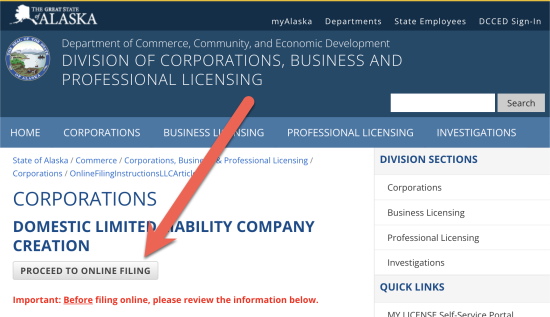

2. Click “Proceed to Online Filing.” Read the disclaimers and, if agree, click the “Proceed to Online Filing” button.

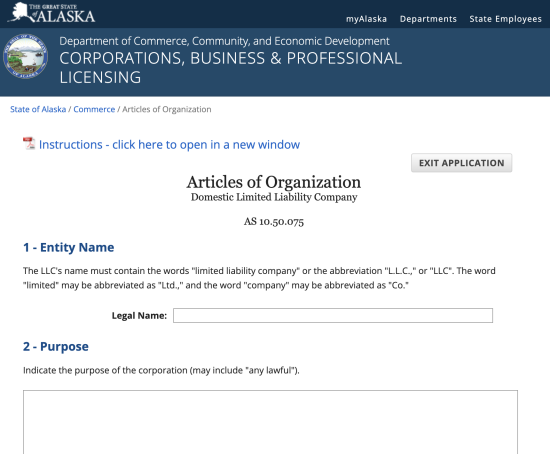

3. Complete the Online Form. Fill in the LLC details with the online version of the Articles of Organization. The following information is required:[4]

- Company name;

- NAICS Code (6-digit number);

- Purpose of the business (can simply write “any lawful”);

- Registered agent name and address;

- Management, such as the name of a manager (if applicable); and

- Any other information requested by the State of Alaska is dependent on the filing status or entity.

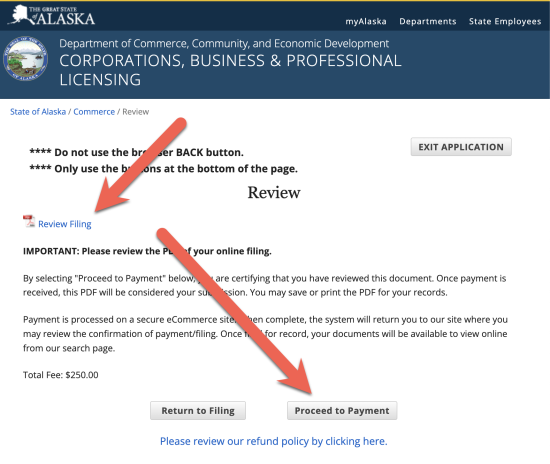

4. Review the LLC Details. A screen will appear that allows viewing the LLC information entered to ensure it is correct.

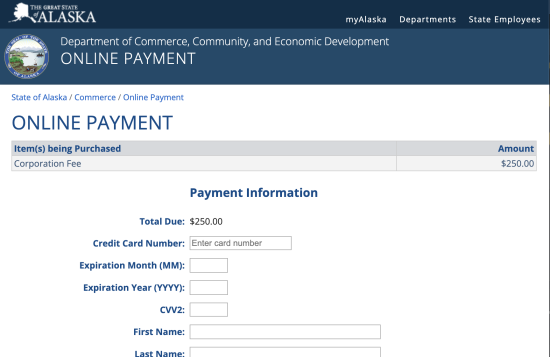

5. Pay the Filing Fee. The organizer will be required to pay the filing fee by credit card (Visa, MasterCard, American Express, and Discover accepted).

An organizer can form an LLC by filing, signing, and delivering one of the following documents:[5]

Articles of Organization (Form 08-484) – For Alaskan entities.

Articles of Organization (Form 08-484) – For Alaskan entities.

Filing Fee: $250

Mailing Address: State of Alaska, Corporations Section, PO Box 110806, Juneau, AK 99811-0806

Initial Report: After the LLC is formed, an initial report must be filed within 6 months[6].

Certificate of Registration (Form 08-497) – For out-of-state entities.

Certificate of Registration (Form 08-497) – For out-of-state entities.

Filing Fee: $350

Mailing Address: State of Alaska, Corporations Section, PO Box 110806, Juneau, AK 99811-0806

4. Get a Tax ID Number (EIN)

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

Otherwise known as an employer identification number (EIN or FEIN) that is obtained for free by applying with the IRS. Much like an individual’s social security number (SSN), an EIN is required to conduct financial transactions on behalf of a business.[7]

6. Choose a Tax Classification Type

- LLC (default). If no election is made, profits pass-through to the owners based on their ownership.

- S-Corporation. An LLC can elect to be treated as an S-Corporation by filing IRS Form 2553 within 75 days of the entity’s effective date.

- C-Corporation. An LLC can elect to be treated as a C-Corporation by filing IRS Form 8832 within 75 days of the entity’s effective date.

7. File Biannual Reports

Entities in Alaska are required to be renewed every 2 years. The reporting opens 3 months prior to January 2 and can be filed online.[12] The fees associated with a renewal are the following:

- Domestic: $100.00 ($137.50 late fee if filed on or after February 2nd)

- Foreign: $200.00 ($247.50 late fee if filed on or after February 2nd)

Sources

- www.commerce.alaska.gov (Business Licensing Forms & Fees)

- Sec. 10.50.020

- Sec. 10.50.055

- Sec. 10.50.075

- Sec. 10.50.070

- www.commerce.alaska.gov (Biennial Report FAQs)

- IRS (How to Apply for an EIN)

- Sec. 10.50.095

- Sec. 10.50.110

- Sec. 10.50.150

- Sec. 10.50.155(1)(B)

- www.commerce.alaska.gov (Biennial Report FAQs)