Updated March 17, 2024

Forming an LLC in Alabama can be completed online or by mail, including payment of the required filing fee. For online formations, an LLC is commonly approved within 24 hours. Paper filings can take 2-4 weeks to process.[1][2]

Formation Options

- Online: www.alabamainteractive.org

- Paper:

Filing Fees

- Domestic: $236 (online), $225 (paper)

- Foreign: $184 (online), $175 (paper)[3]

How to form (7 steps) |

1. Find a Business Name

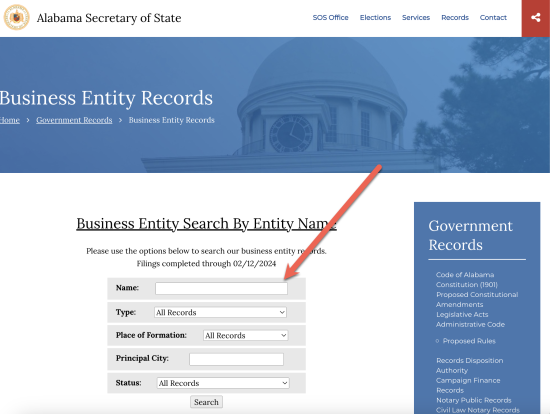

- Business Search: www.sos.alabama.gov

Use the business database portal to find an available entity name. Search a preferred name, and if the words “No matches found” appear, the name is most likely available.

A business name must end in the following terms: “Limited Liability Company” or the abbreviation “L.L.C.” or “LLC”.[4]

Paper Filers (only)

If an LLC is being created through a paper filing, a name reservation must be applied for (skip this step if forming online):[5]

- Domestic Name Change Reservation – For in-state entities.

- Foreign Name Change Reservation – For out-of-state entities.

Attach a $25 fee (check, credit card payment, or money order) made payable to the “Alabama Secretary of State.”

Mail to the following address: Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103

Filing Fee: Include a $25 check, credit card payment, or money order made payable to the “Alabama Secretary of State.”

Mailing Address: Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103

2. Select a Registered Agent

3. Registering an LLC

1. Use the Alabama Secretary of State.

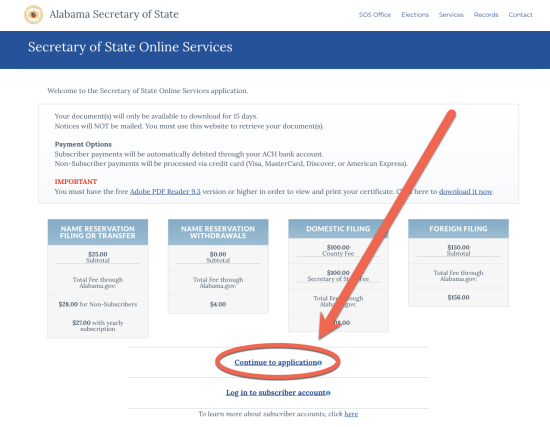

- Go to www.alabamainteractive.org.

Start the process by selecting the “Continue to application” link.

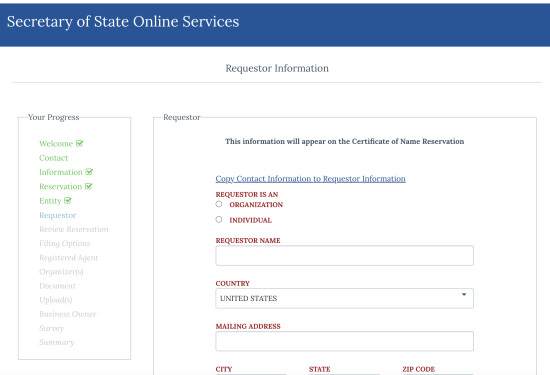

2. Follow the LLC Wizard. Follow the prompts provided by the Secretary of State’s online wizard.

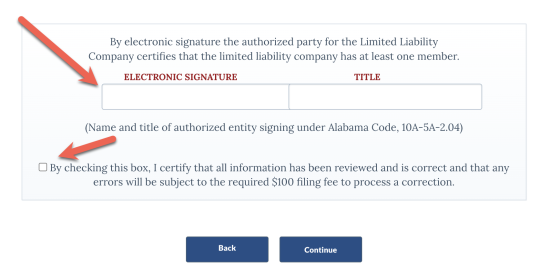

3. Review and Sign. Review the company details and the organizer must sign on the bottom of the page.[7]

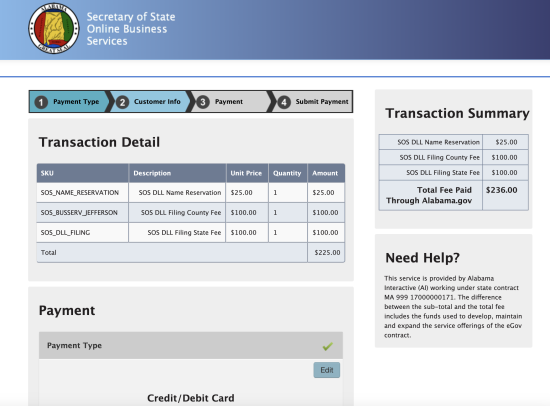

4. Pay the Filing Fee. Use the checkout process to pay the filing fee.

- Domestic: $236

- Foreign: $184

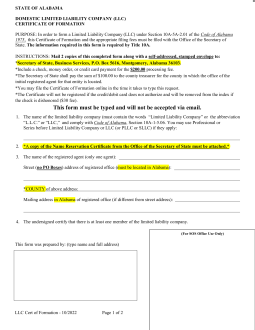

An organizer must use of one the following forms:[8]

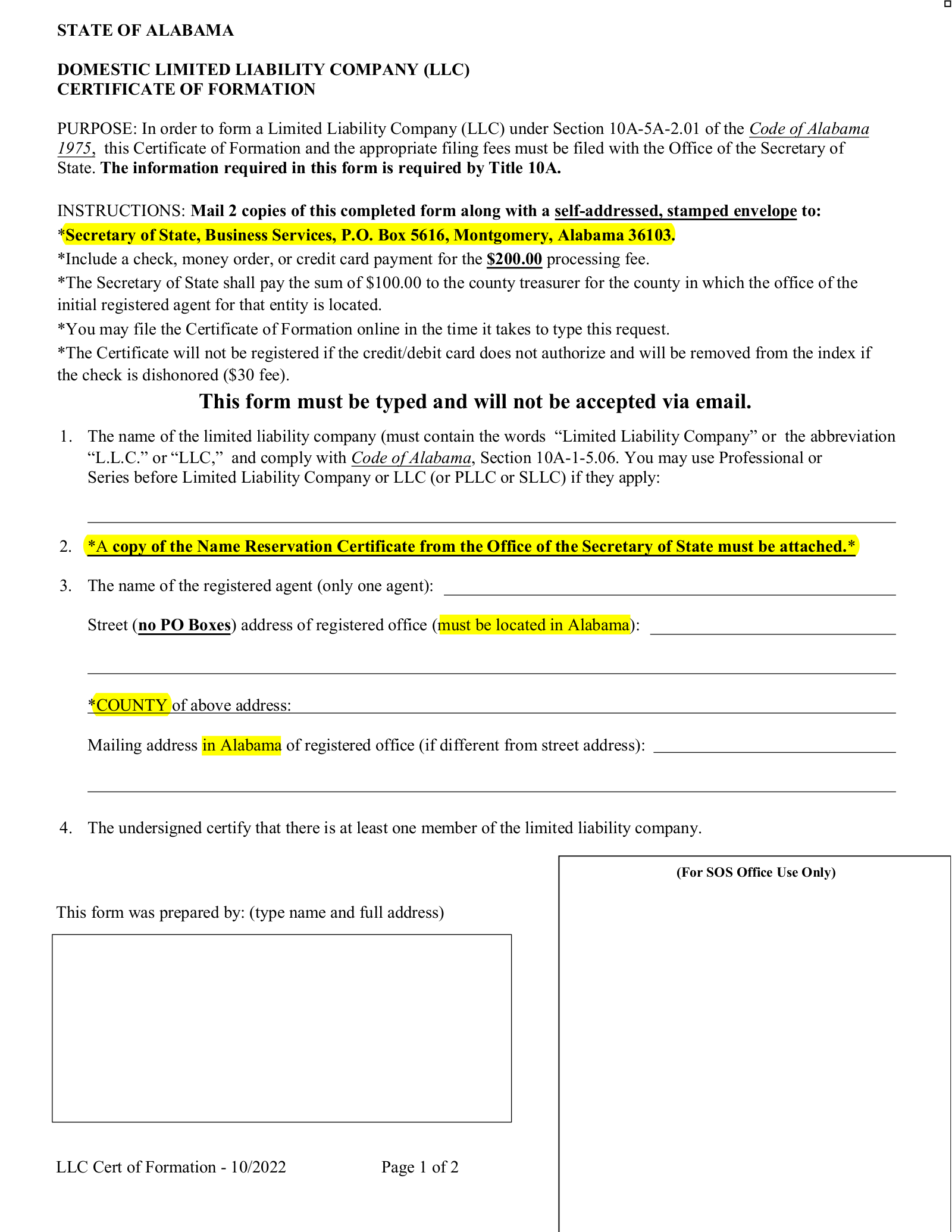

Domestic Certificate of Formation – For in-state entities.

Domestic Certificate of Formation – For in-state entities.

Filing Fee: Include a $200 check, credit card payment, or money order made payable to the “Alabama Secretary of State.”

Make a Copy: Send 2 total.

Mailing Address: Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103

Attach the filed Name Change Reservation Certificate.

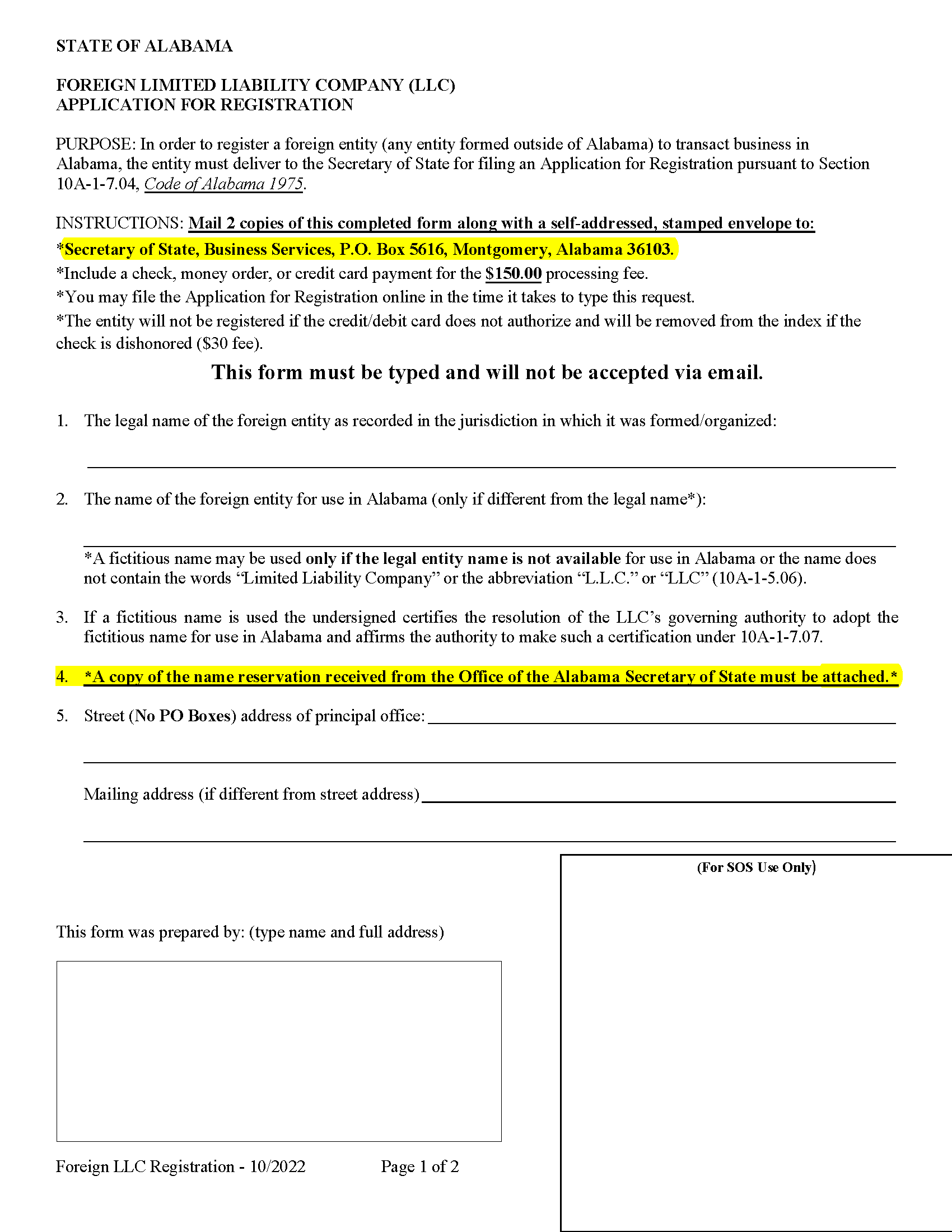

Foreign Application for Registration – For out-of-state entities.

Foreign Application for Registration – For out-of-state entities.

Filing Fee: Include a $150 check, credit card payment, or money order made payable to the “Alabama Secretary of State.”

Make a Copy: Send 2 total.

Mailing Address: Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103

Attach the filed Name Change Reservation Certificate.

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

An Employer Identification Number (EIN) must be obtained to open bank accounts, hire employees, and conduct business activities.[9]

5. Write an Operating Agreement

An operating agreement, either written or oral, is required in Alabama. It can be written or agreed to before, during, or after the LLC is created.[10]

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification (3)

- LLC (default) – By default, an LLC is taxed as a disregarded entity (1 member) or partnership (2 or more members). This means all profits of the entity “pass-through” to each owner based on ownership.[11]

- S-Corporation – An LLC can elect to file as an S-Corporation within 75 days of formation by filing IRS Form 2553.

- C-Corporation – An LLC can elect to file as a C-Corporation within 75 days of formation by filing IRS Form 8832.

7. File Annual Reports

Alabama requires annual reports (Statement of Information) to be filed no later than 2.5 months after the tax ending period (April 15). This can be filed online with the Alabama Department of Revenue.

Sources

- www.llcuniversity.com/how-long-does-it-take-to-get-an-llc-in-alabama/

- www.venturesmarter.com/how-long-does-it-take-to-form-an-llc/alabama/

- Alabama Secretary of State – Fee Schedule

- Section 10A-1-5.06

- Section 10A-1-5.11

- Section 10A-1-5.31

- Section 10A-5A-2.01(a)

- Section 10A-5A-2.01(d)

- IRS (How to Apply for an EIN)

- Section 10A-5A-2.04(a)(1)

- IRS Publication 3402