Updated March 17, 2024

Forming an LLC in Arizona involves filing with the Arizona Corporation Commission online or by mail (paper application). The processing times vary depending on whether the formation was expedited (5 to 7 days if expedited, 18 to 20 days for standard filings).[1]

Formation Options

- Online: www.ecorp.azcc.gov

- Paper:

Filing Fees

- Domestic: $50 ($85 if expedited)[2]

- Foreign: $150 ($60 if expedited)

How to Form (6 steps) |

1. Search for a Business Name

- Business Search: www.ecorp.azcc.gov/EntitySearch/Index

Before filing a new LLC, it is recommended to perform a search on the Corporation Commission’s business database to verify the business name is available.[3]

If no results appear, the name is most likely available for use. Any name selected must contain the phrase “limited liability company” or “limited company” or the abbreviation “L.L.C.”, “LLC”, “L.C.” or “LC” in uppercase or lowercase letters.[4]

2. Choose a Statutory Agent

A statutory agent (registered agent) is a person legally allowed to accept mail and other service requests on behalf of the LLC. This designation is required under State law.[5]

A statutory agent must sign the acceptance of their appointment to be legally recognized.

3. Register an LLC

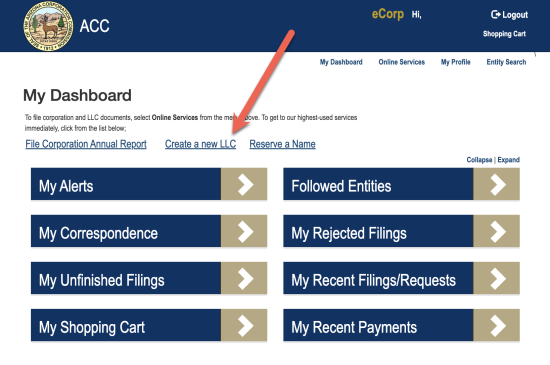

1. Use the Arizona Corporation Commission.

- Go to www.ecorp.azcc.gov.

Register or log in to begin the process.

After registering, a temporary password will be sent to the e-mail used during signup.

2. Click “Create a New LLC”. Once logged in, click the link titled “Create a new LLC” at the top of the page.

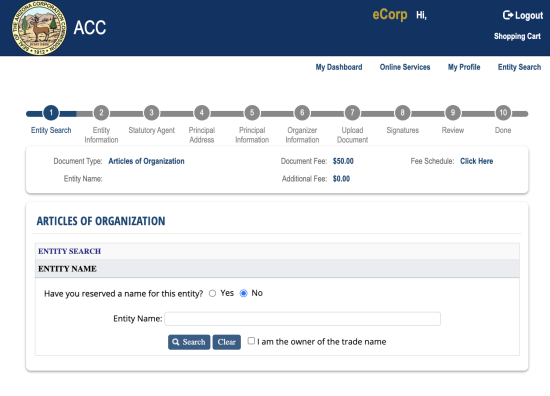

3. Follow the LLC Wizard. Follow the prompts and enter the required information about the business entity. There are ten steps, plus the filing fee payment, which completes the process (see image below).

4. Statutory Agent. On the 7th prompt, the organizer must upload a signed copy of the Statutory Agent Acceptance.[6]

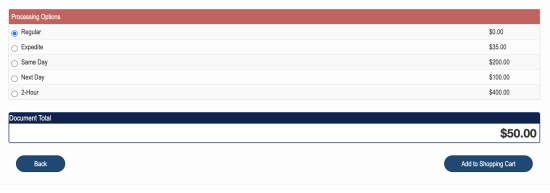

5. Expedited Options. The organizer can select the following expedited options in the checkout process (see image below).

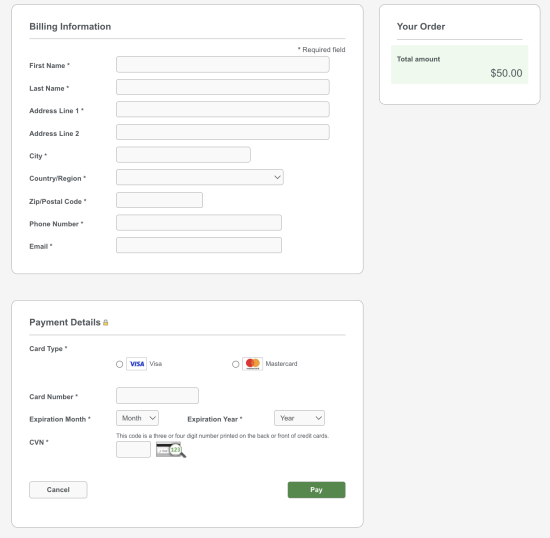

6. Pay the Filing Fee. After selecting, the organizer can pay via Visa or MasterCard.

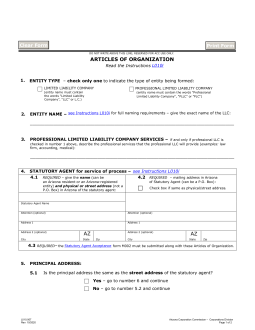

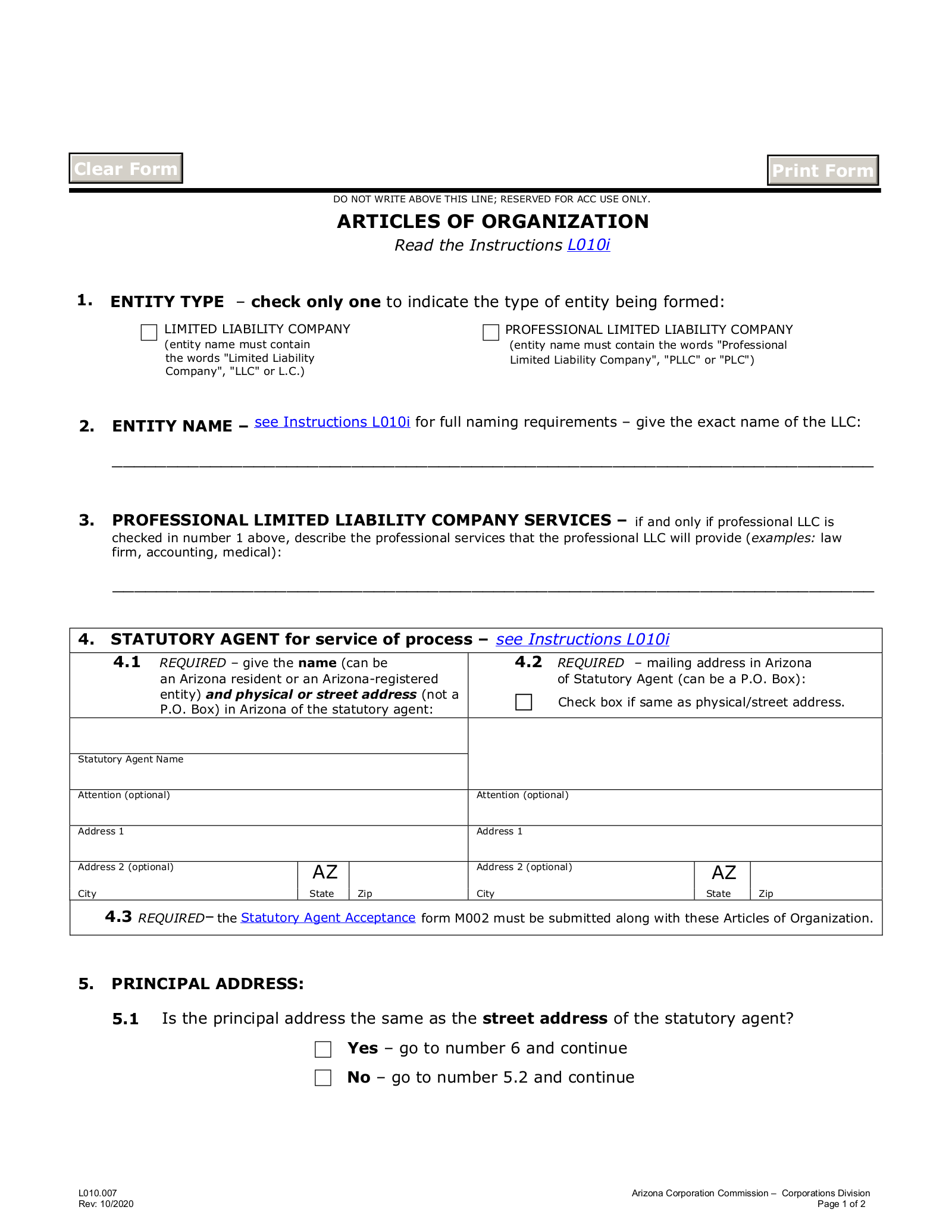

Domestic Articles of Organization (Form L010.007)

Domestic Articles of Organization (Form L010.007)

Filing Fee: $50

Mailing Address: Arizona Corporation Commission – Examination Section – 1300 W. Washington St., Phoenix, Arizona 85007

Fax: 602-542-4100 (standard or expedited) & 602-542-0900 (same day or next day).

Statutory Agent Acceptance: Must be included in the filing.

Foreign Registration Statement (Form L025.005)

Foreign Registration Statement (Form L025.005)

Filing Fee: $150

Mailing Address: Arizona Corporation Commission – Examination Section – 1300 W. Washington St., Phoenix, Arizona 85007

Fax: 602-542-4100 (standard or expedited) & 602-542-0900 (same day or next day).

Statutory Agent Acceptance: Must be included in the filing.

4. Get a Tax ID Number (EIN)

- Apply Online: www.irs.gov

- Apply by Mail: Form SS-4

Not required as part of registering an LLC, but if the entity will open a bank account or have employees, it will need a tax number from the IRS. This is a free service the IRS provides and can be obtained instantly online.

5. Write an Operating Agreement

An operating agreement is not required under State law but is recommended as an agreement between the members on making decisions.

If created and signed, the members are bound to its terms.[7]

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification Type

- LLC (default) – If no classification is made, an LLC will be taxed as a disregarded entity (1 owner) or a partnership (2 owners).

- S-Corporation – A common selection and must be filed within 75 days of formation by using IRS Form 2553.

- C-Corporation – Election must be filed within 75 days of formation by using IRS Form 8832.[8]

No Annual Report Requirements

In Arizona, there is no requirement for an LLC to renew or file an annual report.[9]

However, an entity is required to maintain and keep its records updated with the Corporations Commission, specifically, the statutory agent information.

Sources

- Arizona Corporation Commission (Document Processing Times)

- Arizona Corporation Commission (Schedule of Fees)

- Arizona Corporation Commission (Ten Steps to Starting a Business)

- ARS § 29-3112

- ARS § 29-3115

- ARS § 29-3115(A)

- ARS § 29-3106(A)

- IRS Publication 3402

- https://azcc.gov/corporations/faqs/annual-reports