Updated April 15, 2022

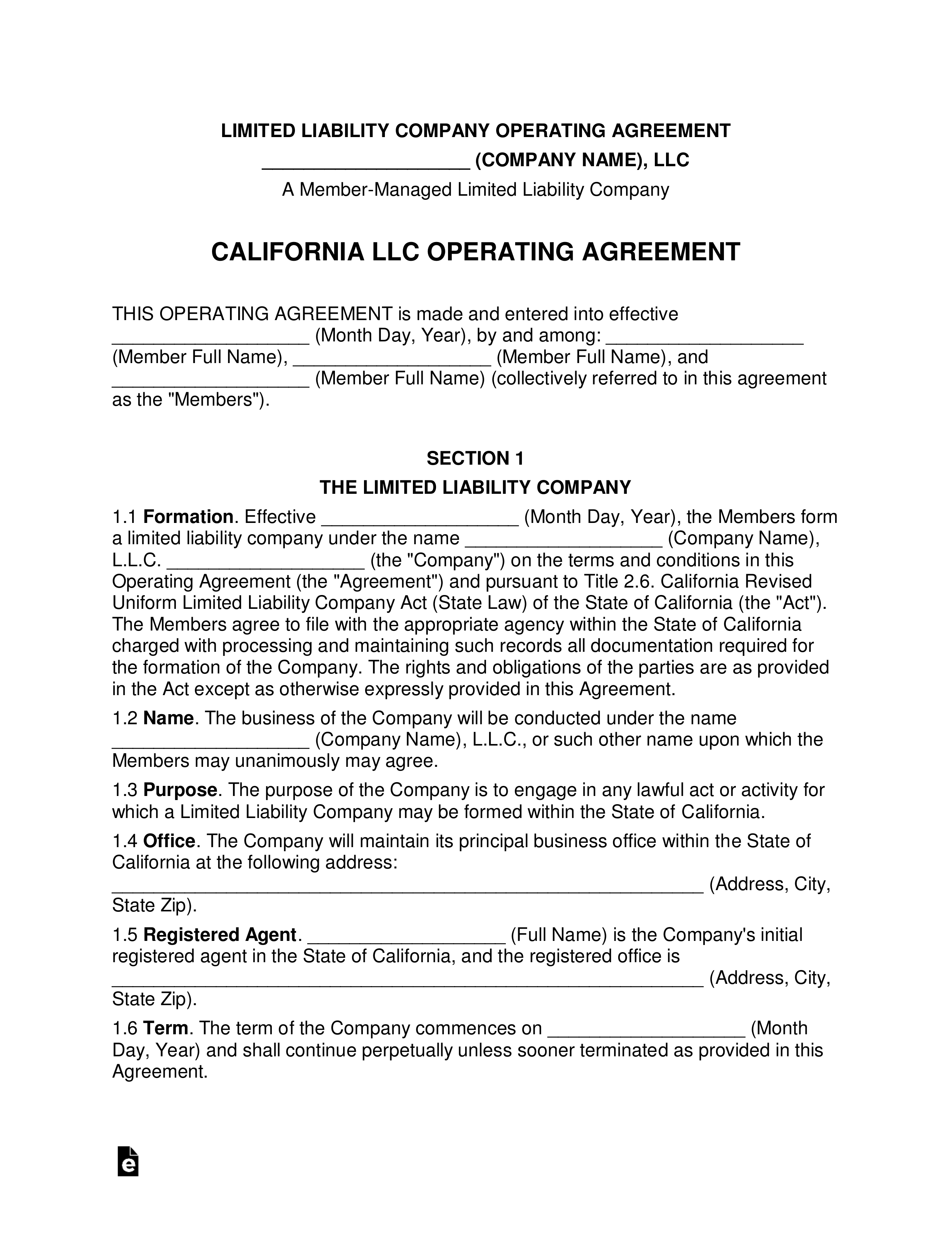

A California multi-member LLC operating agreement is a legal document used by companies and businesses that will be managed by more than one contributing member. The document will assist in outlining obligations, responsibilities, and standard operating procedures for all members to agree to and adhere to as long as the company remains in business. Amendments are possible, so long as all members agree to the changes.

The State of California requires that this agreement is completed and filed prior to the operation of the business. Implementation of the document protects the member(s) in the event of a lawsuit or business failure by separating the member’s personal property (personal financial accounts, homes, vehicles, trust accounts, etc). Once completed, the signatures of all members must be submitted in the presence of a notary public.