Updated March 21, 2024

A Georgia LLC operating agreement is a legal document that sets the operational procedures and other important aspects of a company. The agreement acts as the bylaws and partnership arrangement between the owners (members) that outlines the ownership interest, member responsibilities, officer appointments, and the management of the company. An operating agreement goes into effect when all parties have signed and is to be kept by each member. It is not filed with the Secretary of State.

Is an Operating Agreement REQUIRED in Georgia?

No — operating agreements are not required by law in Georgia.

By Type (2)

Single-Member LLC Operating Agreement – For use of a single owner of a business. This document is designed specifically for the purpose of outlining the business of a sole proprietor.

Single-Member LLC Operating Agreement – For use of a single owner of a business. This document is designed specifically for the purpose of outlining the business of a sole proprietor.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – For use by entities with more than one member/owner to place into writing, with the unanimous agreement of all members, the outline of the agreement.

Multi-Member LLC Operating Agreement – For use by entities with more than one member/owner to place into writing, with the unanimous agreement of all members, the outline of the agreement.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

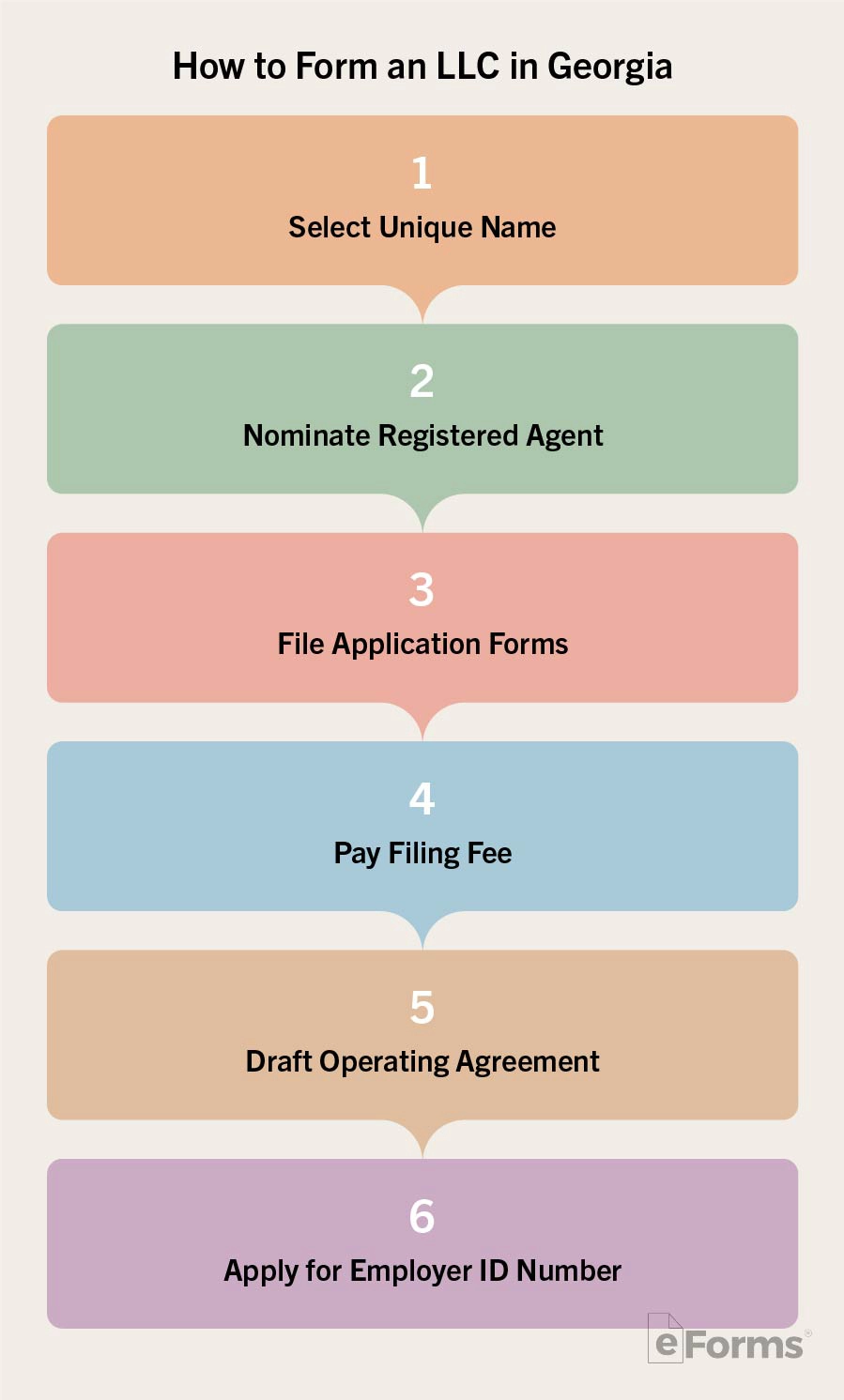

How to Form an LLC in Georgia (5 steps)

- Registered Agent

- Articles of Organization/Certificate of Authority

- Pay the Filing Fee

- Operating Agreement

- Employer Identification Number (EIN)

Before submitting any filings to the Georgia Corporations Division, it is advisable that a Business Search be conducted to investigate the availability of your chosen operating name. Any duplicate or similar names will be rejected by their offices. Ensure that the name you decide on includes the words Limited Liability Company or the abbreviation L.L.C./LLC.

1. Registered Agent

Each LLC must nominate a Registered Agent who shall receive service of process notices, annual filings, and other documents on the business’s behalf. The Registered Agent may be a:

Each LLC must nominate a Registered Agent who shall receive service of process notices, annual filings, and other documents on the business’s behalf. The Registered Agent may be a:

- Corporation

- Foreign Corporation with the authority to transact business in the State

- Individual resident of the State

2. Articles of Organization/Certificate of Authority

- Domestic – Articles of Organization

- File – Online or *PDF (Form CD 030)

- Foreign – Application for Certificate of Authority

- File – Online or PDF (Form CD 241)

*PDF applications must include the original form, one copy, and if the LLC is Domestic, the Transmittal Form 231.

Note that those filing Online will be required to Register for an Account in order to access the filing system.

3. Pay the Filing Fee

The requisite fees are as follows:

The requisite fees are as follows:

- Domestic – $100

- Foreign – $225

Online applicants will be instructed to pay the fee by credit card. If filing by mail, attach a check made out to the ‘Secretary of State’ and deliver your filings to the below address:

Office of Secretary of State, Corporations Division, 237 Coliseum Drive, Macon, Georgia 31217-3858

4. Operating Agreement

An operating agreement is a legal document that outlines the personal interests of the member(s), the management architecture, and various other provisions related to the operating structure of the LLC. The form is not required by State law, however, it is recommended that one is implemented in order to aid in the overall performance of the business.

5. Employer Identification Number (EIN)

Any business that plans on performing financial transactions using the company name will be required to apply for an Employer Identification Number (EIN). It is best to apply for an EIN immediately after filing with the Georgia Corporations Division as it will be required to hire employees, apply for financing, acquire company credit cards, etc. The following methods of application are available:

- Online – Apply on the IRS Website

- By mail – PDF Form SS-4

Laws

- Georgia Limited Liability Company Act – Title 14, Chapter 11

- Operating Agreement Statutes

“Operating Agreement” Definition

“Operating agreement” means any agreement, written or oral, of the member or members as to the conduct of the business and affairs of a limited liability company. In the case of a limited liability company with only one member, a writing signed by that member stating that it is intended to be a written operating agreement shall constitute a written operating agreement and shall not be unenforceable by reason of there being only one person who is a party to the operating agreement. A limited liability company is not required to execute its operating agreement and, except as otherwise provided in the operating agreement, is bound by its operating agreement whether or not the limited liability company executes the operating agreement. An operating agreement may provide enforceable rights to any person, including a person who is not a party to the operating agreement, to the extent set forth therein.

Video