Updated March 21, 2024

A Massachusetts LLC operating agreement is used to include the ownership, business purpose, and day-to-day operations of the company. The basis on how a company will function is written in this agreement and is highly recommended to be completed after forming the LLC. The form is not required under law and is not filed with a government office in the commonwealth. After signing, each member is responsible for keeping their own copy of the agreement.

Is an Operating Agreement REQUIRED in Massachusetts?

No — The State of Massachusetts does not require businesses to use an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – For use by a sole owner so that they may establish the purpose of the company and its policies and procedures.

Single-Member LLC Operating Agreement – For use by a sole owner so that they may establish the purpose of the company and its policies and procedures.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – For use by an entity that has more than one (1) member that will participate in the contribution and management of the company. With this document, the members shall have the ability to collectively set forth the policies and procedures for the management of the company.

Multi-Member LLC Operating Agreement – For use by an entity that has more than one (1) member that will participate in the contribution and management of the company. With this document, the members shall have the ability to collectively set forth the policies and procedures for the management of the company.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

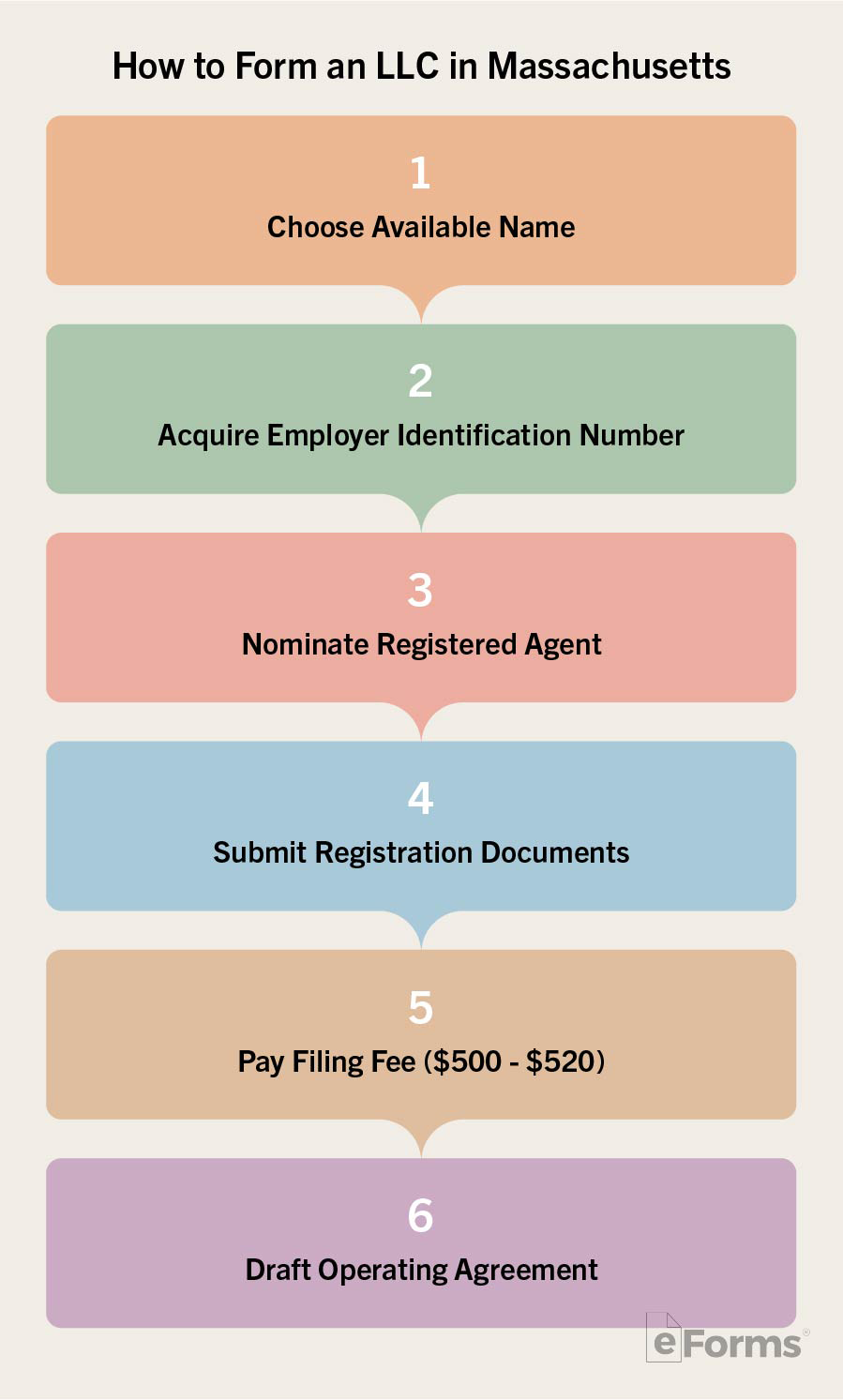

How to Form an LLC in Massachusetts (5 steps)

- Employer Identification Number (EIN)

- Registered Agent

- Submit Registration Documents

- Pay the Filing Fee

- LLC Operating Agreement

Choosing a name for your business is a preliminary step to the LLC filing process. The name chosen must contain the words ‘Limited Liability Company’ or one of the fitting abbreviations (L.L.C./LLC). Also, it is best to ensure that the name is available for use by Searching for the Name in the State’s records.

1. Employer Identification Number (EIN)

2. Registered Agent

A Registered Agent is a third-party that receives legal notices and correspondence on behalf of the company. The LLC must nominate a Registered Agent before submitting any filings to the State.The Registered Agent may be a:

- Legal resident of Massachusetts

- Domestic corporation in Massachusetts

- Foreign corporation with authorization to transact business in Massachusetts

3. Submit Registration Documents

The State will accept your LLC documents through its online filing portal:

- Domestic – Certificate of Organization

- *Foreign– Application for Registration

*A Certificate of Existence, or Certificate of Good Standing, must be included with all Foreign applications.

4. Pay the Filing Fee

Filing fees vary between the two methods of application; online filers will be required to supply $520 while applications filed by mail cost $500.If filing by mail, enclose your payment and send all articles to the following address:

Secretary of the Commonwealth, One Ashburton Place, Room 1717, Boston, Massachusetts 02108-1512

5. LLC Operating Agreement

The LLC operating agreement provides managing member(s) the means to organize their internal affairs and to define any provision they might wish to establish. It is not required that the agreement be drafted, however, it is essential in standardizing the operating structure of the LLC.

Laws

- Limited Liability Company Act – Chapter 156C

- Operating Agreement Statutes

“Operating Agreement” Definition

“Operating agreement,” any written or oral agreement of the members as to the affairs of a limited liability company and the conduct of its business.