Updated March 21, 2024

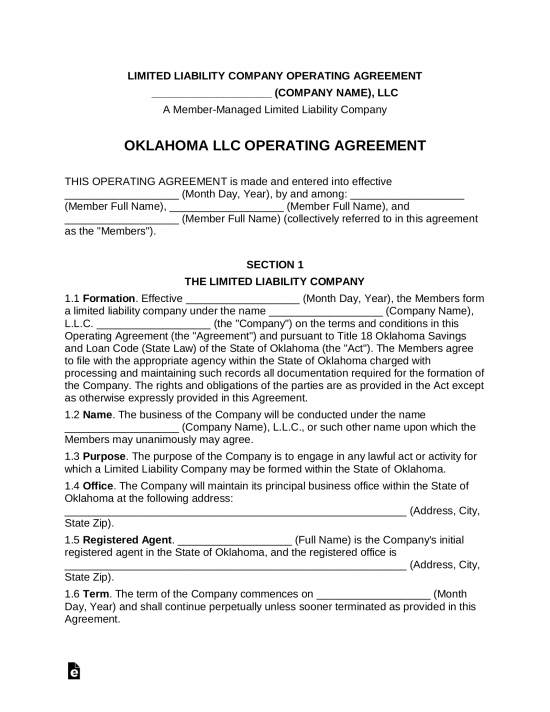

An Oklahoma LLC operating agreement establishes the operating procedures of a company. The agreement is created by the members of the company and includes how the company will be run and its ownership interest. Once completed and signed, the document is to be held by each member.

Is an Operating Agreement REQUIRED in Oklahoma?

No — the State of Oklahoma does not require LLCs to adopt an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – This would be the document to be selected if the business has one owner and therefore one member to be placed under the LLC protections.

Single-Member LLC Operating Agreement – This would be the document to be selected if the business has one owner and therefore one member to be placed under the LLC protections.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – This form would be required for use by companies who have more than one member providing contribution to form one entity.

Multi-Member LLC Operating Agreement – This form would be required for use by companies who have more than one member providing contribution to form one entity.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

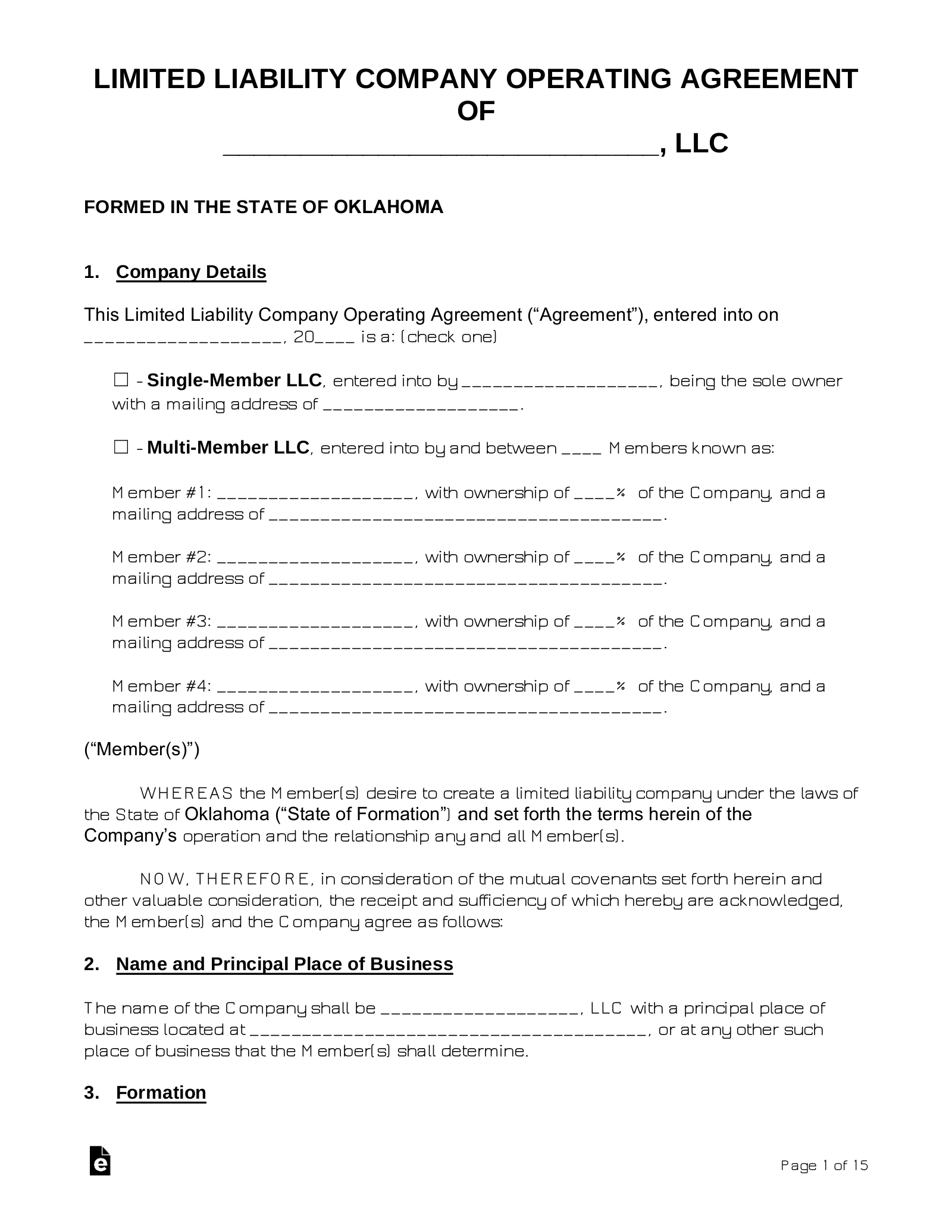

How to Form an LLC in Oklahoma (5 steps)

The Oklahoma Secretary of State recommends that all business filers ensure that their operating name is available for use before attempting to apply for registration. If an application is submitted under a name which is not unique or distinguishable in Oklahoma, the application will be rejected. Therefore, it is best to Search for the Name in the State’s database to ensure that it is available.

Step 1 – Registered Agent

A Registered Agent is a person or business that accepts service of process in the event of litigation against the LLC. In Oklahoma, a Registered Agent may be either of the following:

- A person residing in the State

- A Domestic or Foreign business operating in the State

- The LLC itself (if filing as a Domestic LLC)

Step 2 – Which Type

Select your LLC type from the following list and complete the ensuing application:

- Domestic – Articles of Organization

- Online – provide name and email address, then select Continue

- PDF (Form 0074)

- *Foreign – Application for Registration

- Online – provide name and email address, then select Continue

- PDF (Form 0081)

*A Certificate of Existence (or document of similar import) must be included with all Foreign LLC applications.

Step 3 – Pay the Fee

The requisite processing fees are as follows:

- Domestic – $100

- Foreign – $300

If you are submitting your application online, you will be instructed to supply the fee once you’ve completed your application. Should you choose to file by mail, attach a check or money order made out to the ‘Oklahoma Secretary of State’ and send your filings to the following address:

Oklahoma Secretary of State, 421 N.W. 13th, Suite 210, Oklahoma City, Oklahoma 73103

Step 4 – Operating Agreement (optional)

The LLC operating agreement is a document used to establish policies as well as the working relationship between members (i.e. capital contributions, expected duties/responsibilities, rights). If you choose to implement this document, ensure that each member agrees to the provisions before signing it officially.

Step 5 – Employer Identification Number (EIN)

The Employer Identification Number (EIN) is an important piece of identification that the Internal Revenue Service issues to businesses for tax reporting purposes. It will be necessary to apply for an EIN if your company plans to hire employees or request loans from a financial institution.

- Apply for free on the IRS Website or complete Form SS-4 and submit it by mail

Laws

- Oklahoma Limited Liability Company Act – § 18-2000 to § 18-2060

- Operating Agreement Statutes

“Operating Agreement” Definition

“Operating agreement,” regardless of whether referred to as an operating agreement and whether oral, in a record, implied, or in any combination thereof, means any agreement of the members, including a sole member, as to the affairs of a limited liability company and the conduct of its business, including the agreement as amended or restated.