Updated March 19, 2024

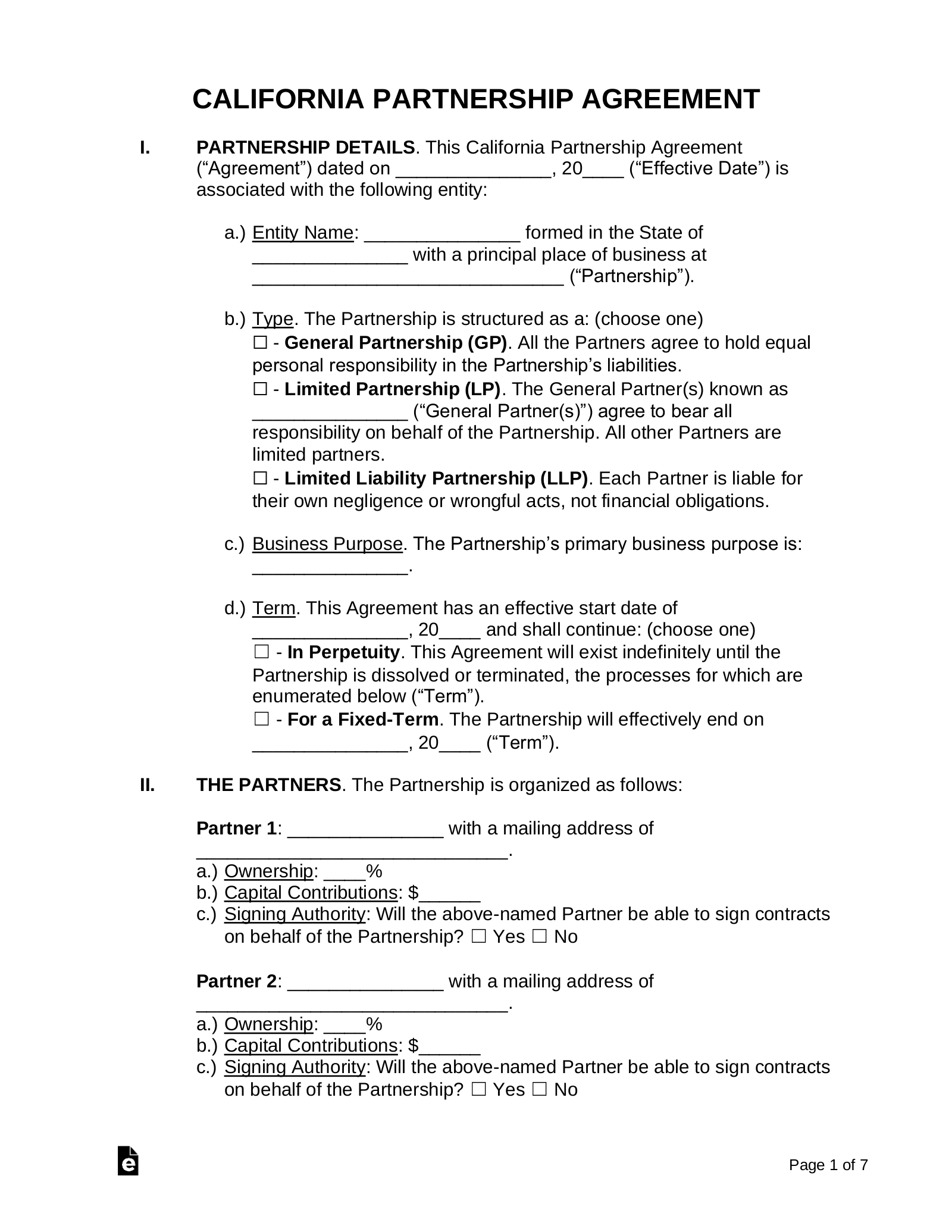

A California partnership agreement is a binding document that delineates the terms of a business partnership. The agreement determines the ownership, involvement, and liability of each partner with respect to the business.

Limited Partnerships (only)

A limited partnership (LP) in California is required to file its partnership agreement with the Secretary of State.[1]

Filing a general partnership agreement is optional.

“Partnership Agreement” Definition

“Partnership agreement” means the partners’ agreement, whether oral, implied, in a record, or in any combination, concerning the limited partnership. The term includes the agreement as amended.[2]

Allowed Partnership Types

- General Partnerships (GP)[3]

- Limited Partnership (LP)[4]

- Limited Liability Partnership (LLP)[5]

- Limited Liability Companies (LLC)[6]

Limited Liability Limited Companies (LLLPs)

California does not allow the formation of LLLPs. Although, it does recognize LLLPs formed in another State that is operating in California.[7]