Updated August 08, 2023

A partnership agreement outlines the day-to-day operations, responsibilities, and ownership of a partnership entity with two or more parties (the partners). It is generally created at the time or shortly after its formation.

Commonly Used For

- Small businesses;

- Real estate companies;

- Law firms;

- Medical offices;

- 50/50 arrangements; and

- Family-run businesses (e.g., husband and wife).

“Partnership” Definition

An association of two or more persons to carry on as co-owners a business for profit.

Table of Contents |

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, D.C.

- West Virginia

- Wisconsin

- Wyoming

By Type (5)

General Partnership (GP) Agreement – All partners share an equal amount of personal liability based on their entity ownership.

General Partnership (GP) Agreement – All partners share an equal amount of personal liability based on their entity ownership.

Download: PDF, MS Word, OpenDocument

Limited Partnership (LP) Agreement – Limited partners have no liability and do not participate in day-to-day business activities. Only the general partner(s) will have liability for the entire partnership.

Limited Partnership (LP) Agreement – Limited partners have no liability and do not participate in day-to-day business activities. Only the general partner(s) will have liability for the entire partnership.

Download: PDF, MS Word, OpenDocument

Limited Liability Partnership (LLP) Agreement – Mainly for professional occupations (lawyer, doctor, etc.). Allows the partners to be liable for personal acts only, not financial obligations.

Limited Liability Partnership (LLP) Agreement – Mainly for professional occupations (lawyer, doctor, etc.). Allows the partners to be liable for personal acts only, not financial obligations.

Download: PDF, MS Word, OpenDocument

*Limited Liability Limited Partnership (LLLP) Agreement – Same as an LLP, except the general partners possess limited liability in addition to the limited partners.

*Limited Liability Limited Partnership (LLLP) Agreement – Same as an LLP, except the general partners possess limited liability in addition to the limited partners.

Download: PDF, MS Word, OpenDocument

*Not offered in all States (view applicable States)

Limited Liability Company (LLC) – Specifically for partnerships registered in the state as an LLC. Also known as an “operating agreement.”

Limited Liability Company (LLC) – Specifically for partnerships registered in the state as an LLC. Also known as an “operating agreement.”

Download: PDF, MS Word, OpenDocument

General Partner vs. Limited Partner

General partners commonly hold personal liability for debts or negligence on behalf of the partnership, while limited partners can only lose what they have invested.

| Partnership Types | Who has Personal Liability? | Required to be Active | Annual Meetings Required? |

| General Partnership (GP) | All partners | All partners | No |

| Limited Partnership (LP) | General Partner(s) only | General partner(s) | No |

| Limited Liability Partnership (LLP) | All partners (for negligent acts only, not for debts) | All partners | No |

| Limited Liability Limited Partnership (LLLP) | No partners | General partner(s) | No |

| Limited Liability Company (LLC) | No partners | No requirement | Yes |

How are Profits Taxed?

Partnerships are considered pass-through entities and taxed on a personal level (26 U.S. Code § 701).

The partnership will send copies to each partner a Schedule K-1 (Form 1065) that reports their portion of income (or deductions) for the tax year. The partner must then attach the Schedule K-1 to their personal filing when submitting it to the IRS.

When are K-1’s Due?

A Schedule K-1 must be distributed to each partner by March 15 or the 15th day of the 3rd month after the end of the partnership’s tax year.

Source: Publication 509 (Page 5)

Self-Employment Tax

Only general partners are subject to self-employment taxes. Limited partners pay taxes based solely on the partnership’s pass-through entity status.

Source: IRS (FAQs – Entities 1)

LLC’s

An LLC of two or more individuals, by default, is taxed as a partnership unless it files IRS Form 8832 within 75 days of formation to choose its tax classification, such as:

- A corporation;

- A partnership; or

- An entity disregarded as separate from its owner.

Source: 26 CFR § 301.7701-3(c)(1)(iii)

Sample Partnership Agreement

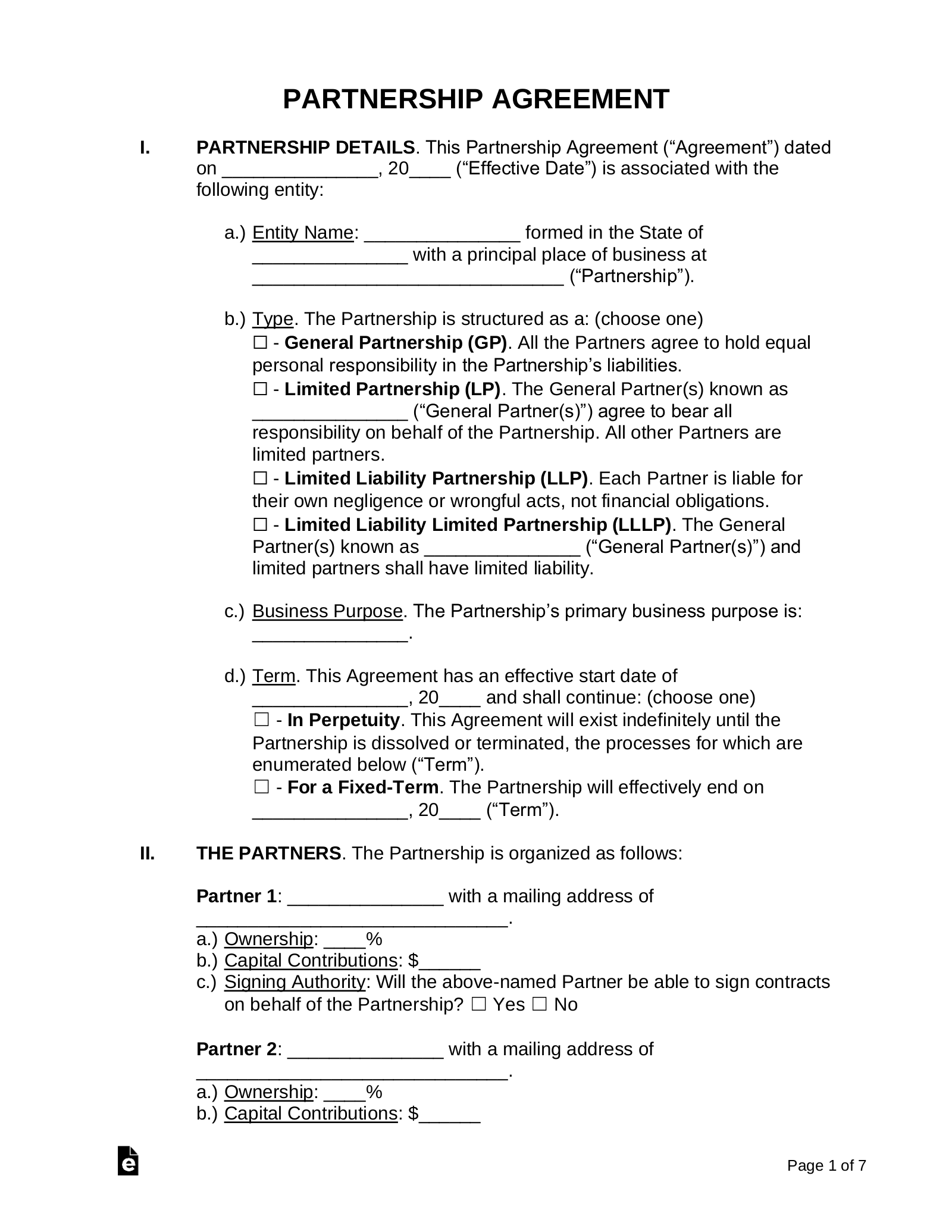

PARTNERSHIP AGREEMENT

1. PARTNERSHIP DETAILS. This Partnership Agreement (“Agreement”) dated on [DATE] (“Effective Date”) is associated with the following entity:

a. Entity Name: [NAME OF PARTNERSHIP] formed in the State of [STATE] with a principal place of business at [MAILING ADDRESS] (“Partnership”).

b. Business Purpose. The Partnership’s primary business purpose is: [DESCRIBE BUSINESS PURPOSE].

c. Term. This Agreement has an effective start date of [START DATE] and shall continue [END DATE OR WRITE “IN PERPETUITY”] (“Term”).

2. THE PARTNERS. The Partnership is organized as follows:

Partner 1: [NAME] with a mailing address of [MAILING ADDRESS].

- Ownership: [%]

- Capital Contributions: [$]

- Signing Authority: The above-named Partner ☐ CAN ☐ CANNOT sign contracts on behalf of the Partnership.

Partner 2: [NAME] with a mailing address of [MAILING ADDRESS].

- Ownership: [%]

- Capital Contributions: [$]

- Signing Authority: The above-named Partner ☐ CAN ☐ CANNOT sign contracts on behalf of the Partnership.

Partner 3: [NAME] with a mailing address of [MAILING ADDRESS].

- Ownership: [%]

- Capital Contributions: [$]

- Signing Authority: The above-named Partner ☐ CAN ☐ CANNOT sign contracts on behalf of the Partnership.

The Partners mentioned above are each referred to herein as a “Partner” and, collectively, as the “Partners.”

3. VOTING. The Partners agree as follows:

a. Voting Determination. Voting shall be based on: (choose one)

☐ – Ownership. In proportion to each Partner’s ownership

☐ – Equal Vote. An equal vote for each Partner.

b. Changes to the Partnership. Any changes made to the Partnership shall require a [DESCRIBE VOTE THRESHOLD].

4. PARTNER DUTIES. The Partners shall have the following duties and obligations:

a. Costs and Expenses. The costs and expenses of the Partnership shall be the responsibility of: [DESCRIBE DISTRIBUTION OF COSTS AND EXPENSES]

b. Conflict of Interest. A Partner ☐ can ☐ cannot participate, directly or indirectly, in a business related to the acts conducted by the Partnership.

c. Management. The following Partner(s) are obligated to manage the day-to-day activities of the Partnership: [PARTNER(S’)] NAME(S)].

d. Work Requirements. The following Partner(s) are required to work for the Partnership. Compensation, if any, shall be agreed to in a separate document. [PARTNER’S NAMES AND WORK REQUIREMENTS].

e. Voluntary Withdrawal. If any Partner should withdraw from the Partnership, they must give at least [#] days’ written notice to the Partnership. Such withdrawal shall not affect the day-to-day operations of the Partnership.

5. ORGANIZATIONAL MATTERS. The Partners agree as follows:

a. Profit Distributions. Profits of the Partnership shall be paid based on: (choose one)

☐ – A Partner’s percentage of ownership. Each Partner shall receive their share of profits based on their ownership interest.

☐ – Custom percentages assigned to each Partner. Each Partner shall be owed the following percentage of profits: [DESCRIBE EACH OWNER’S PROFIT SHARE].

b. Regular Meetings. The Partnership shall have: (choose one)

☐ – Scheduled meetings. The Partnership will have regularly scheduled meetings [DESCRIBE MEETING SCHEDULE].

☐ – Meetings only when needed. The Partnership will only meet when there is a specific request.

c. Special Meetings. Special meetings of the Partnership can be requested by: [DESCRIBE HOW TO CALL A SPECIAL MEETING].

d. Tax Year. The Partnership’s tax year will end on [DATE].

e. Deadline for Capital Contributions. The deadline for all Partner capital contributions must be made by [DATE].

6. DISSOLUTION. Dissolution of the Partnership shall be determined in any of the following methods:

- Vote. If the Partners vote, in accordance with Section 3(b), to dissolve the Partnership in accordance with the Governing Law.

- Less than 2 Partners. If, at any time, the Partnership consists of less than two (2) Partners.

In the event of such dissolution of the Partnership, each Partner will share equally in any remaining assets or liabilities of the Partnership in accordance with their respective ownership interest, less any debts or capital contributions that must be distributed first.

7. INDEMNIFICATION. All Partners shall be considered indemnified and held harmless by the Partnership from and against any and all claims of any nature arising from a Partner’s participation in Partnership affairs. Although, a Partner shall not be entitled to indemnification under this section for liability arising out of gross negligence or willful misconduct of the Partner or the breach by the Partner of any section of this Agreement.

8. GOVERNING LAW. This Agreement shall be governed under the laws located in the State of [STATE] (“Governing Law”).

9. SEVERABILITY. In the event any section, provision, or part of this Agreement is found to be invalid or unenforceable, only that specific language or part so found, and not the entire Agreement, will be inoperative.

10. SIGNATURES. IN WITNESS WHEREOF, this Agreement has been executed and delivered in the manner prescribed by law as of the Effective Date first written above.

Partner 1 Signature: _________________________ Date: _________________

Print Name: _________________________

Partner 2 Signature: _________________________ Date: _________________

Print Name: _________________________

Partner 3 Signature: _________________________ Date: _________________

Print Name: _________________________