Updated February 09, 2022

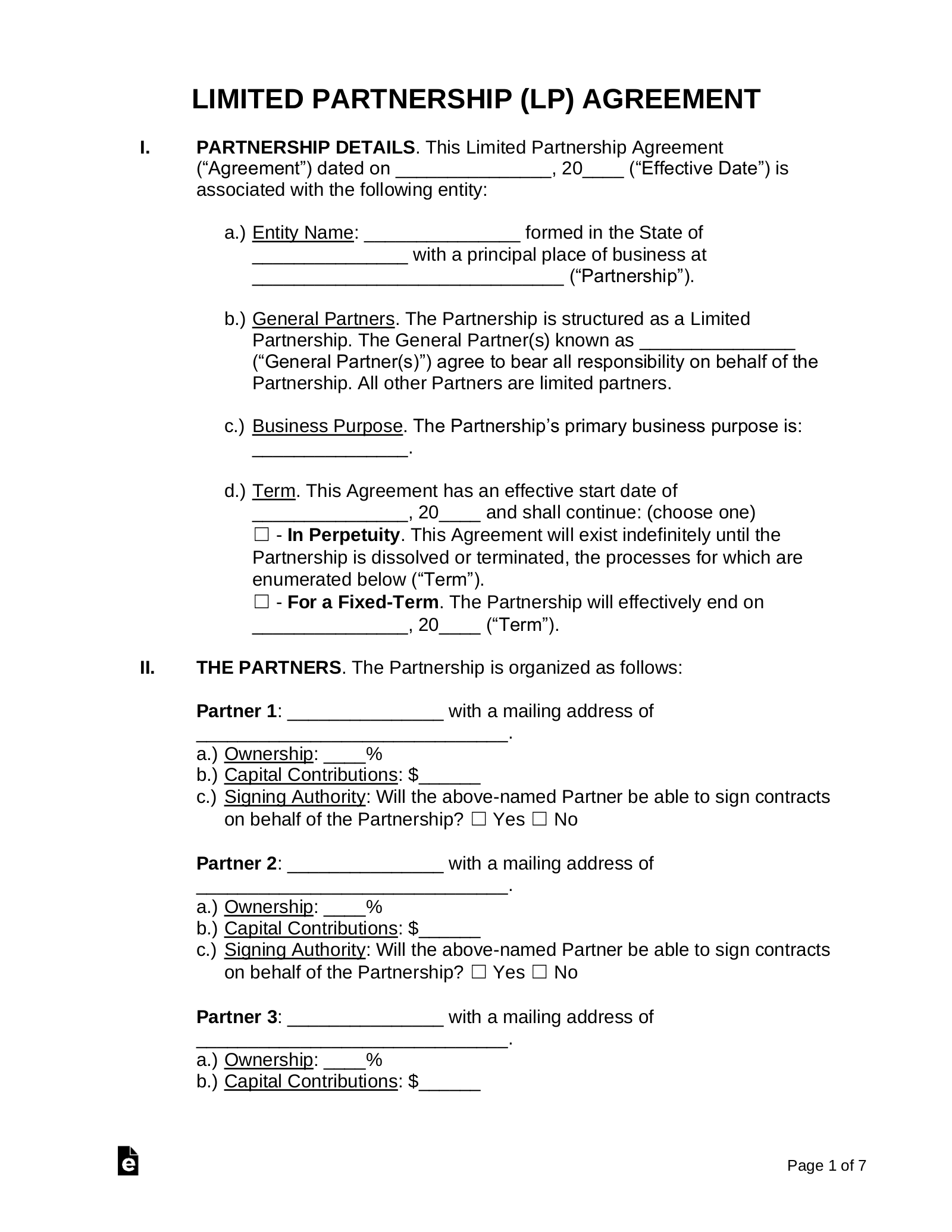

A limited partnership (LP) agreement is between a general partner, who holds all personal liability on behalf of the entity, and limited partners. Unlike the general partner, limited partners have no personal liability and can only lose their investment in the partnership.

Main Purpose

For any business where a general partner manages the day-to-day activities while limited partners make an investment and collect a return with no personal liability.

Highly recommended for real estate investments.

Pros and Cons

A limited partnership has pros and cons that each partner should be aware of.

Pros

- Limited partners can only lose what they invest in the partnership, with no personal liability.

- Limited partners can leave the day-to-day operations to the general partner.

- Limited partners are not subject to self-employment taxes.

- No requirements for annual meetings.

- Ideal for businesses where there is limited work to do, such as real estate investment.

- Available in all 50 States.

Cons

- General partners assume all risk on behalf of the partnership.

- General partners can make most management decisions. Therefore, limited partners have little say in the day-to-day decisions.

- To sell ownership interest, limited partners often need the consent of the general partner and/or other partners.