Updated October 11, 2023

A personal financial statement is a document summarizing a person’s financial standing. It provides a full list of their personal assets and liabilities as well as their income and expenses. Commonly required by financial institutions when applying for credit or a loan, it demonstrates a person’s creditworthiness and repayment ability.

Common Uses

- Credit, loan, or financing application (mortgage, vehicle, etc.)

- Seeking financing from an investor

- Application for a lease

- Financial planning

Table of Contents |

What is a Personal Financial Statement?

A personal financial statement is an overview of a person’s financial situation at a given time. It includes a list of their assets, liabilities, income, and expenses to calculate the person’s net worth and monthly profit/loss.

How to Prepare a Financial Statement

A financial statement is comprised of two parts: a balance sheet (assets and liabilities) and an income statement (monthly income and expenses).

What to Include (6)

To create an accurate, up-to-date financial statement, be sure to collect a list of all assets, liabilities, income, and expenses with their estimated cash values.

1. Assets

Assets are physical or digital goods with monetary value. Examples include:

- Bank accounts (checking, savings, money market accounts)

- Investment accounts: Stocks, ETFs, mutual funds, bonds, commodities

- Retirement accounts: 401(k), IRA, etc.

- Certificate of deposit

- Physical cash

- Real estate

- Personal properties with significant value: Vehicles, boats, collectibles, jewelry

2. Liabilities

Liabilities are debts and financial obligations that a person is tied to. Examples include:

- Credit cards with a balance

- Student loans

- Unpaid medical bills or taxes

- Mortgages or vehicle loans

- Co-signed loans

3. Net worth

A person’s net worth represents their monetary value after their liabilities have been accounted for.

[Total Value of Assets ($) – Total Value of Liabilities ($) = Net Worth ($)]

4. Income

Income represents all the positive cash flow coming in. Examples include:

- Monthly wages

- Bonuses

- Commissions

- Passive income: Dividends, interest on savings account, etc.

5. Expenses

Expenses represent the cost of living and other negative cash flows. Examples include:

- Monthly rent

- Car payments

- Student loan payments

- Utilities

- Other living expenses

6. Net profit/loss

A person’s net profit or loss is calculated by comparing the incoming cash flow with the outgoing cash flow.

[Total Sum of Income ($) – Total Sum of Expenses ($) = Net Profit/Loss ($)]

What Not to Include

- Business assets and liabilities — A personal financial statement should not include business-related assets and liabilities unless the person is directly liable.

- Loaned assets — If the person does not have legal ownership over an item, it should not be included in their personal financial statement.

- Personal home goods like furniture — Items without significant cash value or items that may not be easily sellable should not be included.

Sample

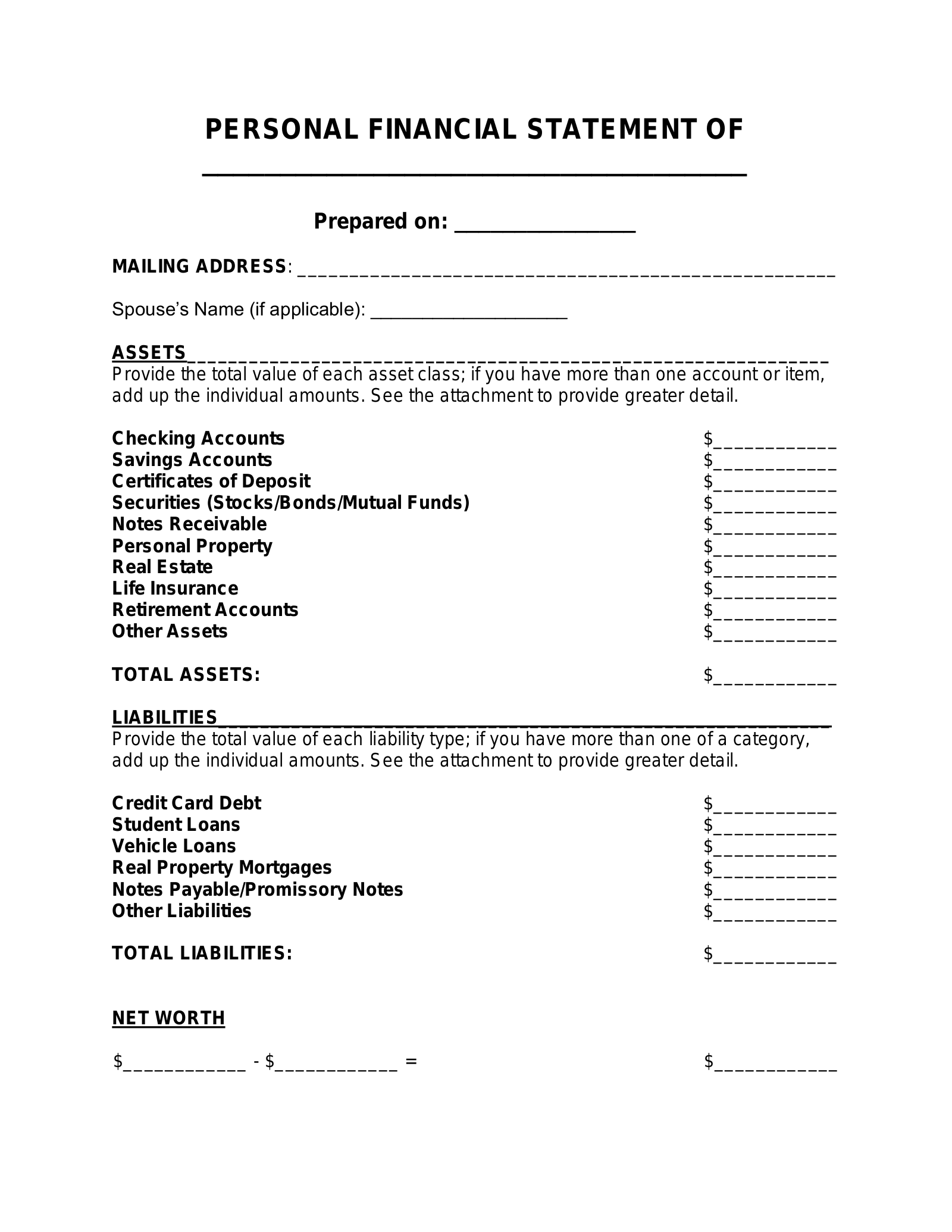

PERSONAL FINANCIAL STATEMENT OF [NAME]

Prepared on: [DATE]

MAILING ADDRESS: [MAILING ADDRESS]]

Spouse’s Name (if applicable): [[DATE]

ASSETS______________________________________________________________

Provide the total value of each asset class; if you have more than one account or item, add up the individual amounts. See the attachment to provide greater detail.

Checking Accounts [AMOUNT AVAILABLE]

Savings Accounts [AMOUNT AVAILABLE]

Certificates of Deposit [AMOUNT AVAILABLE]

Securities (Stocks/Bonds/Mutual Funds) [TOTAL VALUE]

Notes Receivable [TOTAL VALUE]

Personal Property [TOTAL VALUE]

Real Estate [TOTAL VALUE]

Life Insurance [SURRENDER VALUE]

Retirement Accounts [TOTAL VALUE]

Other Assets [TOTAL VALUE]

TOTAL ASSETS: [SUM OF ALL ASSETS]

LIABILITIES___________________________________________________________

Provide the total value of each liability type; if you have more than one of a category, add up the individual amounts. See the attachment to provide greater detail.

Credit Card Debt [TOTAL OWED]

Student Loans [TOTAL OWED]

Vehicle Loans [TOTAL OWED]

Real Property Mortgages [TOTAL OWED]

Notes Payable/Promissory Notes [TOTAL OWED]

Other Liabilities [TOTAL OWED]

TOTAL LIABILITIES: [SUM OF ALL LIABILITIES]

NET WORTH

[SUM OF ALL ASSETS] – [SUM OF ALL LIABILITIES] = [NET WORTH]

CERTIFICATION

I certify that the information contained in this statement is true and accurate to the best of my knowledge on the date indicated. I agree that, if after submitting this statement, there are any material changes to my finances that would impact the information it contains, I have an affirmative duty to alert the person or entity receiving this statement as soon as possible. I acknowledge that, as a result of submitting this statement, further inquiries, including a credit report, may be necessary to verify the information contained, and I hereby authorize the person or entity receiving those statements to make such inquiries.

Signature: _______________________________ Date: ______________

Print Name: _______________________________