Updated August 08, 2023

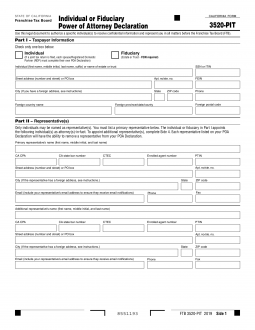

A California tax power of attorney, also known as “Form FTB 3520”, is used when an individual desires an agent to represent them in front of the tax board for filings or other issues related to taxes. Due to the sensitive nature of the information being dealt with, some paperwork will be required to prove the agent has the right to represent the principal. This form will allow your agent to receive your tax information and make filings on your behalf.

How to Write

Download: PDF

1 – Organize The Required Paperwork

Make sure you have gathered your records and references (i.e. correspondence, tax information, returns) that are relevant to this paperwork. When you are ready, select the appropriate file type underneath the preview image on this page.

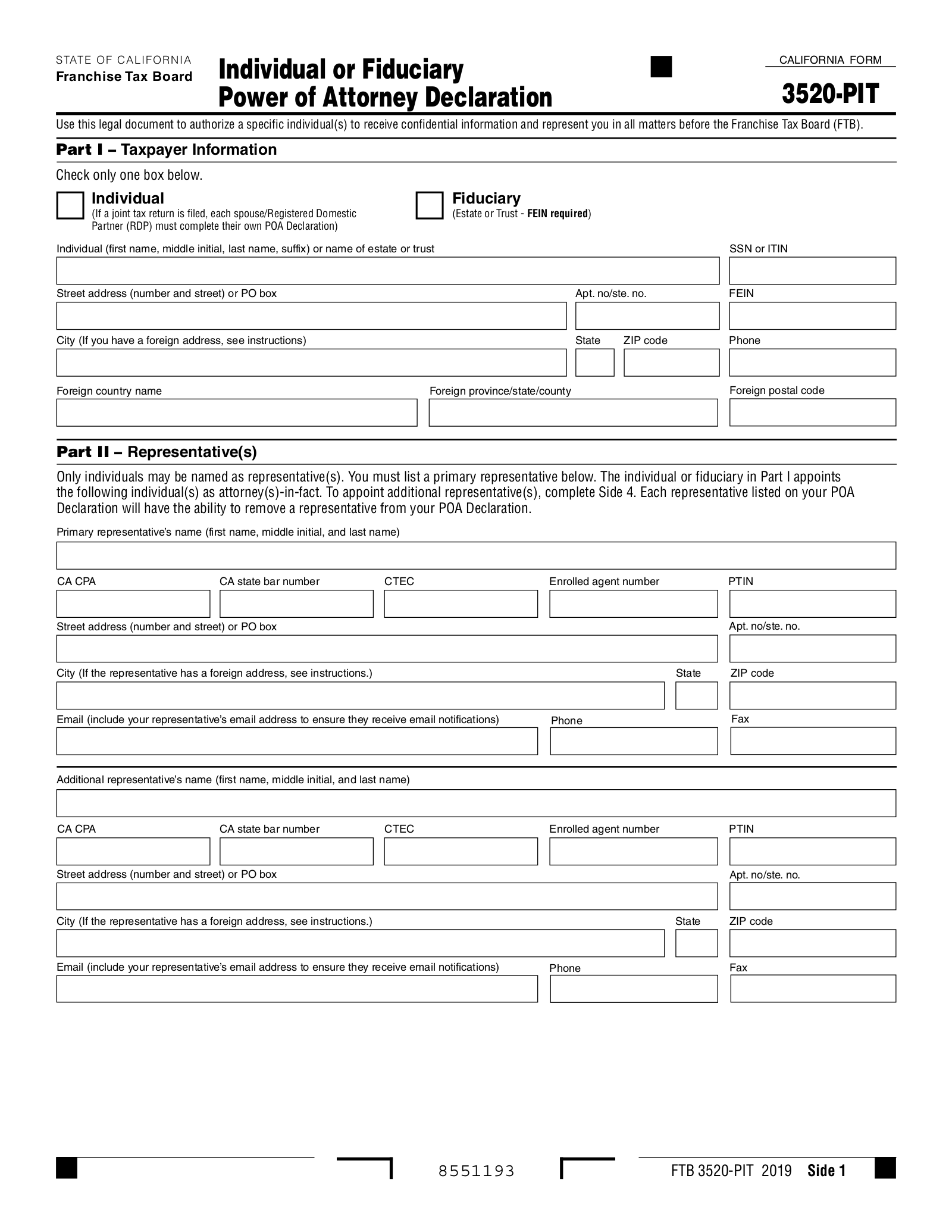

2 – Enter Taxpayer and Fiduciary Information

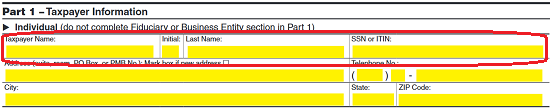

In Part 1, “Taxpayer Information,” several areas will require attention. This information may be reported through one of the simple tables provided. Fill in the table labeled “Individual,” “Fiduciary,” or “Business Entity” based on the Principal Taxpayer’s status.

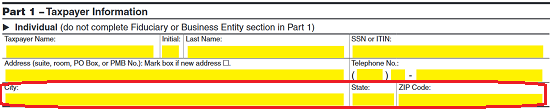

In the “Individual” table, on the first row, report the Taxpayer’s First Name, Middle Initial, Last Name, and Social Security Number or Individual Taxpayer Identification Number in the boxes labeled “Taxpayer Name,” “Initial,” “Last Name,” and “SSN or “ITIN” respectively.

On the second row, report the complete Taxpayer Street Address and Telephone Number using the two boxes provided.

The third row will require the City, State, and Zip Code for the Taxpayer’s Street Address.

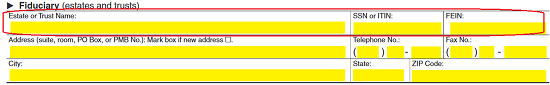

In the “Fiduciary” table, the first row will require the “Estate or Trust Name,” “SSN or ITIN”, and “FEIN” (Federal Employer Identification Number) in the corresponding boxes.

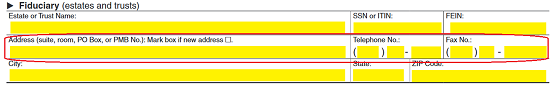

The next row of this table requires the Estate or Trust’s Street Address, Telephone Number, and Fax Number in the appropriately labeled boxes. Note: If the Address being reported is a different one than one previously reported, then mark the check box in the upper portion of the “Address” field.

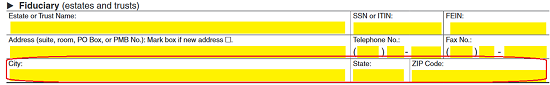

The third row in this table must have the City, State, and Zip Code entered in the areas provided.

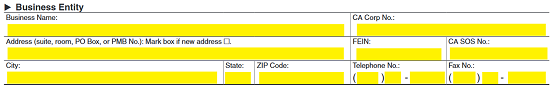

If the Principal Taxpayer is a Business Entity, then use the third table to supply the “Business Name,” “CA Corp. No.,” “Address,” “FEIN,” “CA SOS No.,” “City,” “State,” “Zip Code,” “Telephone No.,” and “Fax No.” of the Principal Taxpayer

3 – Declare The Principal’s Representative Agent

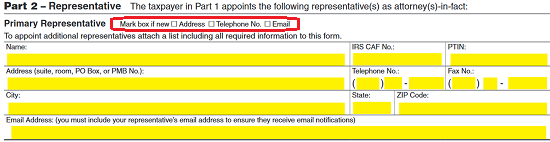

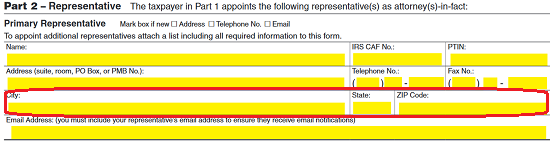

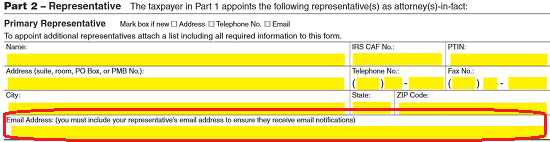

The next section, “Part 2 – Representative,” must have the Attorney-in-Fact or Agent’s information reported. The information reported must match any that may have been reported for this individual in the past. If the Agent indicates that his or her information is new, then mark the “Address,” “Telephone No.,” and/or “Email” boxes in the Primary Representative Table’s title row.

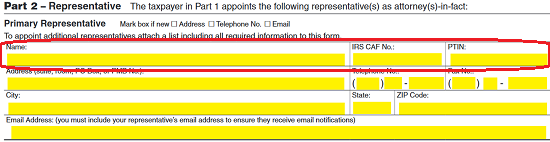

In the first row of the Primary Representative Table, enter the “Name” of the Agent, the Agent’s “IRS CAF No.,” and the Agent’s “PTIN”

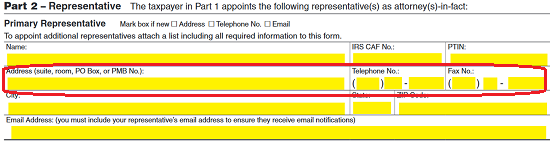

The second row must display the Agent’s Street Address, Telephone Number, and Fax Number.

Present the Agent’s City, State, and Zip Code in the third row.

Enter the Agent’s Email Address in the fourth row.

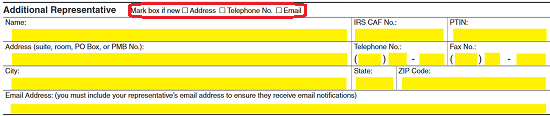

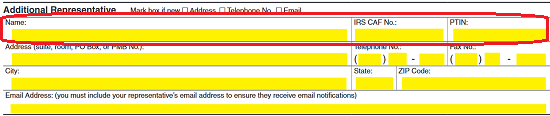

The Principal may name an “Additional Representative.” This party will assume the Primary Representative’s responsibility and Principal Authority should he or she be unable to satisfy the Primary Representative’s role. If the Principal wishes to name a successor Agent, this individual may be declared in the Additional Representative Table. To begin, indicate if any of the successor Agent’s information reported is new by checking any or all the boxes labeled “Address,” “Telephone No.,” and/or “Email” in the title row. If this information is the same as that on record, leave these check boxes unmarked.

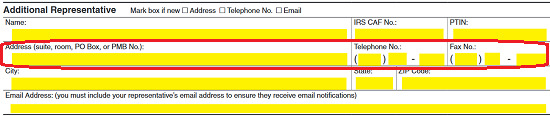

Report the Additional Representatives Name, IRS CAF No., and PTIN in the first row.

Enter the Additional Representative’s Street Address, Telephone Number, and Fax Number in the second row.

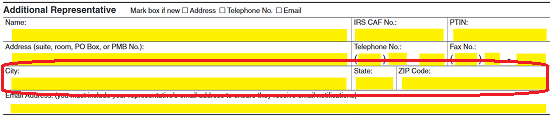

The third row requires the Additional Agent’s City, State, and Zip Code in the third row.

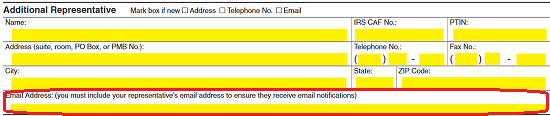

Report the Additional Representative’s Email Address in the fourth row.

4 – Assigning Blanket Authority For a Limited Time

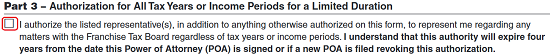

Part 3 will provide the opportunity to entitle the Representative to Principal Authority when dealing with the FTB on the Principal’s behalf. This may be done by marking the box preceding the words “I authorize the listed representative(s)…” This will naturally expire in four years from the Signature Date.

5 – Restricting Power to Specific Tax Years/Income Periods

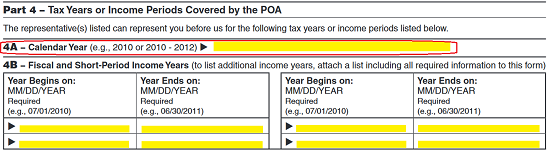

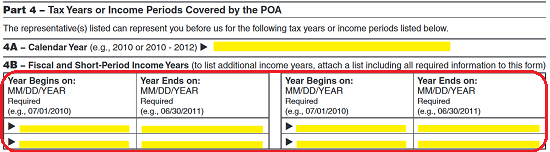

Locate Part 4, Item 4A Calendar Year, then report the years in which the Representative’s Principal Power should be considered active and respected. If you marked the box in Part 3 and would like specific Calendar Years when the Representative should retain Authority past the four-year expiration, report these in Item 4A in Part 4.

If there are specific periods of time in which the Representative’s Principal Power should be considered active, this should be reported in Item 4B. Two tables have been provided, each with two columns. Use the first column to report the start of an Income Period the Representative will have Authority in and the second column to report the last day of the Income Period the Representative retains Principal Authority. Each Table will have two rows so there is enough room to report four separate periods however, you may include an attachment with additional periods.

6 – Privileges

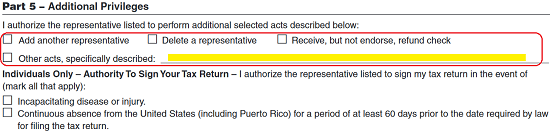

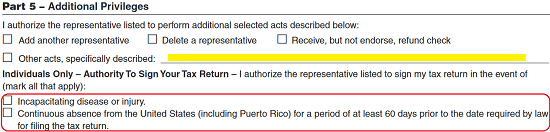

Part 5 will produce a few options for additional Privileges that should be available to the Representative at the discretion of the Principal. To begin, locate the first statement (beginning with “I authorize…”), then indicate if the Representative may “Add another representative,” “Delete a representative,” “Receive, but not endorse, refund check” by checking the box corresponding to these labels. If there are other acts the Representative may perform with Principal Authority then mark the box “Other acts, specifically described,” then define such liberties on the blank line provided.

The next issue to be tended to will only apply if the Representative is an individual. Locate the words “Authority To Sign Your Tax Return.” There will be two checkboxes below. If the Representative may sign the Principal’s Tax Return in the event of the Principal’s incapacitation or death, then mark the first checkbox. If the Representative may sign the Principal’s Tax Return when the Principal is continually absent from the United States, then mark the second checkbox.

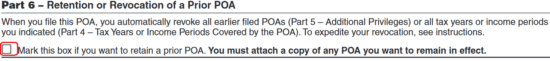

7 – Prior Powers of Authority

This document will automatically revoke any authority documents issued in the past upon its execution. If you would like a previous authority to remain in effect then, mark the box in Part 6. Note: You must attach the previous Power of Attorney that should remain active despite this form’s execution. If there are no other conflicting documents or if you want all previous documents to be revoked by the current form then, leave this box blank.

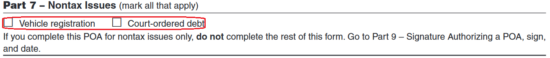

8 – If Filed For A NonTax Issue

In some cases, this form may be filed as the result of a POA for “Vehicle Registration” or “Court Ordered Debt.” If this is the case indicate the reason by checking the appropriate checkbox in Part 7 Nontax Issue and skip Part 8. If this is not the case, then leave these boxes blank and proceed to the next area.

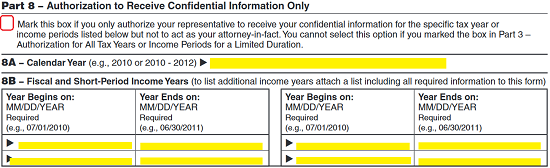

9 – Limiting the Principal Power to Disclosure

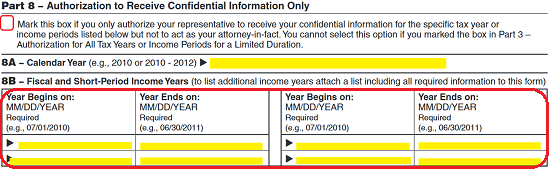

If the box in Part 3 has been left blank and you wish the Represented to receive confidential information for specific Calendar Years or Income periods but not be given Principal Authority in representing the Principal, then mark the Box in Part 8. This box may not be marked if Part 3 has been.

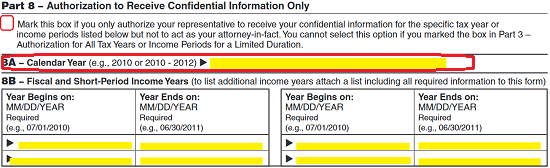

Locate Part 8A. Indicate the Calendar Years the Representative may receive the Principal’s Confidential Information on the blank line provided.

If you would like the Representative to receive Principal Confidential Information for specific income periods, this may be reported by using the tables provided in Part 8B. Each Table will accept the Start Date of the income period the Agent may receive Confidential Information on in the first column and the End Date of this income period in the second column of the table being tended to.

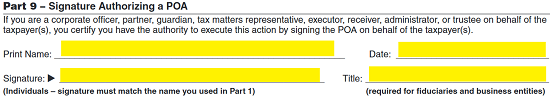

Part 9 Signature Authorizing POA

In order for this form to be accepted by the California Tax Franchise Board, the Principal must locate Part 9, then Print his or her Name on the first blank line, enter the Signature Date on the second blank line, Sign his or her Name on the third blank line, and report his or her Title on the last blank line.

Mail to:

POA UNIT MS F283

FRANCHISE TAX BOARD

PO BOX 2828

RANCHO CORDOVA CA 95741‑2828