Updated June 02, 2022

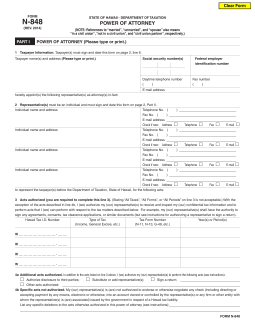

A Hawaii tax power of attorney (Form N-848), otherwise known as Department of Taxation Power of Attorney, provides a way in which a person can appoint someone, usually an accountant or tax advisor, to represent their interests in front of the Department of Taxation. The appointee assists with filings, obtaining information, or speaking to authorities on behalf of the issuer. A notary is not required to sign this document.

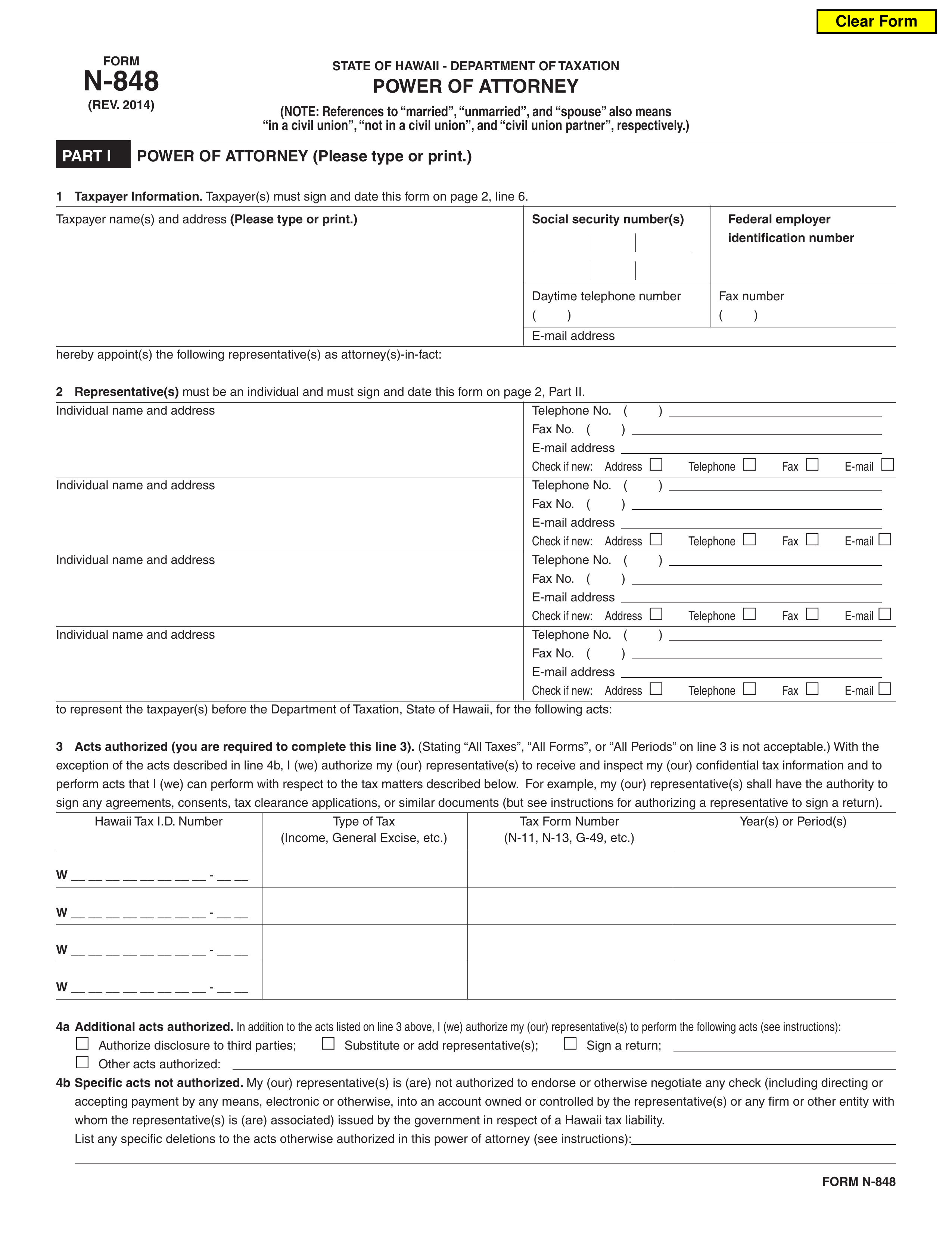

How to Write

1 – Gather Your Tax Document Then Obtain Form-N-848

You will need the Principal’s I.D. information, the Representative’s I.D. Information, and the relevant Tax Records of the Principal. Once these items have been gathered and looked through, open or download the form by selecting the appropriate button on the right.

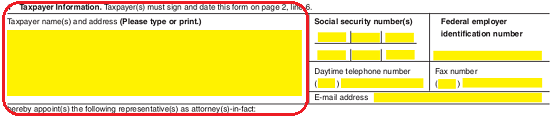

2 – Enter The I.D. Information For The Principal Tax Payer And The Representative

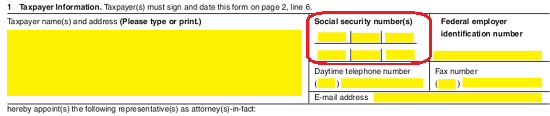

This document will begin with the Taxpayer Information section. Here, the granting Taxpayer must have his or her identity solidified. To do this, enter the Full Name and Address of the Taxpayer in the first available space (under the words “Taxpayer name(s) and address”). It should be noted that if the Principal Taxpayer has filed jointly with a Spouse, the Spouse’s Full Name and Address should also be presented.

The next Taxpayer item that must be furnished will be his or her Social Security Number. There will be two distinct set of lines in the space labeled “Social Security Number(s)” so the Social Security Number of all concerned Taxpayers can be entered.

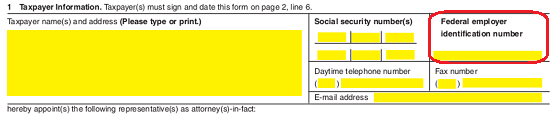

The next box where an Identification Number may be employed is labeled “Federal Employer Identification Number” has been supplied in case the Taxpayer is a business entity that must be identified with a FEIN.

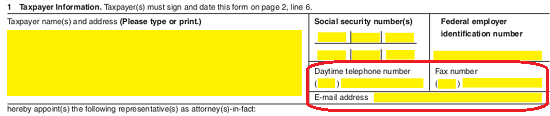

The remaining boxes in this section will allow for the Taxpayer’s “Daytime Telephone Number,” “Fax Number,” and “E-Mail Address” to be entered.

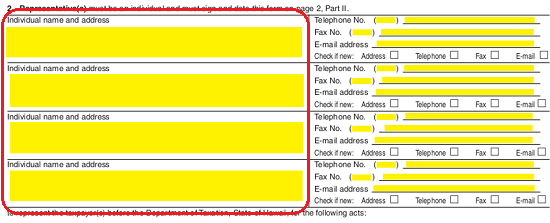

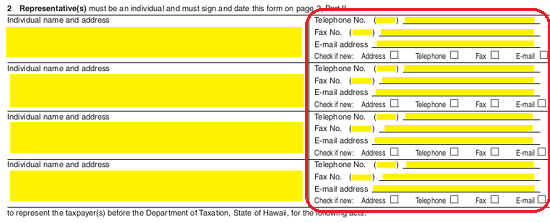

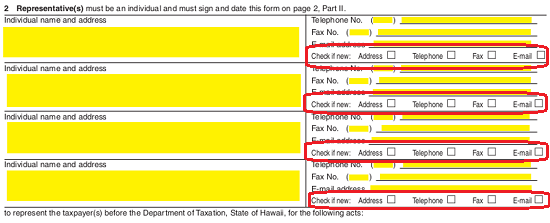

The second section requiring information will focus on the Representative being named with Principal Taxpayer Authority. Find the table in section “2. Representative(s).” This will provide enough space for four Representatives to be designated with Principal Power through this document. At least one row will need to contain the Identity of the Designated Representative who will be appointed Principal Power through this document.

The first column will require the Name and Address of the Representative the Principal will grant power to.

The second column must have the Designated Representative’s Telephone Number, Fax Number, and E-Mail Address entered.

The final item in the second column will be a simple choice of three checkboxes. If any of the Designated Representative’s information reported is new or different from an earlier report, this should be indicated by marking the type of information that is new (“Address,” “Telephone,” “Fax,” and/or “E-mail”).

3 – Document The Actions And Matters The Representative Will Wield Principal Authority In

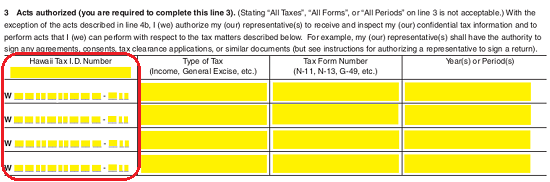

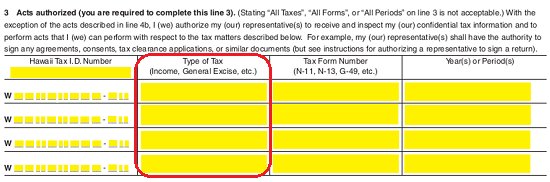

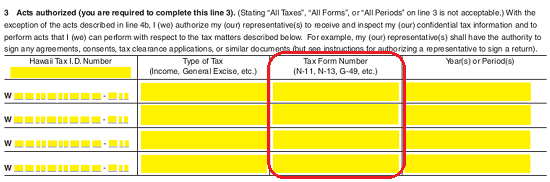

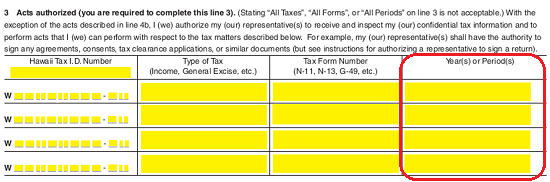

Section 3, “Acts authorized,” will present a simple table meant to clearly document the types of Powers the Principal Taxpayer will appoint to the Designated Representative.

The “Hawaii Tax I.D. Number” for the Matter where the Designated Representative will have power should be entered in the first column

The “Type of Tax” Matter the Designated Representative is being granted power in should be reported in the second column

The third column requires that each matter’s “Tax Form Number” the Designated Representative may act with be recorded.

Finally, each Tax Matter must have the “Year(s) or Period(s)” of time the Designated Representative’s Principal Power will be valid be entered.

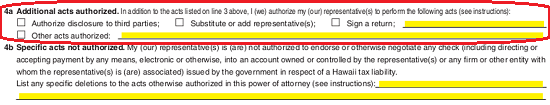

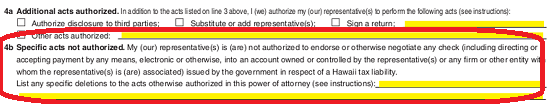

Section “4a Additional Acts Authorized” will provide an opportunity to grant additional powers to the Designated Representative’s ability by checking the appropriate box. The Principal Taxpayer may give the Representative the Principal Right to “Authorize disclosure to third parties,” “Substitute or add representative(s),” “Sign a return,” and “Other acts authorized.” If the Representative is given the right to sign a return, the blank line must have the official reason in the required language for the reason of such a granting. If “Other acts authorized” has been checked, these other acts must be defined on the blank line.

Section 4b will provide a blank line where the Taxpayer may delete acts that are normally authorized by this document’s execution. Each Power the Principal wishes to deny the Designated Representative from using in his or her Name, should be entered in a detailed manner on the blank line in Section 4b.

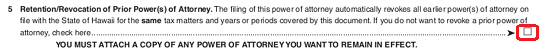

4 – The Option To Keep Previous Documents In Effect

Section 5, “Retention/Revocation of Prior Power(s) of Attorney,” shall revoke any previously issued power documents concerning these matters for these time periods. If the Taxpayer wishes to keep such documents in effect, the checkbox in Section 5 will need to be checked and the previous Authority Documents should be attached.

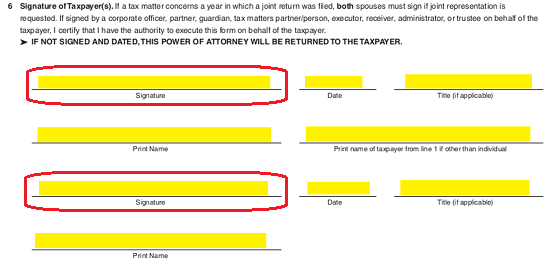

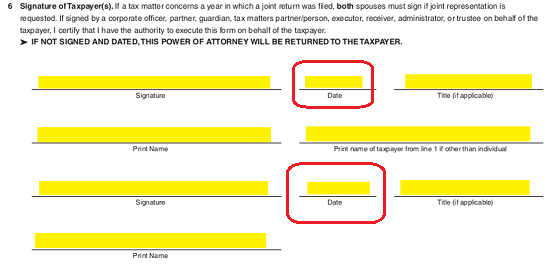

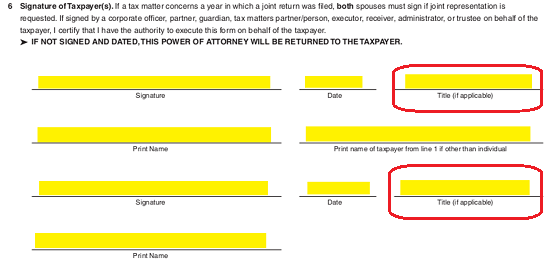

5 – The Grantor’s Signature And Signature Date Must Be Provided

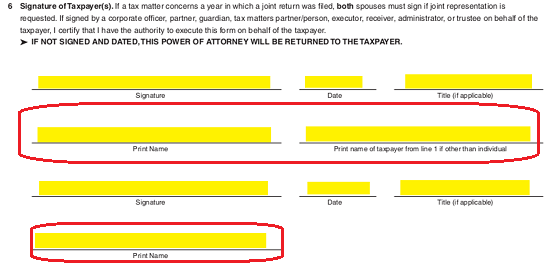

Section 6, “Signature of Taxpayer(s)” requires that each Principal Taxpayer sign his or her name on the Signature line.

The Principal Taxpayer should report the Date he or she is signing this form on the next blank line.

If the Principal Taxpayer has a “Title” that should be considered part of his or her Identity (i.e. Doctor) this should be entered on the “Title” line.

Each Principal Taxpayer should also Print his or her name on the line labeled “Print Name.” If this is a different entity then the individual in Section 1, then Print the Name reported on line 1 on the line labeled “Print Name of Taxpayer if from line 1…if other than the individual.”

6 – The Representative Report And Signature

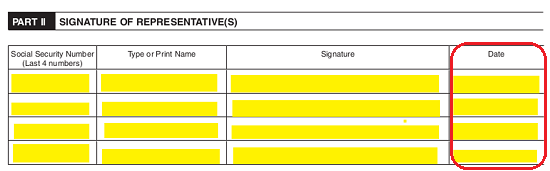

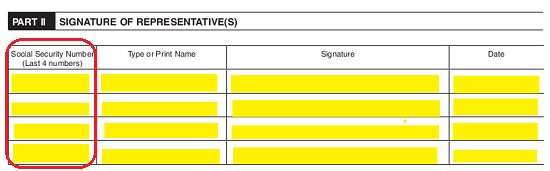

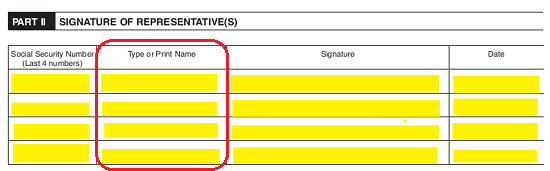

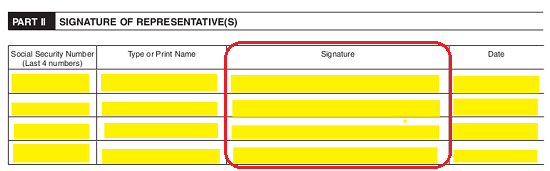

The next part, “Part II Signature of Representative(s)” will need to have some items directly attended to by each Representative.

Each Representative must enter the last four digits of his or her “Social Security Number” in the first column.

The second column must have the Printed Name of each Representative entered.

The third column requires the Signature of the Designated Representative.

The Date of Signature must be entered in the fourth column.