Updated June 02, 2022

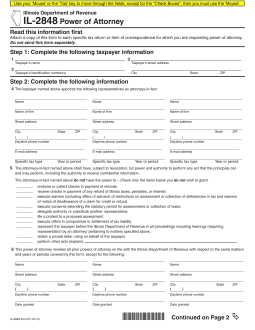

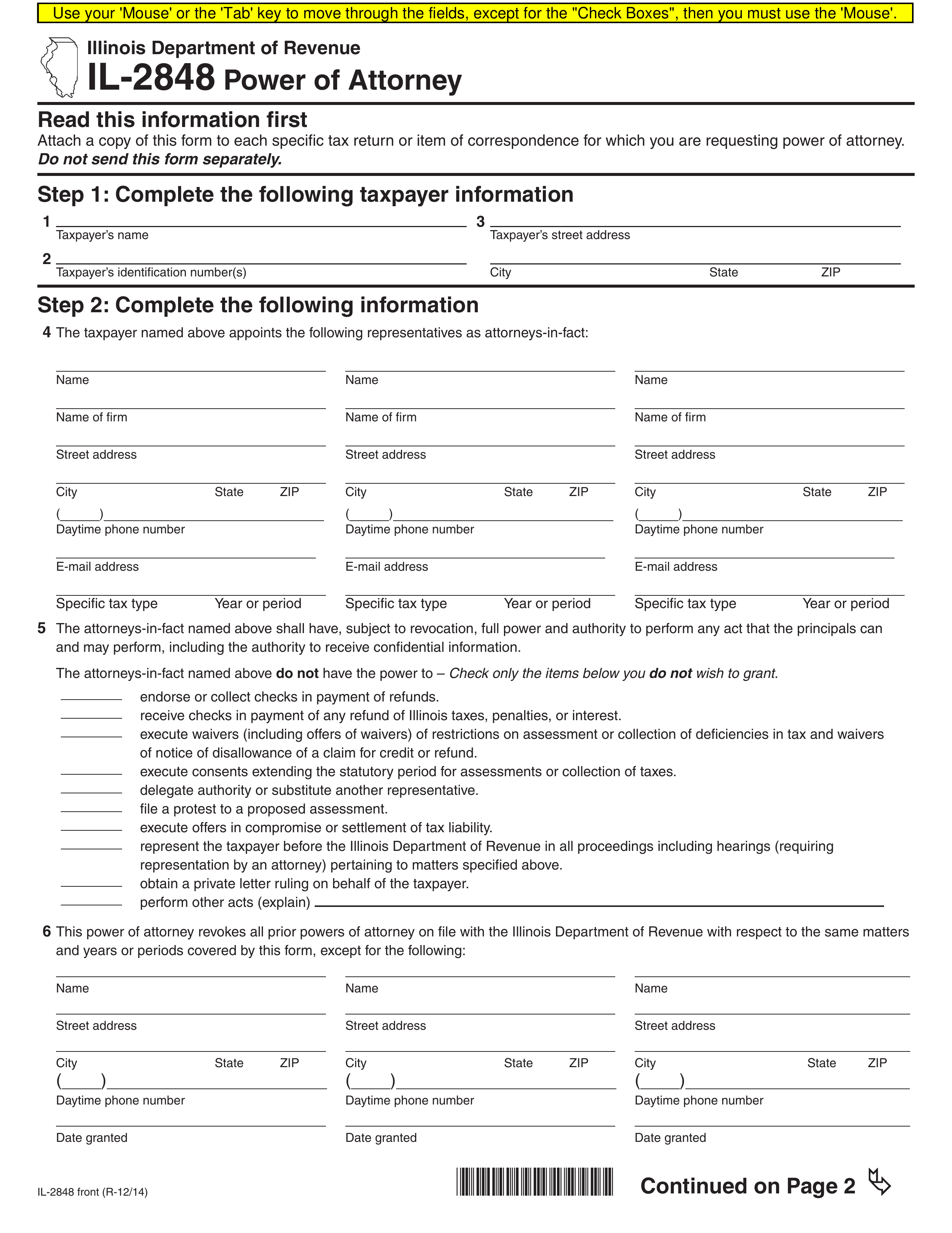

An Illinois tax power of attorney (Form IL-2848) can be utilized to delegate a person, usually, an accountant or tax adviser, to represent another person in matters related to your Illinois taxes. This type of power document grants the representative the authority to access your tax information and make filings on your behalf.

How to Write

1 – Gather The Relevant Tax Documents Then, Open The Document Below The File Image

Any information submitted to the Illinois Department of Taxation Should be reported as accurately as possible. Thus, make sure you have the Tax Matters being referenced. When you are ready, use your reference materials to fill in the form after you open/download it from this page.

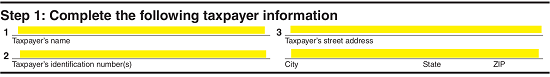

2 – The Taxpayer’s Information Should Be Recorded

There will be three items in the first step. Locate the heading “Step 1,” then in Item 1, enter the “Taxpayer’s Name.” This is the Grantor of Power or the Principal. Item 2, directly below it, requires the “Taxpayer’s Identification Number”(i.e. Social Security Number). Item 3 will have two lines so the “Taxpayer’s Street Address,” “City,” “State,” and “Zip” may be properly documented.

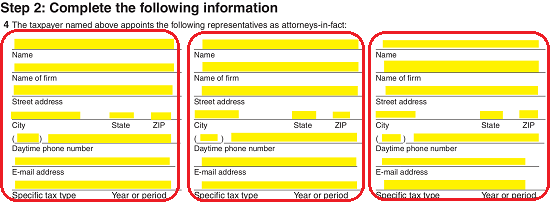

3 – Each Attorney-in-Fact or Representative Should Have His Or Her Information Documented

The second step will supply three columns, in Item 4, so the Principal may Name up to three Agents or Attorneys-in-Fact to represent the Principal with Principal Authority. At least Agent or Attorney-in-Fact must be recorded here. Utilize the blank lines to report the “Name,” “Name of Firm,” “Street Address,” “City,” “State,” “Zip,” “Daytime Phone Number,” and “E-mail Address” of each Attorney-in-Fact. The last line of each column will provide a blank line to report the “Specific Tax Type” and “Year or Period” the reported Attorney-in-Fact may wield Principal Power in.

4 – The Tax Matters Where Principal Power Is Appointed Should Be Approved

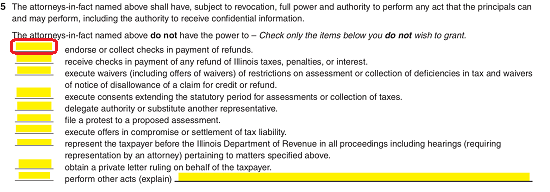

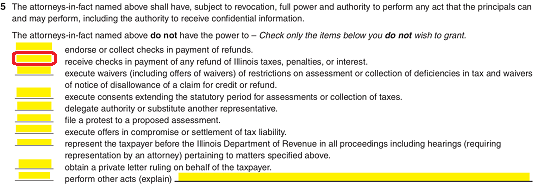

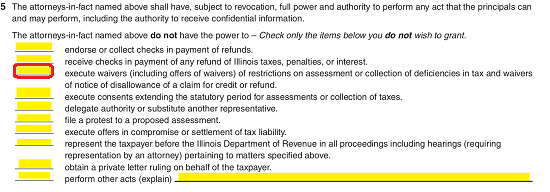

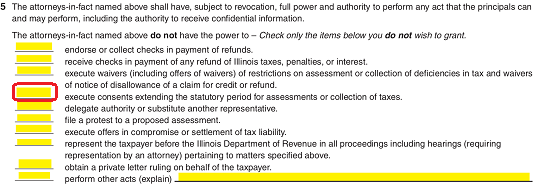

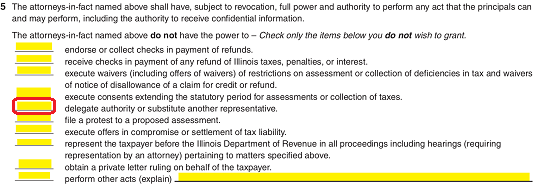

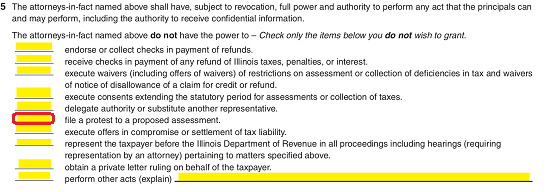

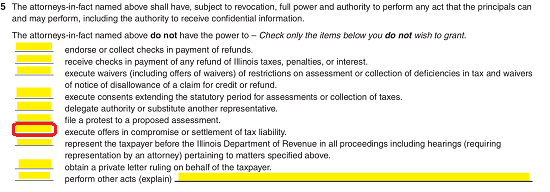

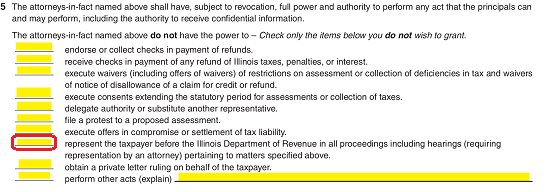

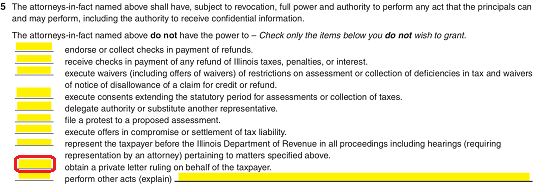

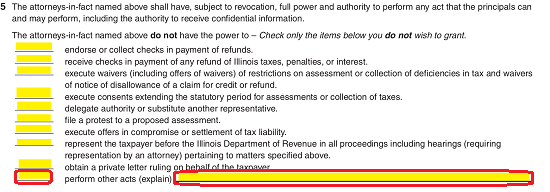

Item 5 will contain a list of powers that will be appointed to the Attorney-in-Fact through this document by default. The Principal Taxpayer or Grantor may choose to withhold any of these Powers from the Attorney-in-Fact by checking the blank line corresponding to the statement description of Authority.

To withhold the ability to Endorse or Collect Refund Checks on behalf of the Principal from the Agent, check the first statement.

If the Agent should not be able to receive any Refund, Penalty, or Interest Checks of Illinois Taxes, then check the second statement.

Check the third statement if the Attorney-in-Fact should not be able to execute waivers or offers of waivers regarding the Principal’s Tax matters.

The fourth statement should be checked if the Attorney-in-Fact should not be empowered to provide consent for a period of Tax Assessment or Collection

If the Attorney-in-Fact may not delegate Authority or Name a Substitute Representative, then check the fifth statement.

The sixth statement should be checked if the Attorney-in-Fact may not file a Protest to a proposed assessment.

Check the seventh statement if the Attorney-in-Fact should not be empowered to make or carry out any offers of compromise or settlement regarding Tax Liability.

The eighth statement should be checked if the Attorney-in-Fact may represent the Principal to the Illinois Department of Revenue regarding the above Tax Matters.

Check the ninth statement to prevent the Agent from having the Authority to receive private letters regarding any rulings on the taxpayer on behalf of the taxpayer.

The last statement provides a blank line to withhold any specific Authorities that have not been mentioned. If a statement is entered here, the blank line preceding the words “perform other acts(explain)” should be checked.

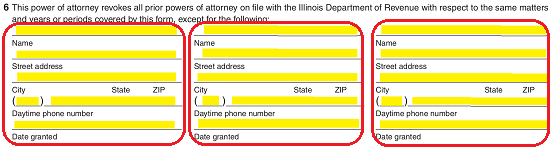

5 – The Status Of Previous Authorities Must Be Dictated

Item 6 will declare that all other previous Authorities granted to Agents in the past will be automatically revoked with this document’s execution. If there are any Agents who should retain Authority this may be accomplished by documenting their Names, Addresses, Daytime Phone Numbers, and Dates when Authority was granted. Three columns have been provided so up to three Agents holding Authority may be exempt from this document’s power. Each Agent must be reported in only one column. This area may be left blank if it is not applicable. Do not list an Agent’s Name here if the Principal Authority they hold should be automatically revoked with this document’s execution.

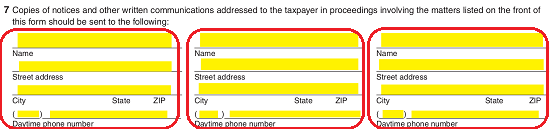

6 – Any Parties Other Than The Principal Should Receive Copies Of Notices And Communications Must Be Reported

Item 7 shall also provide three columns. The Illinois Department of Taxation will send copies of notices and communications regarding the Principal’s Tax Matters all of the addresses listed here. Each column will have a space to report the Recipient’s Name, Street Address, City, State, Zip, and Daytime Phone Number.

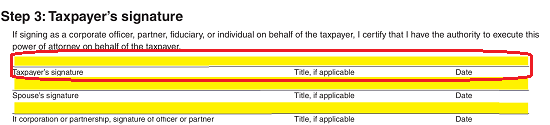

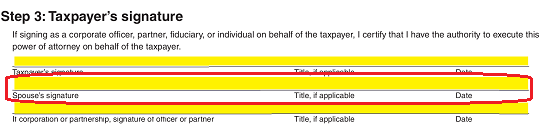

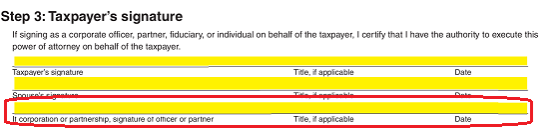

7 – The Required Signature Parties Must Verify This Document

The “Taxpayer’s Signature” will be step three. Here, the Taxpayer must sign the blank line starting with “Taxpayer’s Signature,” report his or her Title, and enter the Date of Signature.

There will be a blank line below this in case the Taxpayer filed jointly. Here, the Taxpayer’s Spouse must sign his or her Name, report any applicable Title held, and provide a Signature Date

If the Taxpayer Signature is that representing a business entity, an authorized representative of that entity (i.e. Officer or Partner) should sign his or her name on the third line of this section, enter his or her Title, and supply the Date of Signature.

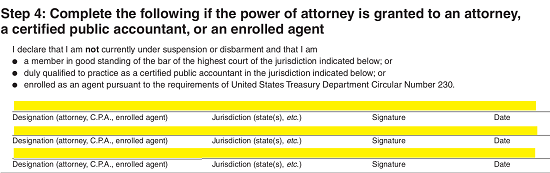

Below this will be two more Steps. If the Attorney-in-Fact is an Attorney, C.P.A., or Enrolled Agent, then Step 4 must be completed by that entity. There will be enough room for three separate entities to provide their Designation, Jurisdiction, Signature, and Date of Signature. Only one entity may fill in one line.

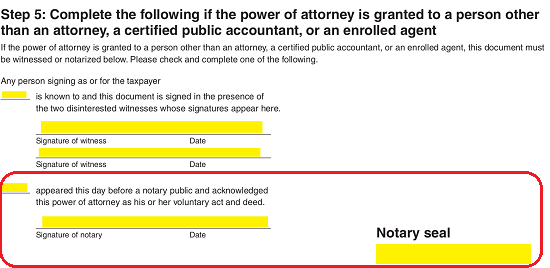

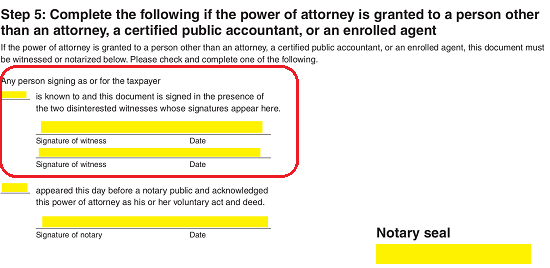

If any of the Agents/Attorneys-in-Fact are not a C.P.A., Attorney, or Enrolled Agent then, Step 5 will need to be completed. This will require the Signature and Date of Signature of two Witnesses who have viewed the signing of this document.

Below the Witness Signatures, a Notary Public must Sign, Date, and Stamp this form in the appropriate areas.