Updated August 03, 2023

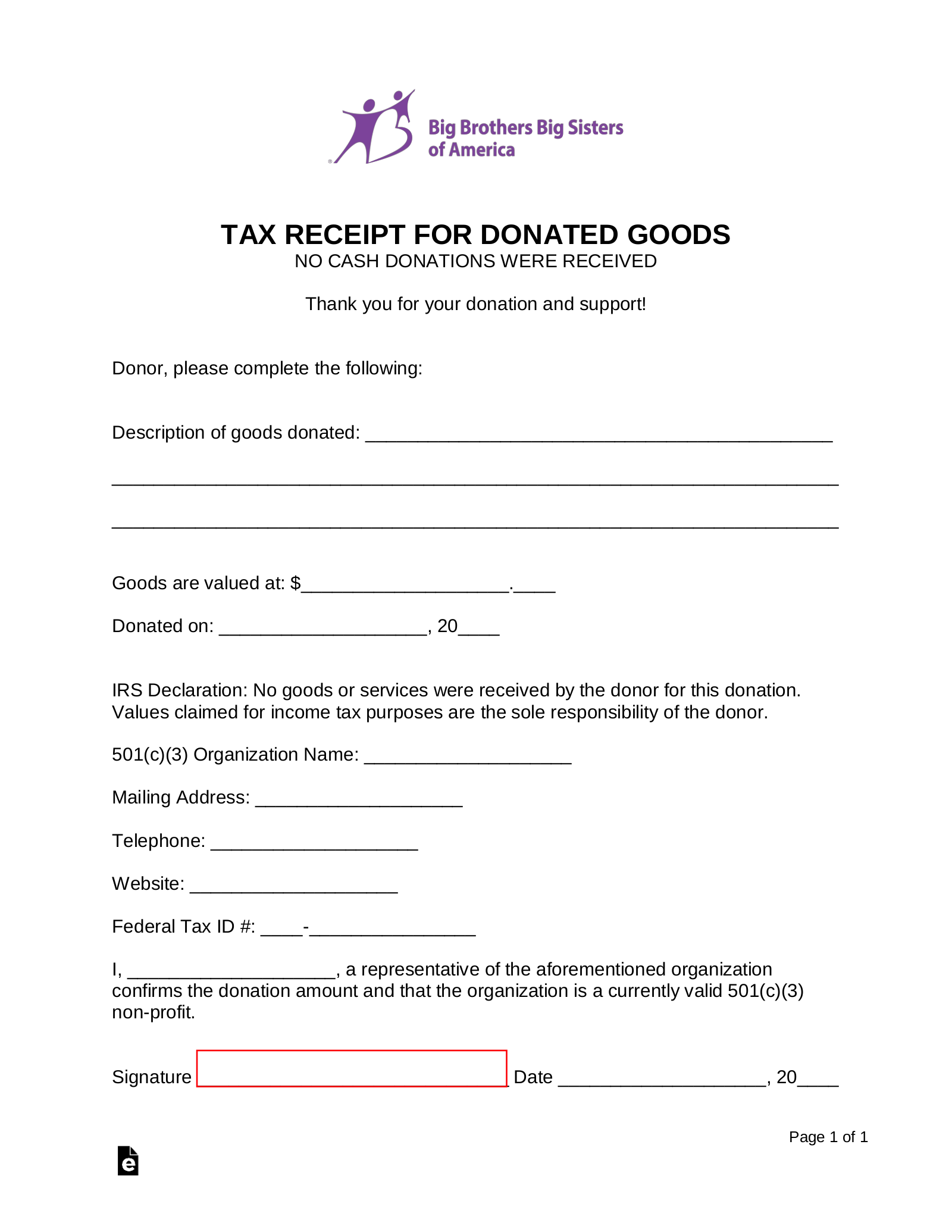

A Big Brothers Big Sisters (BBBS) donation receipt is given to a person or an organization when a tax deductible contribution is made to support the mentoring of a child in the Big Brothers Big Sisters charitable organization. Big Brothers Big Sisters of America is a 501(c)(3) organization that mentors vulnerable children in need.

Tax Identification Number (EIN) – By local chapter.

Donation Methods

The main purpose of Big Brothers Big Sisters is to match kids with a positive influence to help guide and steer them away from trouble. The average cost of sponsoring a child with a mentor (Big Brother/Big Sister) is $1,500 per year.

Donate Online – Make a one-time or monthly contribution via credit card.

Donate by Mail – Make a donation by mail using their donation form. Payments should be made payable to Big Brothers Big Sisters of America with the address of 2502 N. Rocky Point Drive, Suite 550, Tampa, FL 33607.

Other ways of giving include IRA Charitable Rollovers, Stocks and Securities and Cars. For additional information call (813) 720-8778.