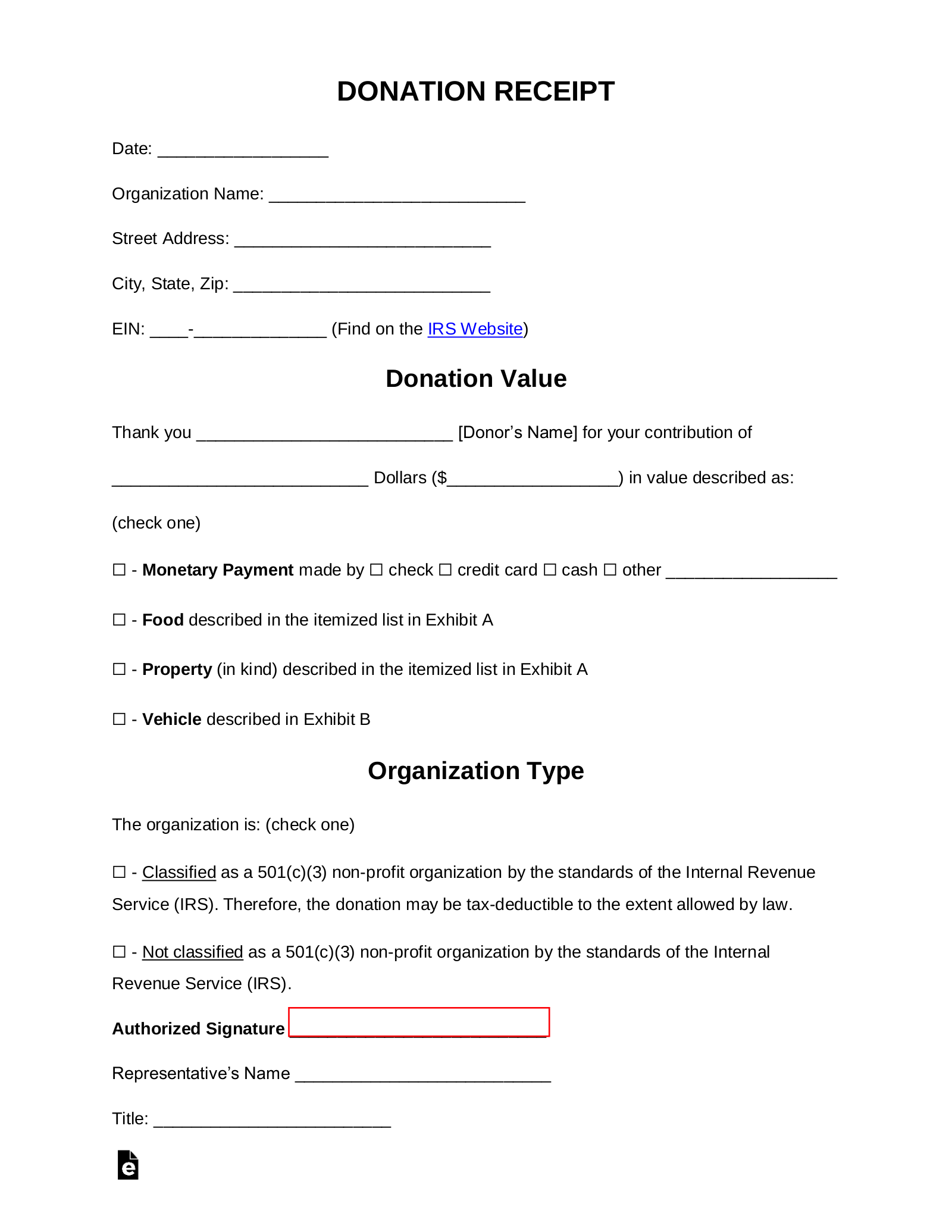

Updated November 14, 2023

A Donation Receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit.

Goodwill Resources

- Donation Valuation Guide – Get a “ballpark value” of an item’s worth.

- Tax Identification Number (EIN) – Find by looking up the local Goodwill entity on the IRS Tax Exemption Search.

Donation Methods

Goodwill accepts clothing (which is the most popular item from donors), household items, electronics, and retail inventory.

- Clothing (Goods) – Goodwill has many locations in all 50 states and many donation bins scattered throughout. It’s best to give your local Goodwill donation center a phone call to find out if your items are acceptable.

- Hazardous Items – Use this link to stay updated on hazardous items, which should be avoided when donating items to Goodwill.