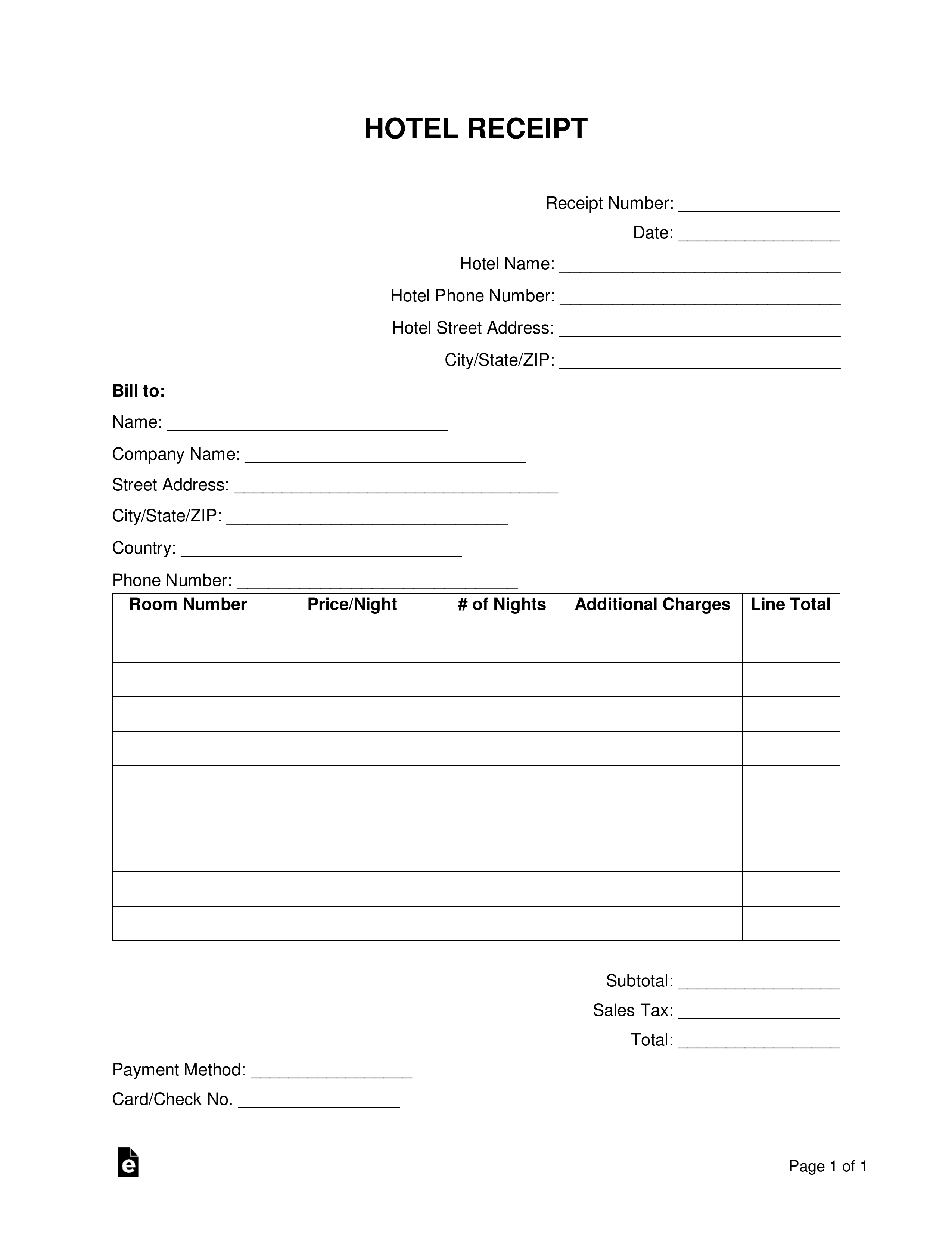

Updated August 03, 2023

A hotel receipt is issued after the bill has been paid by the guest. The receipt should indicate the guest room rate in addition to any extra amenities, mini-bar, food service, breakfast charges, parking fees, taxes, and any other charges by the hotel. The receipt may be used by any franchise or private hotel, motel, inn, bed and breakfast, or any other housing provided to the public for a fee.

Hotel Credit Card Authorization Form – Used to accept a guest’s credit card or by someone else on behalf of the guest.