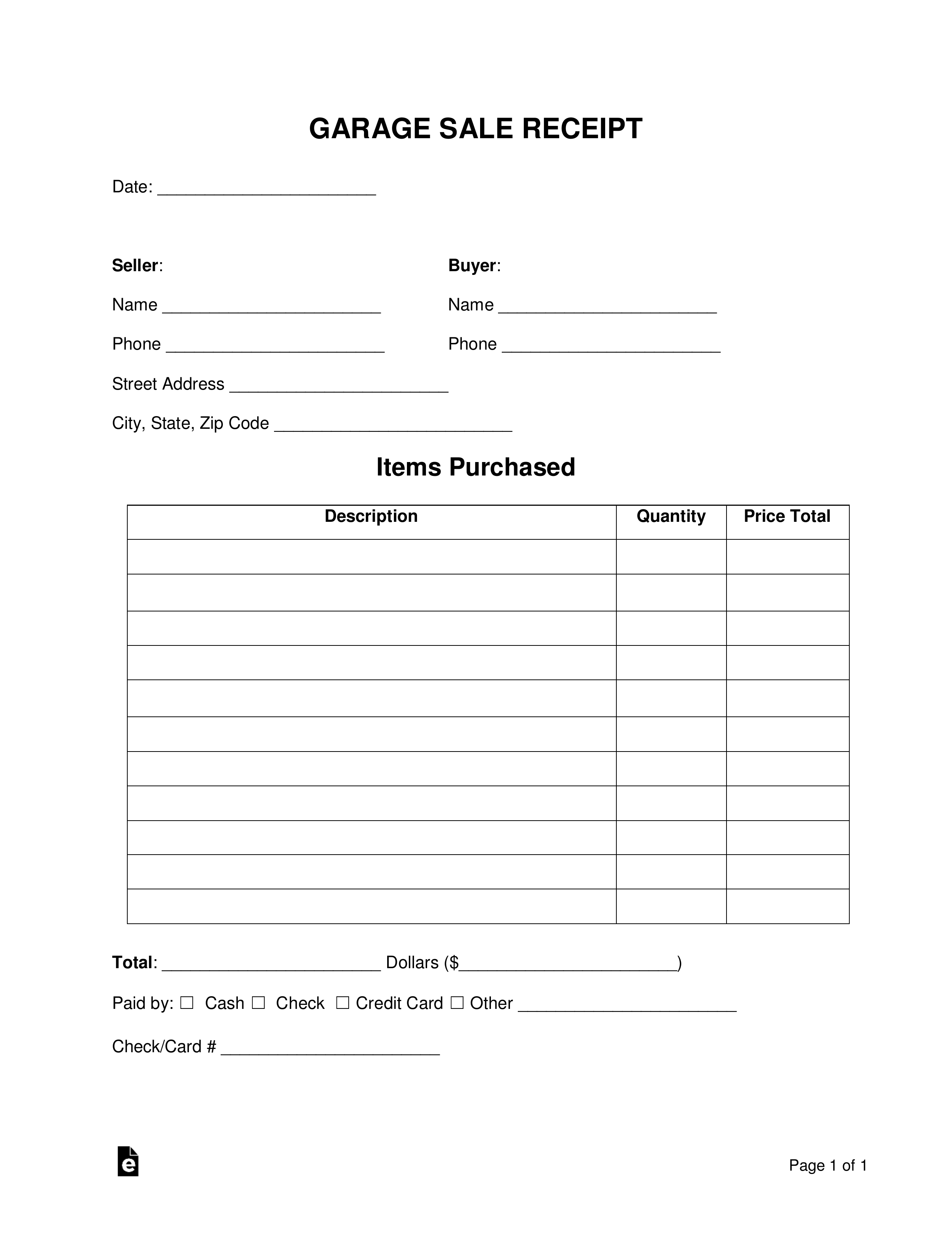

Updated August 03, 2023

A garage sale receipt can be used by anyone who is putting on a garage sale and wishes to provide buyers with a record of their transaction. Some people will want to keep a record of how much they paid for each item. For example, if a buyer is planning on reselling their purchases or will be using them for business, they may need a receipt for tax purposes. The receipt includes space for buyer and seller information, the selling price for each item, and the method of payment.