Updated August 04, 2023

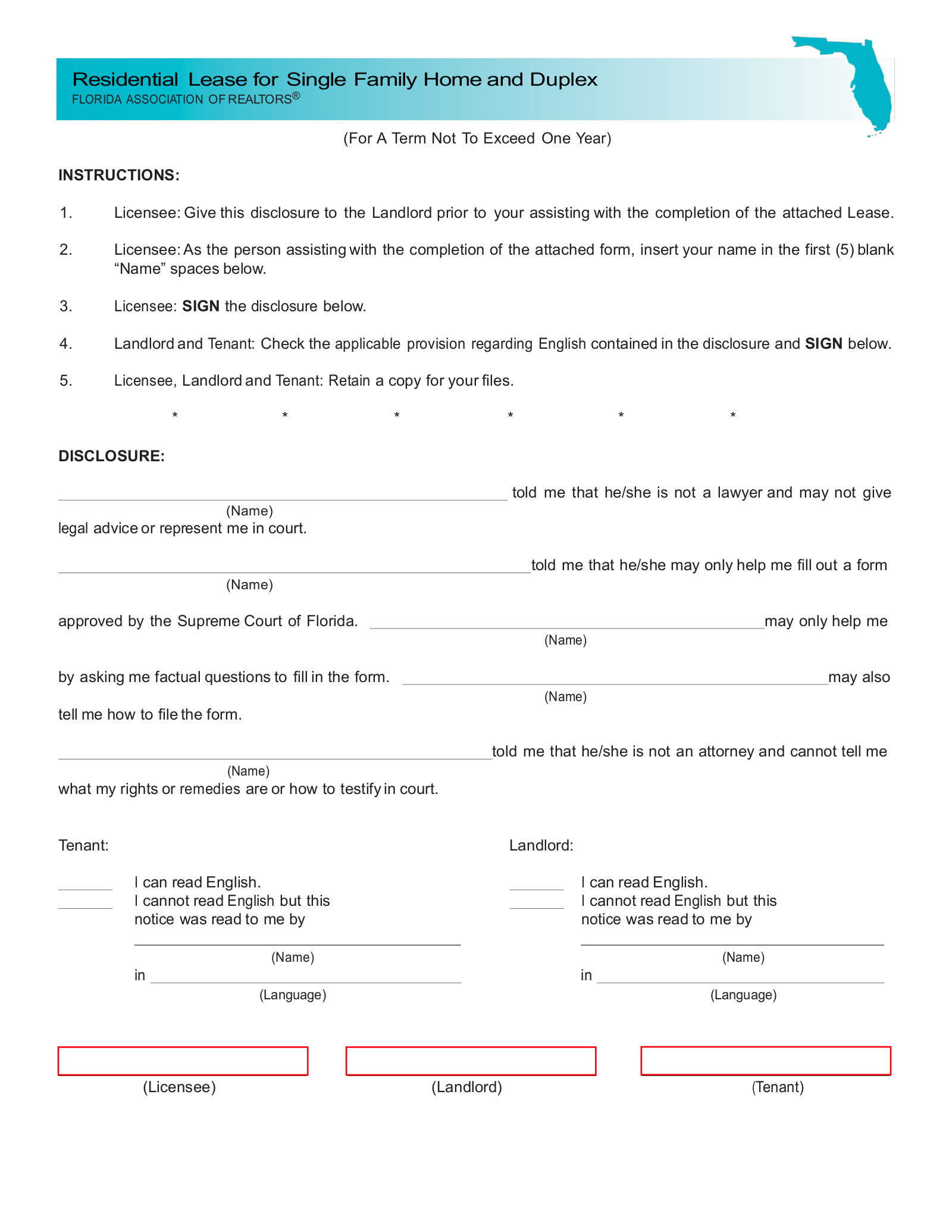

The Florida association of realtors lease agreements have produced 2 types of agreements, one for single-family homes and one for multi-family properties, for landlords and tenants to enter into a rental contract. The agreements have been approved by the Association of Realtors and may be used by landlords seeking to protect themselves when agreeing to a rental arrangement with a tenant.

Rental Application – All landlords are advised to verify the identity, employment, and background of their tenants. There is no maximum fee a landlord may charge to run this verification.

Types (2)

Download: PDF

Multi-Family Realtor Lease (apartment)

Multi-Family Realtor Lease (apartment)

Download: PDF