Updated February 29, 2024

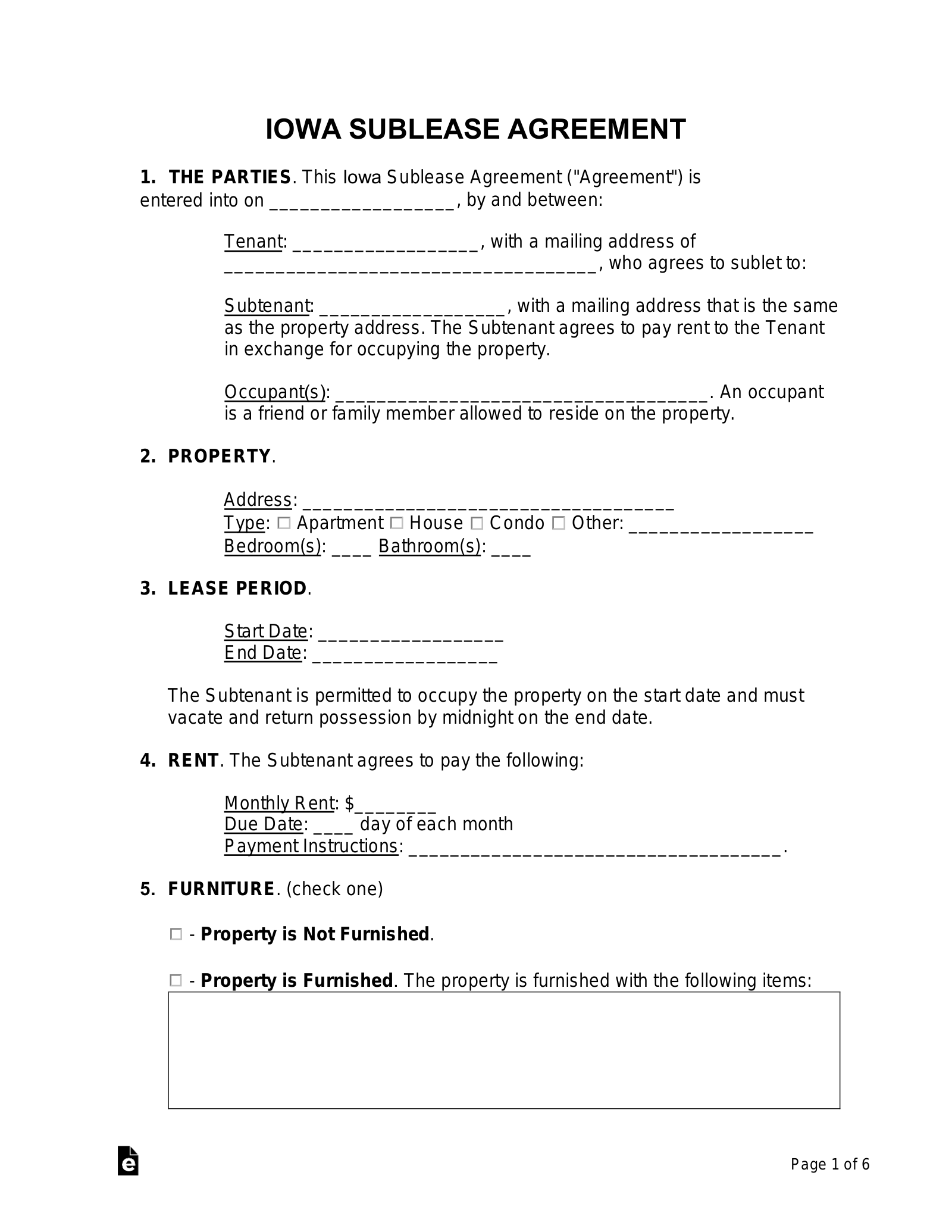

An Iowa sublease agreement provides a defined framework for a sublet arrangement in which a tenant rents space in their residence to a sub-tenant while still being under a rental lease. In such a case, the principal tenant becomes a sub-lessor and acts as a landlord for the individual who is renting via this new agreement (known as a “sub-lessee”).

Right to Sublet

Unless a rental agreement explicitly prohibits it, tenants in Iowa may sublease the premises. When the landlord’s permission is required prior to subleasing, the landlord may only deny the request if it is reasonable to do so.[1]

When a landlord’s permission to sublease is necessary, a Landlord Consent Form is an efficient way to get it in writing.

Short-Term (Lodgings) Tax

Under Iowa state law, a short-term rental (STR) is defined as any dwelling that is “offered for a fee for thirty days or less.”[2] While short-term rentals in Iowa are not subject to state sales tax, they are subject to a state hotel tax. Individual counties and cities may levy additional fees and taxes.

Iowa short-term rental taxes:

- 5% state hotel tax[3]

- Additional city and county taxes (varies by location)

Nearly all of the state, county, and city taxes are collected by the state and are submitted electronically via the GovConnectIowa website.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF