Updated March 01, 2024

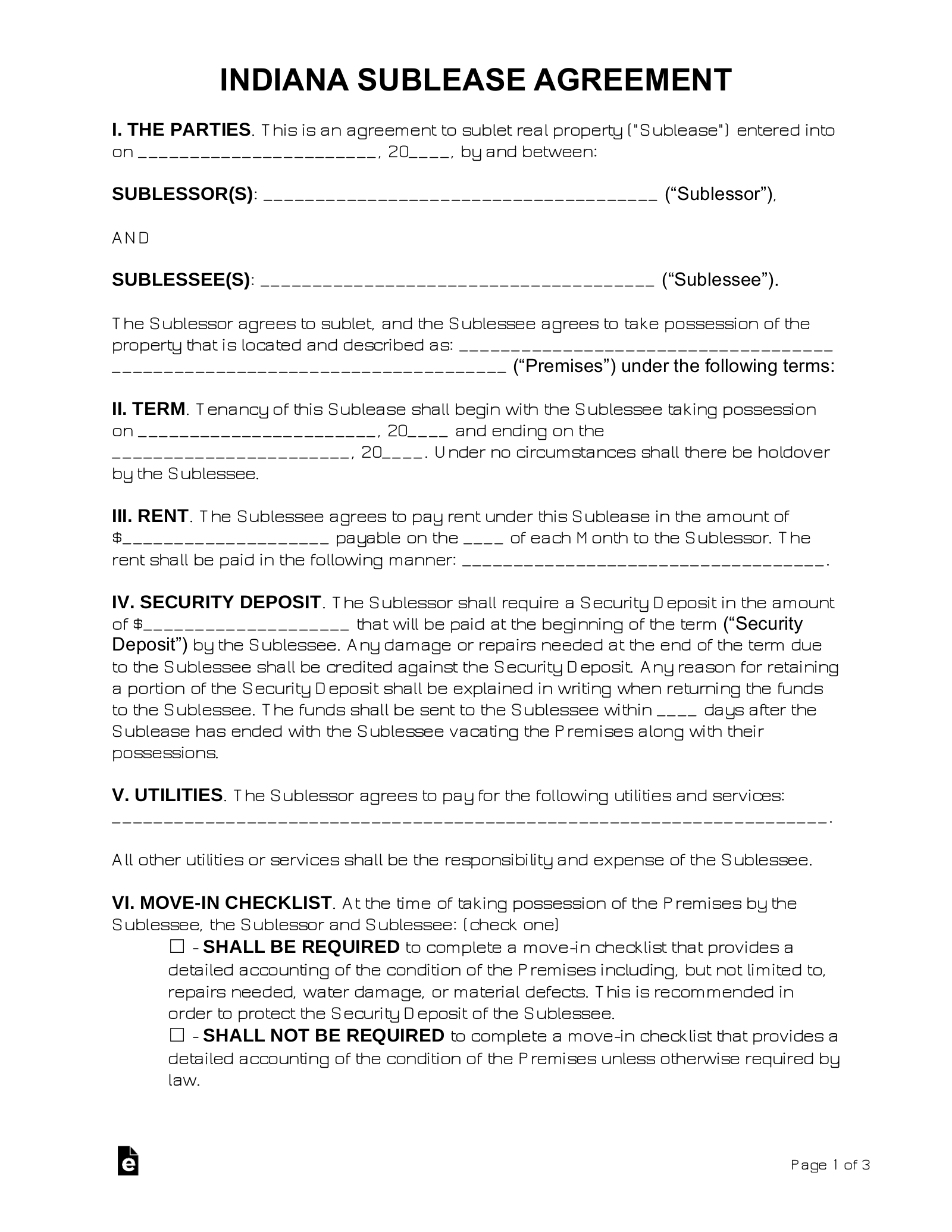

An Indiana sublease agreement is a written contract defining the conditions of a sublet commitment between a sub-lessor and a sub-lessee. A sub-lessor is the tenant under the original lease, while the sub-lessee is the party renting this property from the sub-lessor.

Right to Sublet

Indiana law does not specifically grant its residents the right to sublet. Each lease will determine whether or not a tenant may create a sublease. Unless the lease explicitly grants the right to sublet, the landlord has the right to approve additional tenants.

If the lease is unclear about subleasing or does not address the subject, the landlord’s approval is probably necessary. When seeking a landlord’s permission, a Landlord Consent Form will help to get it in writing.

Short-Term (Lodgings) Tax

Indiana state law defines a short-term rental (STR) as any part of a home, condominium, cooperative, or timeshare that is offered “for terms of less than thirty (30) days at a time through a short-term rental platform.”[1] Short-term rentals in Indiana are subject to state sales tax and many counties levy additional innkeeper’s tax.

Indiana short-term rental taxes:

County innkeeper’s tax is remitted to the Indiana Department of Revenue. Their website provides detailed information, including a list of counties that have adopted the tax.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF