Updated August 04, 2023

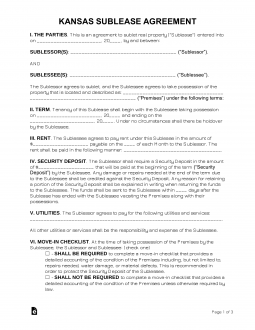

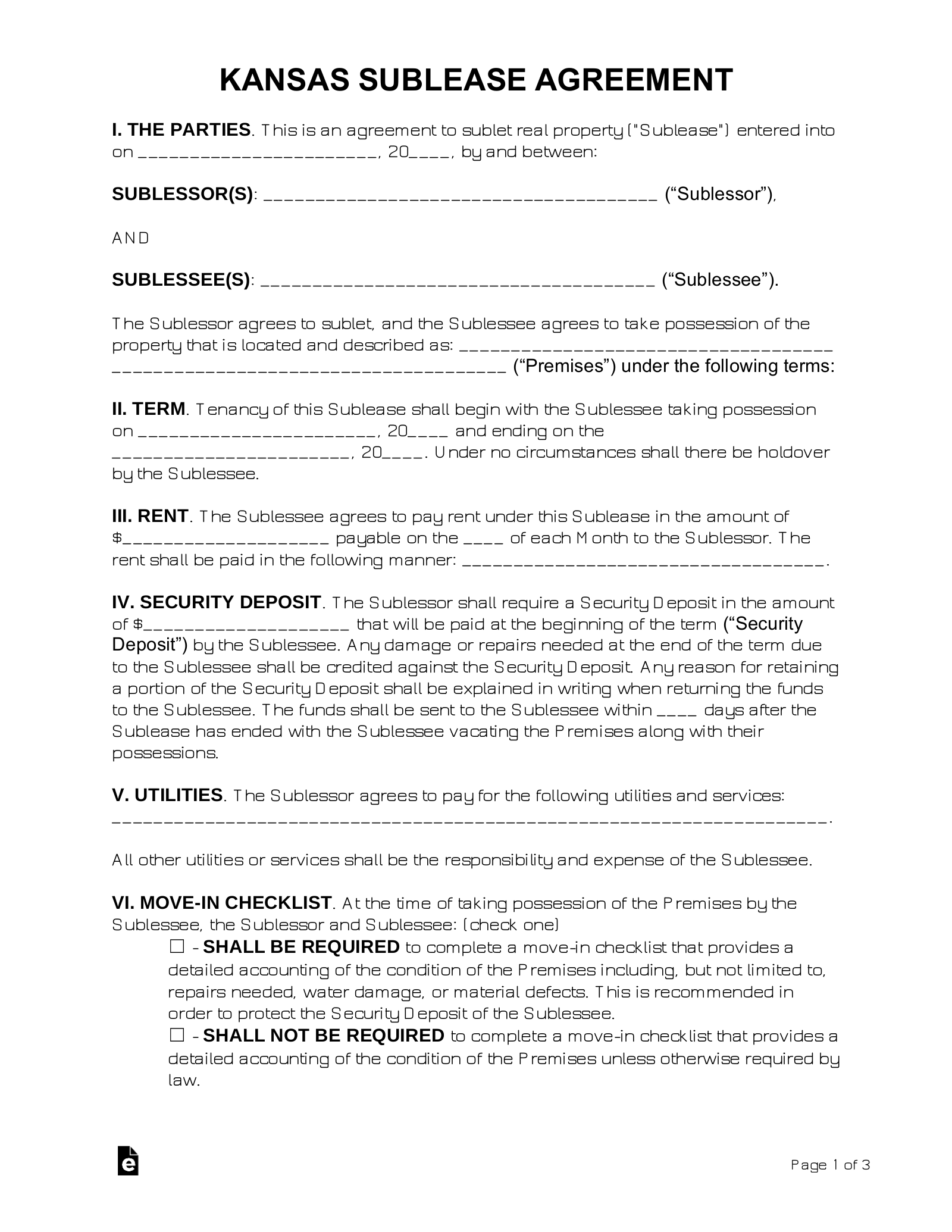

A Kansas sublease agreement delivers a flexible subleasing contract that may be used to solidify a significant range of terms between a sub-lessor and sub-lessee. For one, it allows both parties to enter either a fixed-term, a month-to-month, or even a week-to-week lease term. This time period will play a vital factor since it must conform to the original tenant-landlord lease. No sublease agreement shall outlast the primary, dominant lease due to the property manager’s indirect relationship with the sub-lessee. Instead, the sub-lessee enters an agreement with the sub-lessor, who will act as a landlord in relation to the new sub-tenant. Generally speaking, sub-lessors seek sub-lessees in order to fulfill an obligation to an outstanding tenancy with a property manager/owner. They may be lease locked or financially responsible for a lease that they can no longer afford. Regardless of the reasoning, subletting is an effective solution to a wide range of problems.

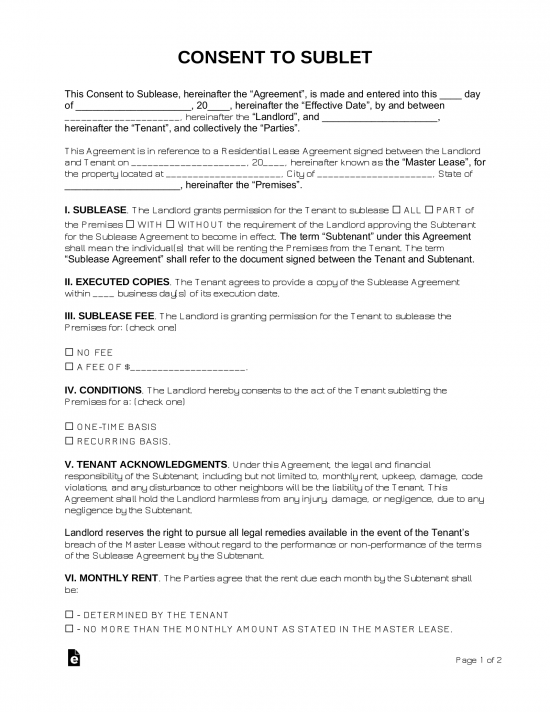

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF