Updated January 18, 2024

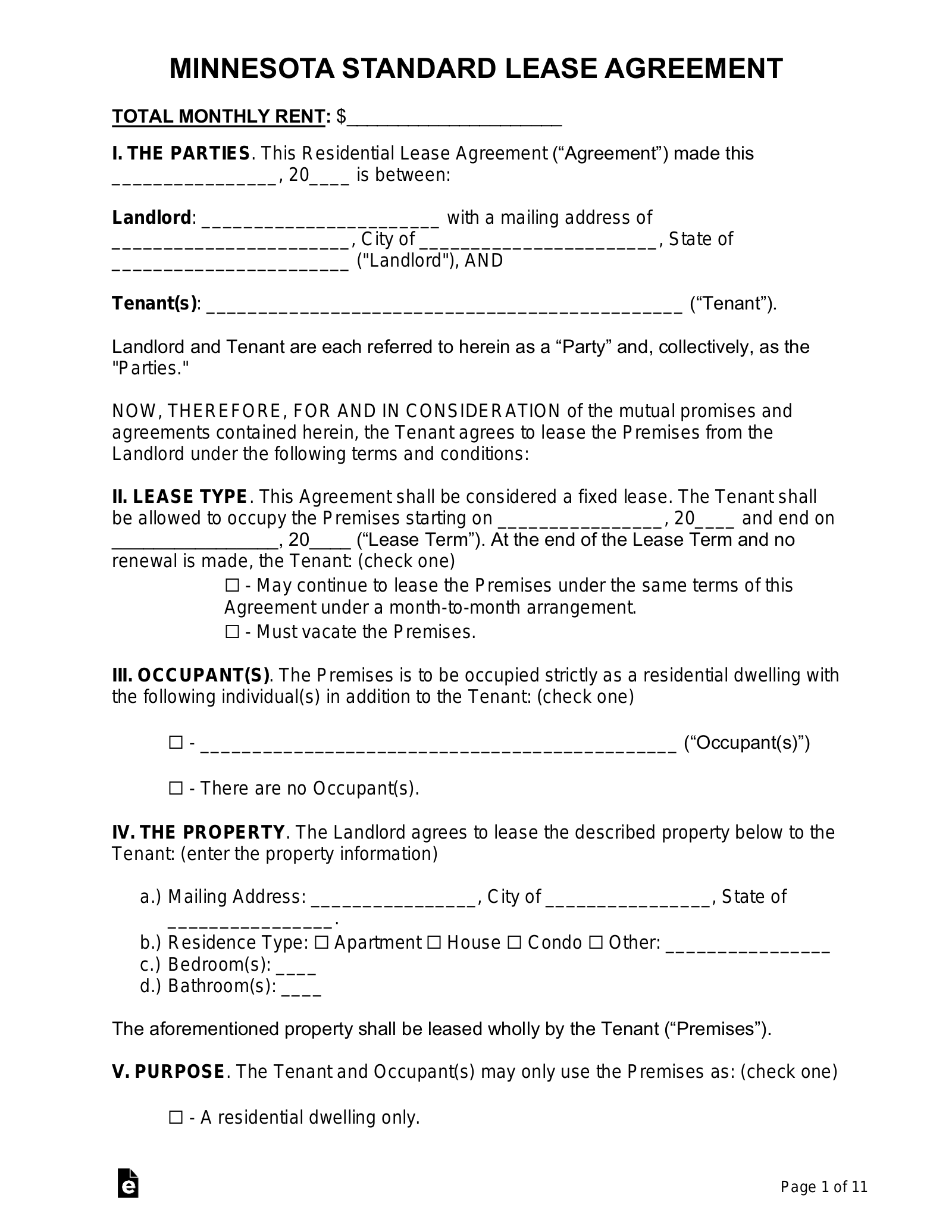

A Minnesota standard residential lease agreement is a rental contract that creates a binding tenancy arrangement between a landlord and tenant. A prospective tenant will commonly be shown the premises before renting by the landlord or their agent. If interested, the tenant will complete a rental application and request to be approved by the landlord. If so, the landlord will accept the tenant and write a lease with the negotiated terms. After signing, the tenant will be responsible to pay the first (1st) month’s rent and the security deposit.

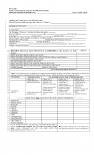

Laws – Chapter 504B (Landlord and Tenant)

Handbook – Landlords and Tenants: Rights and Responsibilities (PDF)

Other Versions (2)

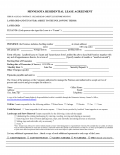

Minnesota STATE BAR Association

Minnesota STATE BAR Association

Download: PDF

Minnesota Standard Residential Lease Agreement Versions 2

Minnesota Standard Residential Lease Agreement Versions 2

Download: PDF