Updated March 01, 2024

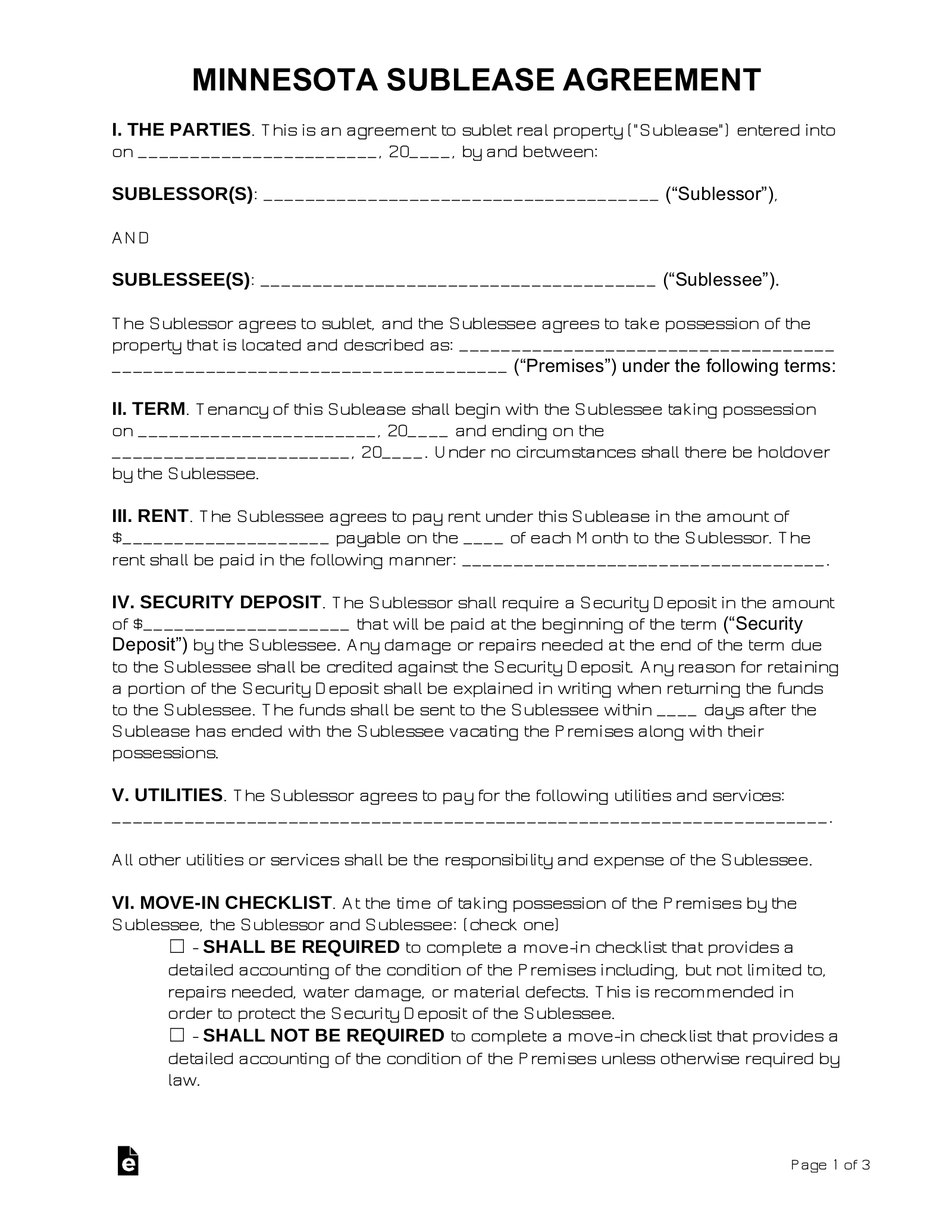

A Minnesota sublease agreement details the terms of a sublet arrangement between a sub-lessor and sub-lessee in which the sub-lessor is the current tenant, and the sub-lessee is a third party. Under a sublease agreement, the existing tenant effectively becomes the landlord to the third party while remaining responsible for the original lease through the end of its term.

Right to Sublet

Minnesota state law does not explicitly address a tenant’s ability to sublet. As a result, most leases will detail the conditions under which a tenant may do so. It is common for a lease to require tenants to get the landlord’s permission before subletting. However, according to the Minnesota Attorney General, tenants may sublease their rental provided that the lease does not prohibit it.[1]

When the landlord’s approval is required, a Landlord Consent Form is an effective way to secure their permission in writing.

Short-Term (Lodgings) Tax

Under state law, sales tax is due if the rental period is less than 30 days. Tax must also be collected on rentals of 30 days or more unless it is under a written lease that requires prior written notice to terminate.[2] Individual counties and cities frequently levy additional taxes and may require permits, licenses, or inspections for short-term rentals.

Minnesota short-term rental taxes:

- 6.875% state sales tax[3]

- County tax (varies by county)

- City taxes and permits (varies by city)

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF