Updated March 18, 2024

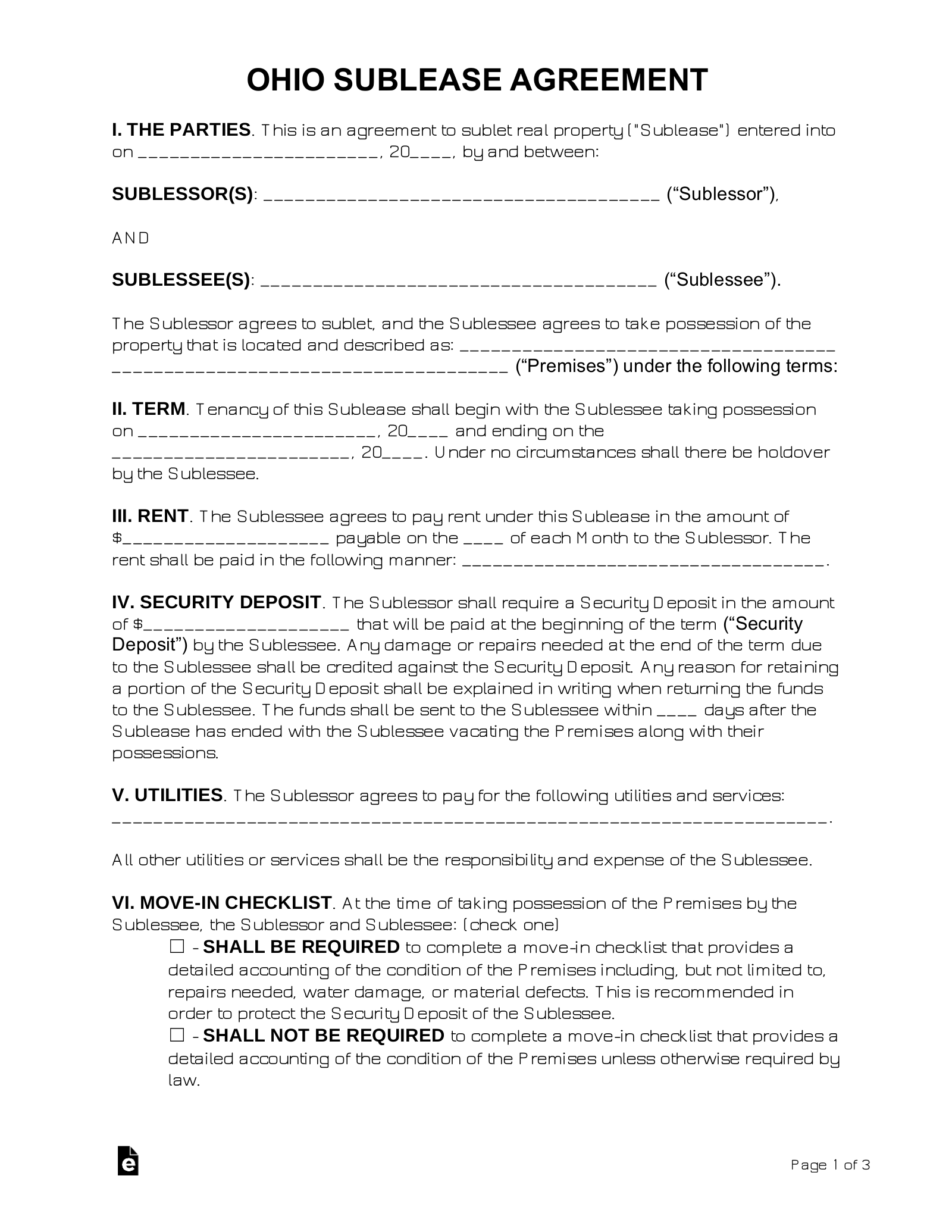

An Ohio sublease agreement is a rental contract between a current tenant (sub-lessor) and a new tenant (sub-lessee) who will sublet some or all of the rental property. Sub-lessors typically use this opportunity to move out of the unit prematurely without breaking their lease. Sub-lessees pay rent directly to the sub-lessor; the sub-lessor then utilizes those funds to pay the property owner.

Right to Sublet

Ohio law does not directly regulate the practice of subletting. Therefore, the lease will ultimately determine whether or not a tenant can rent the property to a third party. If the lease does not grant explicit permission to sublet, the landlord’s written consent should be obtained before the tenant enters a sublease agreement.

When permission to sublet is necessary, consider using a Landlord Consent Form.

Short-Term (Lodgings) Tax

In Ohio, short-term rentals (transient accommodations) are typically defined as those with a duration of fewer than 30 days. These rentals are subject to taxation by the state, counties, and cities. However, total tax rates will vary by location.

Ohio short-term rental taxes:

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF