Updated April 22, 2024

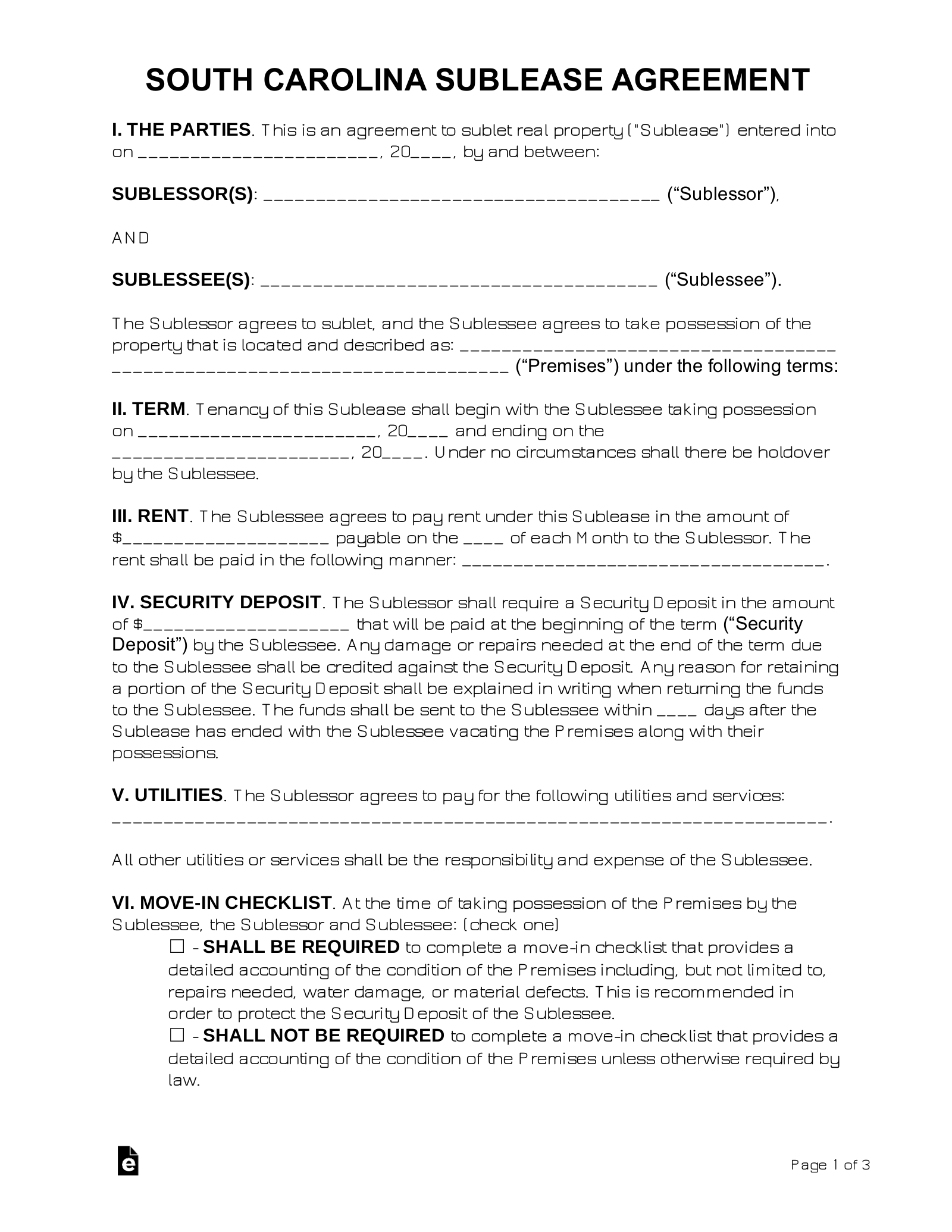

A South Carolina sublease agreement is a legally binding agreement in which the current tenant of a property rents part or all of their residence to another person. The current tenant becomes a sub-lessor, and the new renter becomes a sub-lessee. Under such an arrangement, the new renter will become a roommate to the sub-lessor or will take over the unit completely while the sub-lessor moves elsewhere.

Right to Sublet

Without the landlord’s written consent, a sublease agreement in South Carolina has no legal force or effect.[1] Tenants interested in subletting should read their lease carefully. If it does not explicitly grant permission to sublet, it will be necessary to obtain the landlord’s permission in writing.

When a landlord’s permission to sublet is required, consider using a Landlord Consent Form.

Short-Term (Lodgings) Tax

For state tax purposes, a short-term rental in South Carolina is defined as one with a duration of fewer than 90 days.[2] Short-term rentals are subject to state and local taxes, the total of which varies by location.

South Carolina short-term rental taxes:[3]

- 5% state sales tax

- 2% state accommodations tax

- Any applicable local sales and use tax

- Any applicable local accommodations tax (3% max)[4]

State accommodations taxes do not apply to facilities consisting of less than six sleeping rooms that is also the owner’s primary place of residence.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF